An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

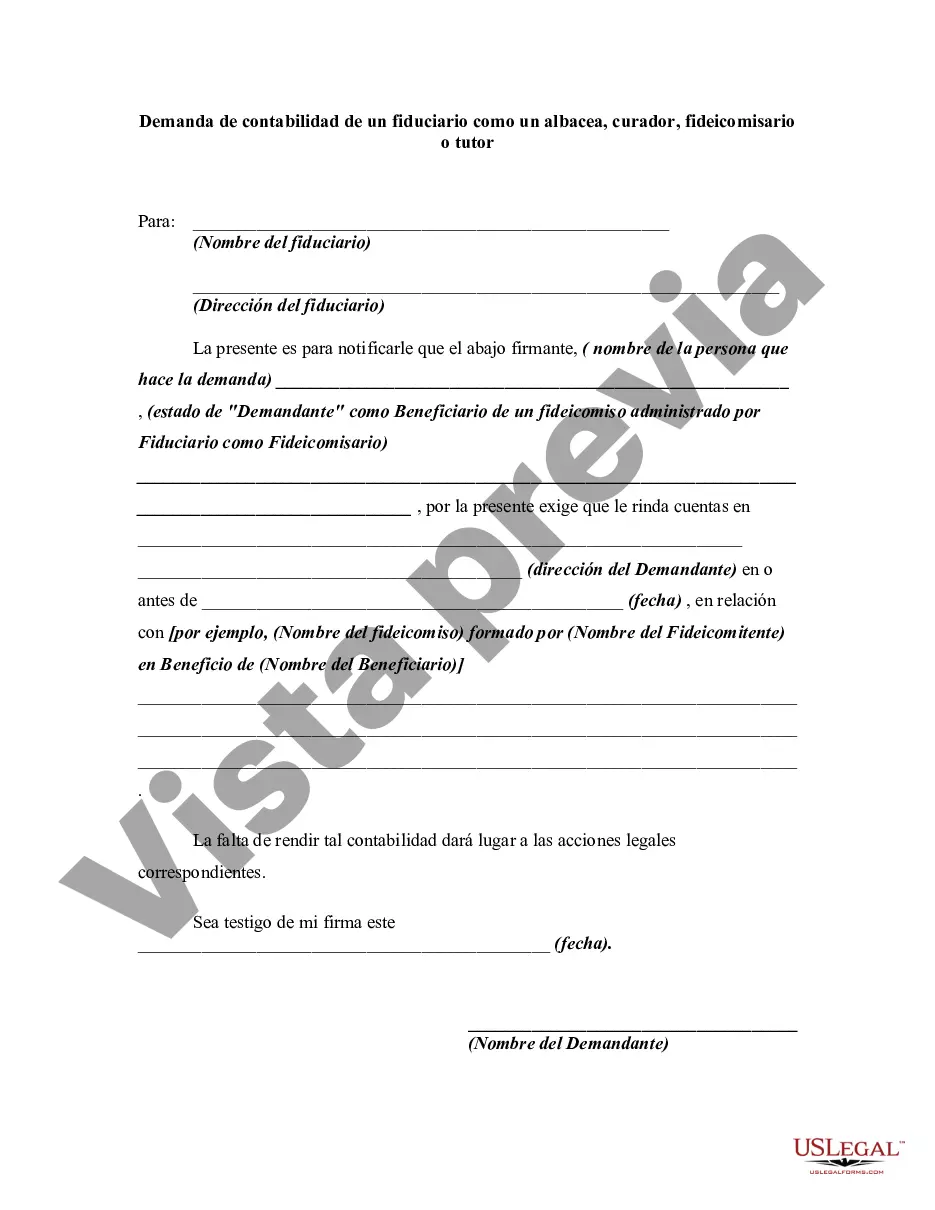

Nassau County, located in the state of New York, has a high demand for accounting services from various fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. These individuals hold important roles in managing the financial affairs and assets of others, and their accountability is crucial to ensure transparency and fairness. Here are different types of Nassau New York Demand for Accounting from a Fiduciary: 1. Executor Accounting: Executors are responsible for managing the estate and financial affairs of a deceased person. They are entrusted with gathering assets, paying debts and taxes, and distributing the estate to beneficiaries according to the deceased's will. Demand for accounting from Executors ensures proper administration and fair distribution of the estate's assets. 2. Conservator Accounting: A Conservator is appointed by the court to manage the financial affairs and assets of an incapacitated individual, often due to old age, disability, or mental incapacity. The Conservator must provide regular accounting reports to demonstrate the handling of finances and guarantee that the individual's best interests are being served. 3. Trustee Accounting: Trustees oversee the administration of trusts, which are legal arrangements that hold assets for the benefit of designated beneficiaries. They are responsible for managing, investing, and distributing trust assets in accordance with the terms of the trust document. Demand for accounting from Trustees ensures transparency, accountability, and compliance with legal requirements. 4. Legal Guardian Accounting: A Legal Guardian is appointed by the court to manage the finances and affairs of a minor child or an adult who is deemed incapacitated. They are responsible for making financial decisions, budgeting, and ensuring the well-being of their wards. Demand for accounting from Legal Guardians ensures that the funds of the ward are used appropriately and to safeguard their best interests. In summary, Nassau New York has a significant demand for accounting services from fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. These individuals play vital roles in managing assets and finances on behalf of others, and demand for accounting ensures transparency, accountability, and the protection of beneficiaries' interests.Nassau County, located in the state of New York, has a high demand for accounting services from various fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. These individuals hold important roles in managing the financial affairs and assets of others, and their accountability is crucial to ensure transparency and fairness. Here are different types of Nassau New York Demand for Accounting from a Fiduciary: 1. Executor Accounting: Executors are responsible for managing the estate and financial affairs of a deceased person. They are entrusted with gathering assets, paying debts and taxes, and distributing the estate to beneficiaries according to the deceased's will. Demand for accounting from Executors ensures proper administration and fair distribution of the estate's assets. 2. Conservator Accounting: A Conservator is appointed by the court to manage the financial affairs and assets of an incapacitated individual, often due to old age, disability, or mental incapacity. The Conservator must provide regular accounting reports to demonstrate the handling of finances and guarantee that the individual's best interests are being served. 3. Trustee Accounting: Trustees oversee the administration of trusts, which are legal arrangements that hold assets for the benefit of designated beneficiaries. They are responsible for managing, investing, and distributing trust assets in accordance with the terms of the trust document. Demand for accounting from Trustees ensures transparency, accountability, and compliance with legal requirements. 4. Legal Guardian Accounting: A Legal Guardian is appointed by the court to manage the finances and affairs of a minor child or an adult who is deemed incapacitated. They are responsible for making financial decisions, budgeting, and ensuring the well-being of their wards. Demand for accounting from Legal Guardians ensures that the funds of the ward are used appropriately and to safeguard their best interests. In summary, Nassau New York has a significant demand for accounting services from fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. These individuals play vital roles in managing assets and finances on behalf of others, and demand for accounting ensures transparency, accountability, and the protection of beneficiaries' interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.