An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Sacramento, California: Understanding the Demand for Accounting from a Fiduciary In Sacramento, California, the demand for accounting from fiduciaries, including Executors, Conservators, Trustees, and Legal Guardians, is an essential aspect of ensuring transparency, adhering to legal requirements, and safeguarding the interests of beneficiaries and ward-protected individuals. These fiduciaries play crucial roles in managing financial affairs and making important decisions on behalf of others, and the need for accurate and comprehensive accounting cannot be overstated. Executor Demand for Accounting: When an individual passes away, their estate may require an executor to handle all legal and financial matters. The executor is responsible for managing assets, paying debts, distributing inheritances, and accurately reporting all financial transactions. Beneficiaries have the legal right to request an accounting from the executor to ensure the proper administration of the estate. Conservator Demand for Accounting: In cases where an individual is unable to manage their own affairs due to incapacity or disability, a conservator is appointed to make financial and personal decisions on their behalf. A conservator's duty is to act in the best interests of the conservative, ensuring their financial resources are prudently managed. Relatives, beneficiaries, or interested parties may request an accounting to verify that the conservator is carrying out their responsibilities ethically and adhering to legal guidelines. Trustee Demand for Accounting: Trustees are entrusted with managing assets placed in trust for the benefit of designated beneficiaries. Whether it's a revocable living trust or an irrevocable trust, trustees have a legal obligation to administer the trust according to its terms, act in the best interests of the beneficiaries, and provide regular accounting to beneficiaries, as specified by California law. Legal Guardian Demand for Accounting: Legal guardians are appointed to make decisions and manage the affairs of individuals unable to care for themselves, such as minors or incapacitated adults. These guardians have a fiduciary duty to act in the best interests of their wards, including managing financial matters responsibly. Interested parties, such as family members or beneficiaries, can request accounting to ensure guardians are effectively carrying out their duties and protecting the ward's financial interests. The significance of accurate accounting from these fiduciaries cannot be emphasized enough. It safeguards against mismanagement, financial abuse, and fraud, providing beneficiaries, conservatives, and wards with the necessary transparency and peace of mind. Accounting should include comprehensive records of all assets, income, expenses, distributions, and any other financial transactions related to the fiduciary role. In conclusion, Sacramento, California, recognizes the importance of demanding accounting from fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. These individuals hold positions of trust and are legally obligated to manage assets and make decisions on behalf of others. Through regular and accurate accounting, beneficiaries, conservatives, wards, and interested parties can ensure the proper administration of finances while safeguarding their rights and interests in accordance with California law.Sacramento, California: Understanding the Demand for Accounting from a Fiduciary In Sacramento, California, the demand for accounting from fiduciaries, including Executors, Conservators, Trustees, and Legal Guardians, is an essential aspect of ensuring transparency, adhering to legal requirements, and safeguarding the interests of beneficiaries and ward-protected individuals. These fiduciaries play crucial roles in managing financial affairs and making important decisions on behalf of others, and the need for accurate and comprehensive accounting cannot be overstated. Executor Demand for Accounting: When an individual passes away, their estate may require an executor to handle all legal and financial matters. The executor is responsible for managing assets, paying debts, distributing inheritances, and accurately reporting all financial transactions. Beneficiaries have the legal right to request an accounting from the executor to ensure the proper administration of the estate. Conservator Demand for Accounting: In cases where an individual is unable to manage their own affairs due to incapacity or disability, a conservator is appointed to make financial and personal decisions on their behalf. A conservator's duty is to act in the best interests of the conservative, ensuring their financial resources are prudently managed. Relatives, beneficiaries, or interested parties may request an accounting to verify that the conservator is carrying out their responsibilities ethically and adhering to legal guidelines. Trustee Demand for Accounting: Trustees are entrusted with managing assets placed in trust for the benefit of designated beneficiaries. Whether it's a revocable living trust or an irrevocable trust, trustees have a legal obligation to administer the trust according to its terms, act in the best interests of the beneficiaries, and provide regular accounting to beneficiaries, as specified by California law. Legal Guardian Demand for Accounting: Legal guardians are appointed to make decisions and manage the affairs of individuals unable to care for themselves, such as minors or incapacitated adults. These guardians have a fiduciary duty to act in the best interests of their wards, including managing financial matters responsibly. Interested parties, such as family members or beneficiaries, can request accounting to ensure guardians are effectively carrying out their duties and protecting the ward's financial interests. The significance of accurate accounting from these fiduciaries cannot be emphasized enough. It safeguards against mismanagement, financial abuse, and fraud, providing beneficiaries, conservatives, and wards with the necessary transparency and peace of mind. Accounting should include comprehensive records of all assets, income, expenses, distributions, and any other financial transactions related to the fiduciary role. In conclusion, Sacramento, California, recognizes the importance of demanding accounting from fiduciaries such as Executors, Conservators, Trustees, and Legal Guardians. These individuals hold positions of trust and are legally obligated to manage assets and make decisions on behalf of others. Through regular and accurate accounting, beneficiaries, conservatives, wards, and interested parties can ensure the proper administration of finances while safeguarding their rights and interests in accordance with California law.

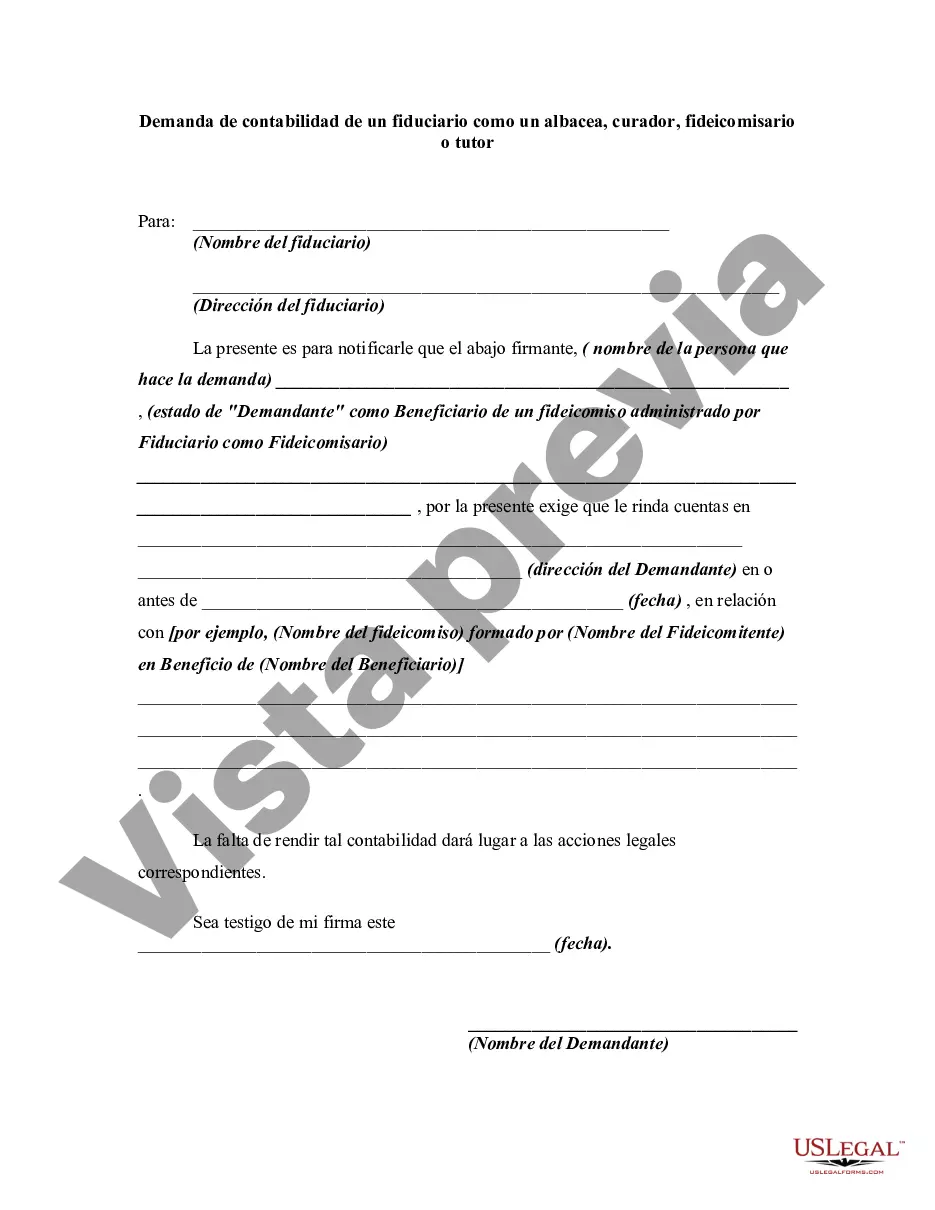

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.