An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Phoenix, Arizona Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian In the bustling city of Phoenix, Arizona, there is a growing demand for accounting services from fiduciaries, including Executors, Conservators, Trustees, and Legal Guardians. These professionals play essential roles in managing the affairs and assets of individuals and entities, ensuring that the necessary financial obligations are met and that the best interests of their beneficiaries or wards are protected. Accounting services are crucial for fiduciaries operating in Phoenix, as they need to maintain accurate records, prepare financial statements, and comply with legal requirements. 1. Executor Accounting: Executors are appointed to administer the estates of deceased individuals. They are responsible for managing the deceased person's assets, paying outstanding debts, fulfilling tax obligations, distributing assets to beneficiaries according to the will or intestacy laws, and securing legal closure of the estate. Demand for accounting services from Executors in Phoenix is high, as they must meticulously track and report all financial transactions related to the estate to ensure transparency and accountability. 2. Conservator Accounting: Conservators are appointed by the court to manage the financial affairs and well-being of individuals unable to do so themselves, often due to age, disability, or incapacitation. They are entrusted with the responsibility of using the ward's assets for their benefit and must provide regular accounting to the court for review. Demand for accounting services from Conservators is crucial in Phoenix, as they must maintain precise records, demonstrate prudent management of funds, and disclose all financial activities to protect the ward's interests. 3. Trustee Accounting: Trustees are responsible for managing trusts created to hold and administer assets on behalf of beneficiaries. They must distribute income or assets to beneficiaries according to the trust terms, invest the trust funds wisely, keep accurate records of all transactions, and file tax returns for the trust. Trustee accounting services are in high demand in Phoenix, as Trustees need to ensure compliance with the trust agreement's provisions and provide transparent reporting to beneficiaries, meeting legal and ethical obligations. 4. Legal Guardian Accounting: Legal Guardians are appointed by the court to handle the personal and financial affairs of individuals who are deemed incapacitated, usually minors or adults with disabilities. They must ensure the well-being and financial stability of their wards, managing assets and making financial decisions on their behalf. Accounting services for Legal Guardians are crucial in Phoenix, as they must demonstrate sound financial management, maintain accurate records, and provide detailed accounting to the court. In conclusion, the demand for accounting services from fiduciaries, such as Executors, Conservators, Trustees, and Legal Guardians, is significant in Phoenix, Arizona. These professionals play vital roles in managing and protecting the assets and interests of individuals and entities. Accurate record-keeping, financial transparency, and compliance with legal requirements are imperative for fiduciaries in Phoenix to meet their obligations effectively. Seek the assistance of accounting professionals specializing in fiduciary accounting in Phoenix to ensure the proper management of estates, trusts, and guardianship.Phoenix, Arizona Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian In the bustling city of Phoenix, Arizona, there is a growing demand for accounting services from fiduciaries, including Executors, Conservators, Trustees, and Legal Guardians. These professionals play essential roles in managing the affairs and assets of individuals and entities, ensuring that the necessary financial obligations are met and that the best interests of their beneficiaries or wards are protected. Accounting services are crucial for fiduciaries operating in Phoenix, as they need to maintain accurate records, prepare financial statements, and comply with legal requirements. 1. Executor Accounting: Executors are appointed to administer the estates of deceased individuals. They are responsible for managing the deceased person's assets, paying outstanding debts, fulfilling tax obligations, distributing assets to beneficiaries according to the will or intestacy laws, and securing legal closure of the estate. Demand for accounting services from Executors in Phoenix is high, as they must meticulously track and report all financial transactions related to the estate to ensure transparency and accountability. 2. Conservator Accounting: Conservators are appointed by the court to manage the financial affairs and well-being of individuals unable to do so themselves, often due to age, disability, or incapacitation. They are entrusted with the responsibility of using the ward's assets for their benefit and must provide regular accounting to the court for review. Demand for accounting services from Conservators is crucial in Phoenix, as they must maintain precise records, demonstrate prudent management of funds, and disclose all financial activities to protect the ward's interests. 3. Trustee Accounting: Trustees are responsible for managing trusts created to hold and administer assets on behalf of beneficiaries. They must distribute income or assets to beneficiaries according to the trust terms, invest the trust funds wisely, keep accurate records of all transactions, and file tax returns for the trust. Trustee accounting services are in high demand in Phoenix, as Trustees need to ensure compliance with the trust agreement's provisions and provide transparent reporting to beneficiaries, meeting legal and ethical obligations. 4. Legal Guardian Accounting: Legal Guardians are appointed by the court to handle the personal and financial affairs of individuals who are deemed incapacitated, usually minors or adults with disabilities. They must ensure the well-being and financial stability of their wards, managing assets and making financial decisions on their behalf. Accounting services for Legal Guardians are crucial in Phoenix, as they must demonstrate sound financial management, maintain accurate records, and provide detailed accounting to the court. In conclusion, the demand for accounting services from fiduciaries, such as Executors, Conservators, Trustees, and Legal Guardians, is significant in Phoenix, Arizona. These professionals play vital roles in managing and protecting the assets and interests of individuals and entities. Accurate record-keeping, financial transparency, and compliance with legal requirements are imperative for fiduciaries in Phoenix to meet their obligations effectively. Seek the assistance of accounting professionals specializing in fiduciary accounting in Phoenix to ensure the proper management of estates, trusts, and guardianship.

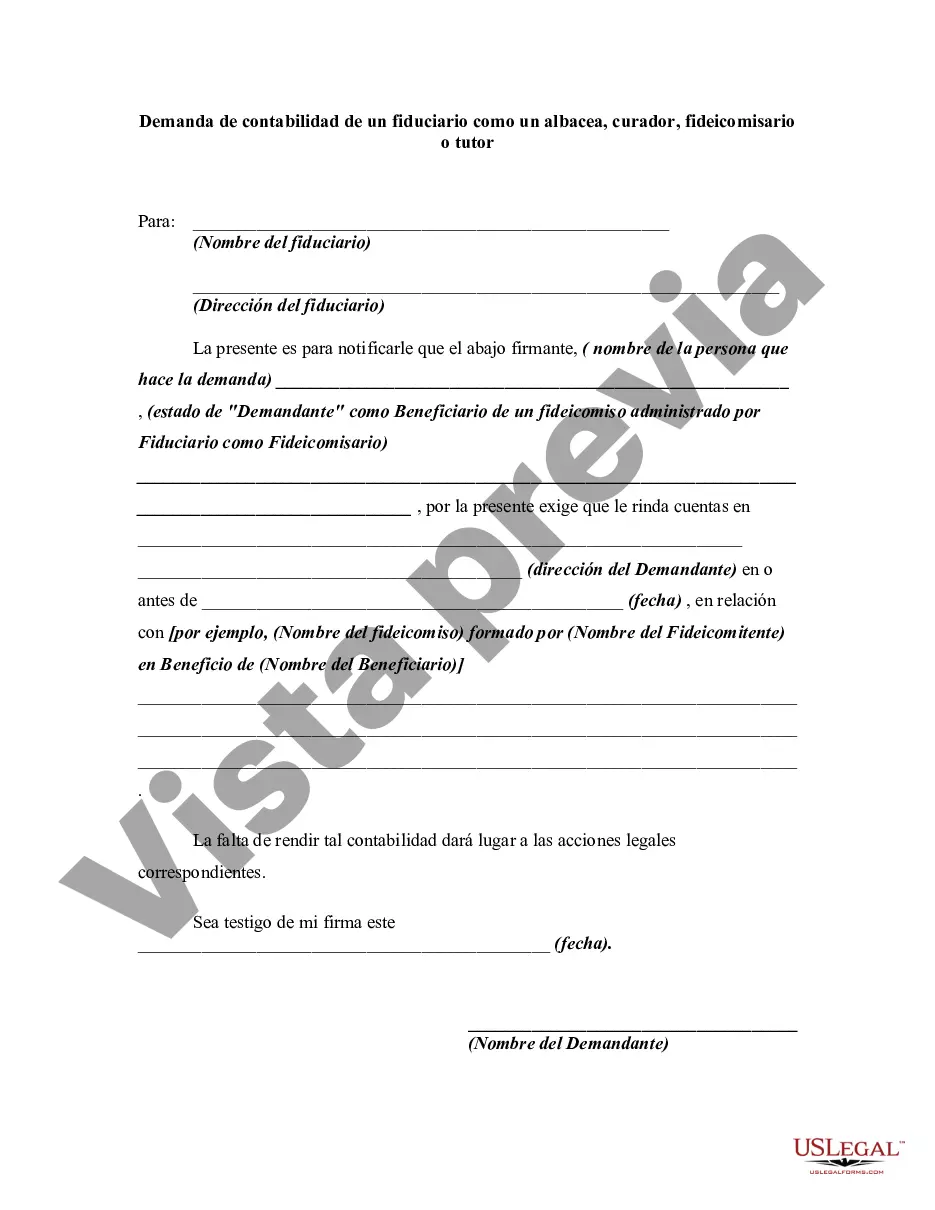

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.