A counter offer is an offer made in response to a previous offer by the other party during negotiations for a final contract. It is a new offer made in response to an offer received. It has the effect of rejecting the original offer, which cannot be accepted thereafter unless revived by the offeror. Making a counter offer automatically rejects the prior offer, and requires an acceptance under the terms of the counter offer or there is no contract.

Mecklenburg North Carolina Counter Offer Letter — Conditional Acceptance WherSubjecter does not Involve the Sale of Goods In Mecklenburg, North Carolina, a counter offer letter is a formal document used in various legal transactions where the subject does not pertain to the sale of goods. This type of letter serves as a response to an initial offer, presenting revised terms and conditions for the agreement. Conditional Acceptance A conditional acceptance is a type of counter offer letter wherein the accepting party agrees to the terms proposed by the offering party, provided certain conditions are met. This allows the party making the counter offer to negotiate specific aspects of the agreement to ensure all parties involved are satisfied. Subject not Involving the Sale of Goods The subject addressed in this type of counter offer letter may vary, encompassing various legal matters other than the sale of goods. Some common subject matters that may involve a counter offer letter include: 1. Contractual Agreements: When parties negotiate a contract, such as a lease agreement, employment agreement, or service contract, a counter offer letter can be used to propose alternate terms and conditions. 2. Real Estate Transactions: In the context of buying or selling property, a counter offer letter can be employed to propose changes to the purchase price, closing date, or any other terms outlined in the initial offer. 3. Business Partnerships: When individuals or entities consider forming a partnership, a counter offer letter may be necessary to negotiate the terms of the partnership agreement, such as profit distribution, managerial responsibilities, or business objectives. 4. Loan and Financing Agreements: In cases where individuals or businesses apply for loans or financing, a counter offer letter can be used to negotiate the interest rate, repayment terms, or loan amount proposed by the lender. By utilizing a Mecklenburg North Carolina Counter Offer Letter — Conditional Acceptance WherSubjecter does not Involve the Sale of Goods, parties involved in legal transactions can have a formal and structured method to negotiate and reach mutually beneficial agreements.Mecklenburg North Carolina Counter Offer Letter — Conditional Acceptance WherSubjecter does not Involve the Sale of Goods In Mecklenburg, North Carolina, a counter offer letter is a formal document used in various legal transactions where the subject does not pertain to the sale of goods. This type of letter serves as a response to an initial offer, presenting revised terms and conditions for the agreement. Conditional Acceptance A conditional acceptance is a type of counter offer letter wherein the accepting party agrees to the terms proposed by the offering party, provided certain conditions are met. This allows the party making the counter offer to negotiate specific aspects of the agreement to ensure all parties involved are satisfied. Subject not Involving the Sale of Goods The subject addressed in this type of counter offer letter may vary, encompassing various legal matters other than the sale of goods. Some common subject matters that may involve a counter offer letter include: 1. Contractual Agreements: When parties negotiate a contract, such as a lease agreement, employment agreement, or service contract, a counter offer letter can be used to propose alternate terms and conditions. 2. Real Estate Transactions: In the context of buying or selling property, a counter offer letter can be employed to propose changes to the purchase price, closing date, or any other terms outlined in the initial offer. 3. Business Partnerships: When individuals or entities consider forming a partnership, a counter offer letter may be necessary to negotiate the terms of the partnership agreement, such as profit distribution, managerial responsibilities, or business objectives. 4. Loan and Financing Agreements: In cases where individuals or businesses apply for loans or financing, a counter offer letter can be used to negotiate the interest rate, repayment terms, or loan amount proposed by the lender. By utilizing a Mecklenburg North Carolina Counter Offer Letter — Conditional Acceptance WherSubjecter does not Involve the Sale of Goods, parties involved in legal transactions can have a formal and structured method to negotiate and reach mutually beneficial agreements.

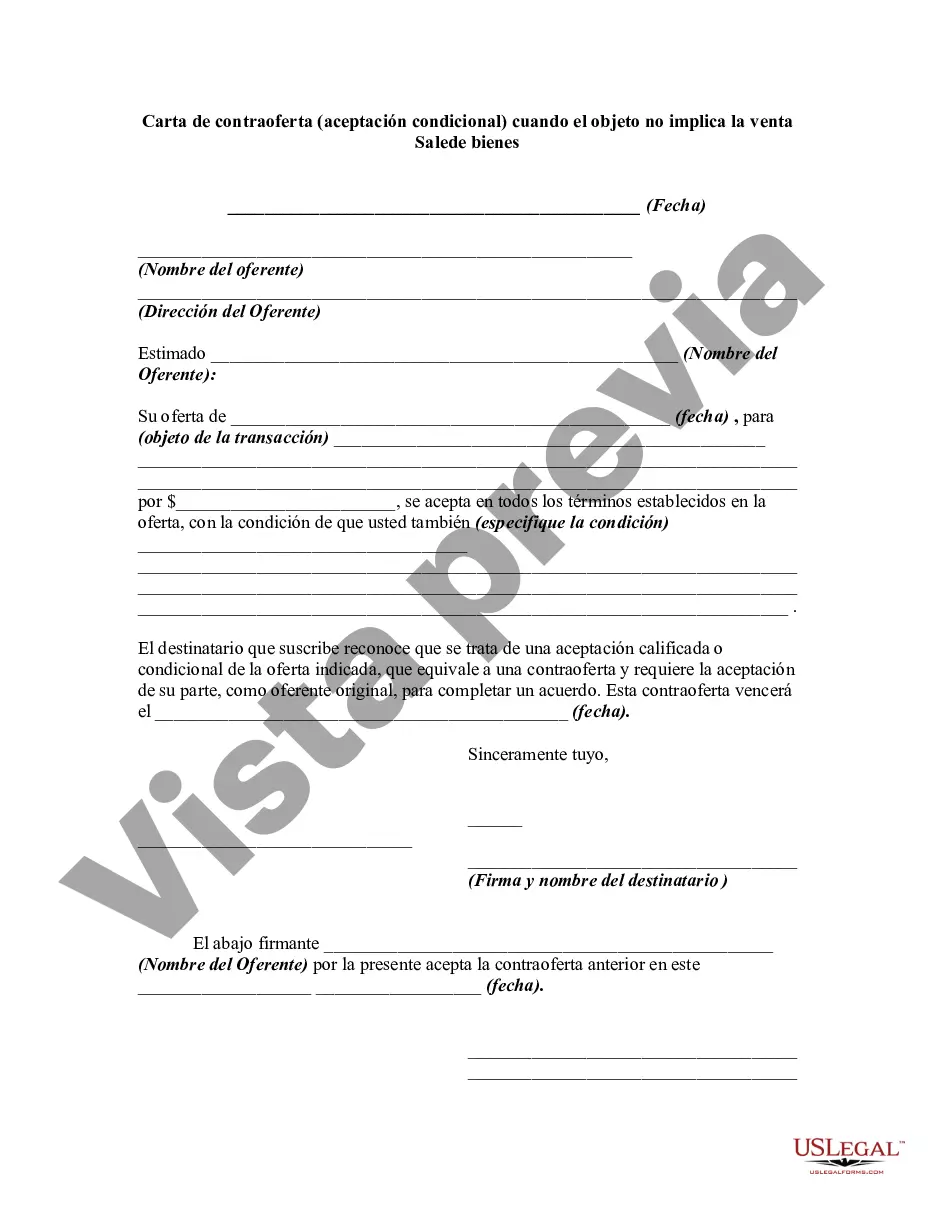

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.