A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

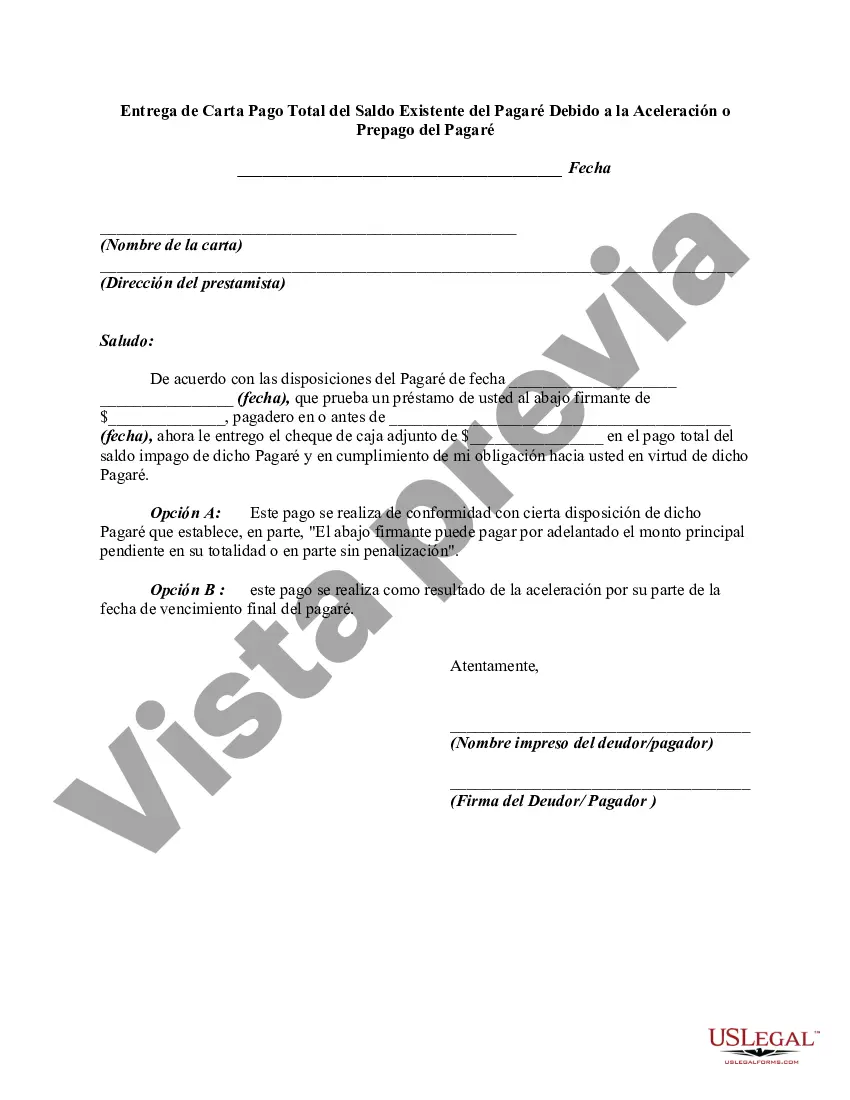

Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note: A Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note is a formal document that serves as a written notice to the lender regarding the borrower's intention to pay off the remaining balance of a promissory note before the agreed-upon maturity date. It highlights the recipient's name, address, and contact information, along with the borrower's details, including their name, address, and contact information. The letter includes a clear and concise introduction, mentioning the promissory note in question and stating the borrower's desire to tender full payment of the existing balance. It is crucial to emphasize the reason behind this acceleration or prepayment, whether it is due to financial capability, refinancing options, or personal circumstances. By providing relevant keywords in the letter, it ensures accurate context for the recipient. The main body of the letter elaborates on the details of the promissory note, such as the original principal amount, the interest rate, and the remaining balance. It might also outline any penalties or charges associated with early repayment. It is advisable to attach supporting documents, including copies of the promissory note, to provide a comprehensive record of the loan and its terms. Furthermore, the letter should clearly state the borrower's intention to cease any future interest accruals and request a written confirmation of payment in full. A deadline for the lender's response acknowledging receipt of the funds and providing the necessary documentation should be specified. Different types of Cuyahoga Ohio Letters Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment might include variations based on the specific circumstances of the loan and repayment. These could be: 1. Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Sudden Financial Express: This type of letter is drafted when the borrower faces an unforeseen financial crisis and requires immediate debt relief through full repayment. 2. Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Improved Financial Standing: This letter is written when the borrower experiences an increase in financial stability, allowing them to accelerate or prepay the promissory note. 3. Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Refinancing Opportunities: If the borrower has found attractive refinancing options for their existing debt, this letter outlines the intention to pay off the promissory note to take advantage of the new terms and interest rates. In conclusion, a Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is a formal document that communicates the borrower's intention to pay off a loan before the maturity date. It is advisable to consult legal professionals or financial advisors when drafting such letters to ensure accuracy and compliance with local laws and regulations.Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note: A Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note is a formal document that serves as a written notice to the lender regarding the borrower's intention to pay off the remaining balance of a promissory note before the agreed-upon maturity date. It highlights the recipient's name, address, and contact information, along with the borrower's details, including their name, address, and contact information. The letter includes a clear and concise introduction, mentioning the promissory note in question and stating the borrower's desire to tender full payment of the existing balance. It is crucial to emphasize the reason behind this acceleration or prepayment, whether it is due to financial capability, refinancing options, or personal circumstances. By providing relevant keywords in the letter, it ensures accurate context for the recipient. The main body of the letter elaborates on the details of the promissory note, such as the original principal amount, the interest rate, and the remaining balance. It might also outline any penalties or charges associated with early repayment. It is advisable to attach supporting documents, including copies of the promissory note, to provide a comprehensive record of the loan and its terms. Furthermore, the letter should clearly state the borrower's intention to cease any future interest accruals and request a written confirmation of payment in full. A deadline for the lender's response acknowledging receipt of the funds and providing the necessary documentation should be specified. Different types of Cuyahoga Ohio Letters Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment might include variations based on the specific circumstances of the loan and repayment. These could be: 1. Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Sudden Financial Express: This type of letter is drafted when the borrower faces an unforeseen financial crisis and requires immediate debt relief through full repayment. 2. Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Improved Financial Standing: This letter is written when the borrower experiences an increase in financial stability, allowing them to accelerate or prepay the promissory note. 3. Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Refinancing Opportunities: If the borrower has found attractive refinancing options for their existing debt, this letter outlines the intention to pay off the promissory note to take advantage of the new terms and interest rates. In conclusion, a Cuyahoga Ohio Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is a formal document that communicates the borrower's intention to pay off a loan before the maturity date. It is advisable to consult legal professionals or financial advisors when drafting such letters to ensure accuracy and compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.