An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Miami-Dade, Florida Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian: In Miami-Dade County, Florida, individuals who hold positions of fiduciary responsibility, like Executors, Conservators, Trustees, or Legal Guardians, are required to adhere to strict accounting standards. The demand for accounting from these fiduciaries is crucial in ensuring transparency, accountability, and the protection of beneficiaries' rights and assets. Several types of demand for accounting can arise in Miami-Dade County: 1. Executor Accounting: When someone passes away in Miami-Dade County and leaves behind a Last Will and Testament, an Executor is appointed to handle the administration of the deceased person's estate. Executors have a fiduciary duty to manage the estate's assets and distribute them according to the decedent's wishes outlined in the Will. Beneficiaries or interested parties can demand accounting from the Executor to verify that the assets are properly managed, debts are paid, and distributions are made lawfully. 2. Conservator Accounting: In cases where individuals in Miami-Dade County are deemed unable to manage their own financial affairs or make decisions related to their estate, a Conservator may be appointed by a court. Conservators have the responsibility to handle and protect the conservative's assets, pay bills, manage investments, and provide necessary care. Interested parties, such as family members or the court, can request an accounting from the Conservator to ensure that the conservative's financial needs are met, and assets are appropriately managed. 3. Trustee Accounting: Trustees in Miami-Dade County are entrusted with the management and distribution of assets held within a trust. Whether it is a revocable living trust or an irrevocable trust, Trustees must abide by their fiduciary obligations. Beneficiaries or interested parties can demand accounting from the Trustee to confirm that the trust's assets are handled prudently, income is correctly distributed, and expenditures are made in accordance with the trust's terms. 4. Legal Guardian Accounting: In cases involving minors or individuals deemed incapacitated in Miami-Dade County, a court may appoint a Legal Guardian to handle their personal and financial matters. Legal Guardians are responsible for making decisions in the best interest of the ward and managing their assets. Interested parties, including family members or the court, may request an accounting from the Legal Guardian to ensure proper stewardship of the ward's assets and funds. In conclusion, demanding accounting from fiduciaries such as Executors, Conservators, Trustees, or Legal Guardians is a vital aspect of ensuring good governance and safeguarding the interests of beneficiaries and wards. These demands help maintain transparency, accountability, and compliance with legal and ethical standards in Miami-Dade County, Florida.Miami-Dade, Florida Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian: In Miami-Dade County, Florida, individuals who hold positions of fiduciary responsibility, like Executors, Conservators, Trustees, or Legal Guardians, are required to adhere to strict accounting standards. The demand for accounting from these fiduciaries is crucial in ensuring transparency, accountability, and the protection of beneficiaries' rights and assets. Several types of demand for accounting can arise in Miami-Dade County: 1. Executor Accounting: When someone passes away in Miami-Dade County and leaves behind a Last Will and Testament, an Executor is appointed to handle the administration of the deceased person's estate. Executors have a fiduciary duty to manage the estate's assets and distribute them according to the decedent's wishes outlined in the Will. Beneficiaries or interested parties can demand accounting from the Executor to verify that the assets are properly managed, debts are paid, and distributions are made lawfully. 2. Conservator Accounting: In cases where individuals in Miami-Dade County are deemed unable to manage their own financial affairs or make decisions related to their estate, a Conservator may be appointed by a court. Conservators have the responsibility to handle and protect the conservative's assets, pay bills, manage investments, and provide necessary care. Interested parties, such as family members or the court, can request an accounting from the Conservator to ensure that the conservative's financial needs are met, and assets are appropriately managed. 3. Trustee Accounting: Trustees in Miami-Dade County are entrusted with the management and distribution of assets held within a trust. Whether it is a revocable living trust or an irrevocable trust, Trustees must abide by their fiduciary obligations. Beneficiaries or interested parties can demand accounting from the Trustee to confirm that the trust's assets are handled prudently, income is correctly distributed, and expenditures are made in accordance with the trust's terms. 4. Legal Guardian Accounting: In cases involving minors or individuals deemed incapacitated in Miami-Dade County, a court may appoint a Legal Guardian to handle their personal and financial matters. Legal Guardians are responsible for making decisions in the best interest of the ward and managing their assets. Interested parties, including family members or the court, may request an accounting from the Legal Guardian to ensure proper stewardship of the ward's assets and funds. In conclusion, demanding accounting from fiduciaries such as Executors, Conservators, Trustees, or Legal Guardians is a vital aspect of ensuring good governance and safeguarding the interests of beneficiaries and wards. These demands help maintain transparency, accountability, and compliance with legal and ethical standards in Miami-Dade County, Florida.

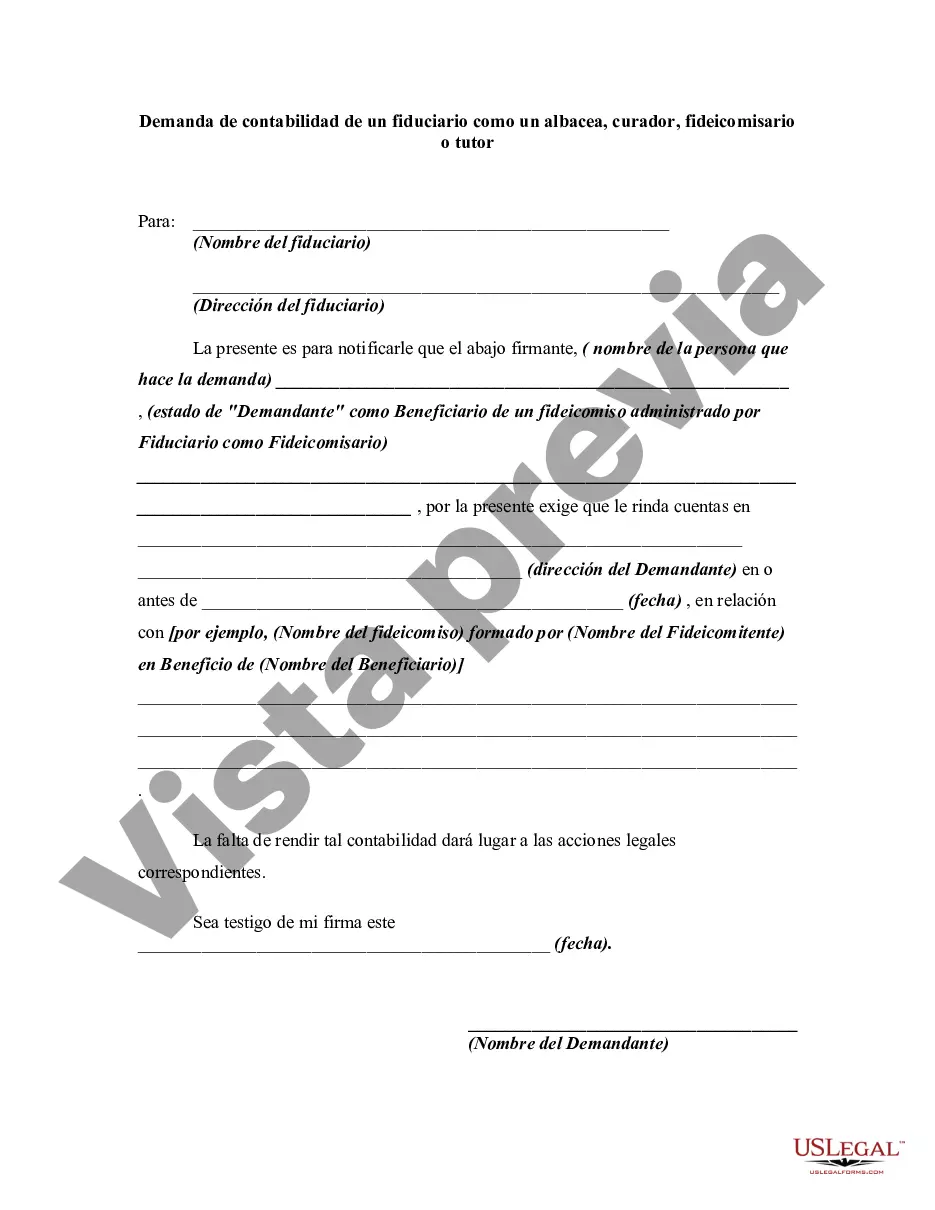

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.