A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

Chicago, Illinois is a vibrant city located in the heart of the Midwest. Known for its stunning architecture, diverse culture, and rich history, Chicago is a bustling metropolis that offers a plethora of attractions and opportunities for both residents and visitors alike. When it comes to financial matters, Chicago is also a hub for businesses and individuals seeking loans or investments. If you find yourself in a situation where you need to make a full payment of an existing balance of a promissory note due to acceleration or prepayment of the note, it is essential to have a clear understanding of the process and the necessary steps to take. In such a scenario, a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" becomes crucial. This formal letter serves as a written notice to the lender, informing them of your intention to satisfy the outstanding balance of the promissory note ahead of the predetermined schedule. The purpose of this letter is to formally request the lender's cooperation in accepting the full payment and to ensure that all necessary documentation is provided to establish the completion of the transaction. The content of the letter should include relevant information such as the lender's details, the borrower's information, and the specific terms of the promissory note. Keywords: Chicago Illinois, letter, tendering, full payment, existing balance, promissory note, acceleration, prepayment, due, balance, loan, lender, borrower, documentation, transaction. Different types of Chicago Illinois Letters Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note may include variations in language, formatting, and specific terms based on the circumstances of the promissory note. Some potential types or variations could be: 1. Acceleration of Note: This type of letter would be used when the lender accelerates the repayment schedule due to a breach of the terms of the promissory note. 2. Prepayment of Note: In situations where the borrower wants to pay off the note before the predetermined maturity date, a prepayment letter would be appropriate. 3. Early Payment Penalty: If there are penalties associated with prepayment, a letter addressing these penalties and detailing the full payment would be necessary. 4. Legal Notice of Full Payment: When legal proceedings are involved in the repayment process, a letter providing evidence of the full payment might be required to protect the borrower's rights and ensure the transaction's legality. Remember, each situation may require a unique approach, and seeking legal advice or guidance from financial professionals is crucial to ensure accuracy, compliance, and protection of your interests.Chicago, Illinois is a vibrant city located in the heart of the Midwest. Known for its stunning architecture, diverse culture, and rich history, Chicago is a bustling metropolis that offers a plethora of attractions and opportunities for both residents and visitors alike. When it comes to financial matters, Chicago is also a hub for businesses and individuals seeking loans or investments. If you find yourself in a situation where you need to make a full payment of an existing balance of a promissory note due to acceleration or prepayment of the note, it is essential to have a clear understanding of the process and the necessary steps to take. In such a scenario, a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" becomes crucial. This formal letter serves as a written notice to the lender, informing them of your intention to satisfy the outstanding balance of the promissory note ahead of the predetermined schedule. The purpose of this letter is to formally request the lender's cooperation in accepting the full payment and to ensure that all necessary documentation is provided to establish the completion of the transaction. The content of the letter should include relevant information such as the lender's details, the borrower's information, and the specific terms of the promissory note. Keywords: Chicago Illinois, letter, tendering, full payment, existing balance, promissory note, acceleration, prepayment, due, balance, loan, lender, borrower, documentation, transaction. Different types of Chicago Illinois Letters Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note may include variations in language, formatting, and specific terms based on the circumstances of the promissory note. Some potential types or variations could be: 1. Acceleration of Note: This type of letter would be used when the lender accelerates the repayment schedule due to a breach of the terms of the promissory note. 2. Prepayment of Note: In situations where the borrower wants to pay off the note before the predetermined maturity date, a prepayment letter would be appropriate. 3. Early Payment Penalty: If there are penalties associated with prepayment, a letter addressing these penalties and detailing the full payment would be necessary. 4. Legal Notice of Full Payment: When legal proceedings are involved in the repayment process, a letter providing evidence of the full payment might be required to protect the borrower's rights and ensure the transaction's legality. Remember, each situation may require a unique approach, and seeking legal advice or guidance from financial professionals is crucial to ensure accuracy, compliance, and protection of your interests.

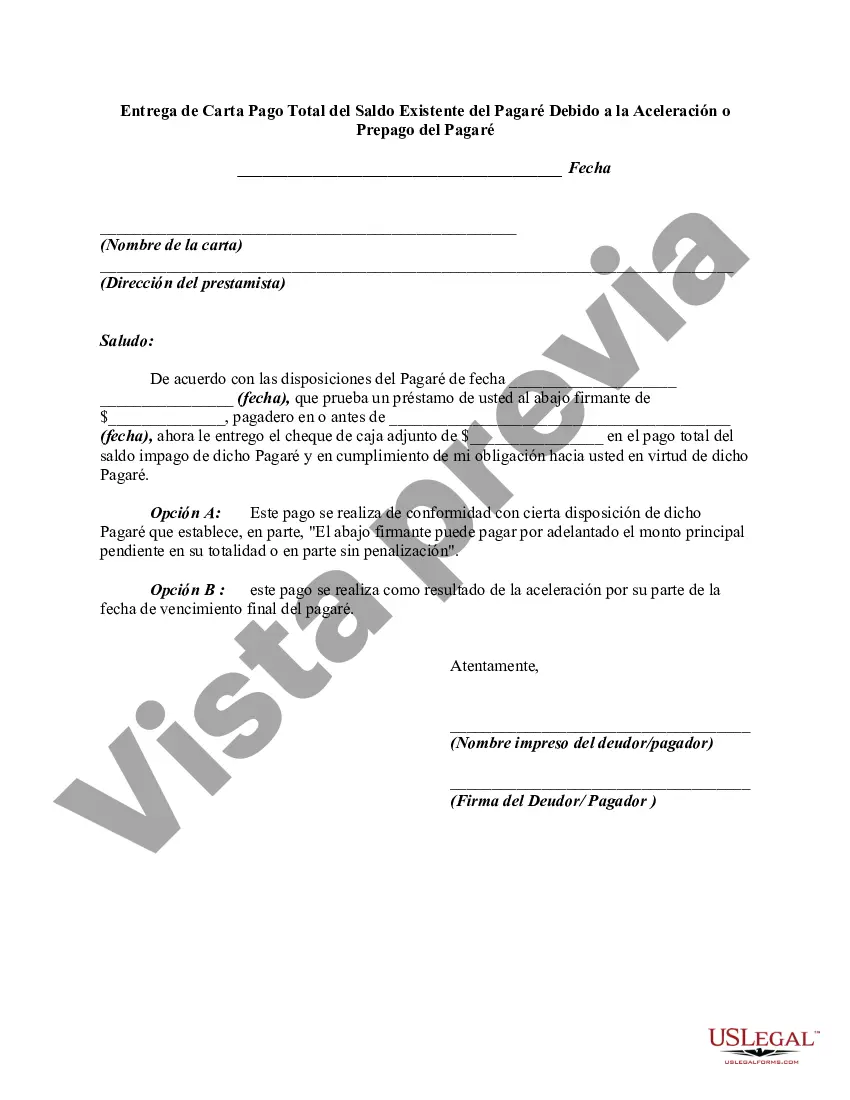

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.