A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

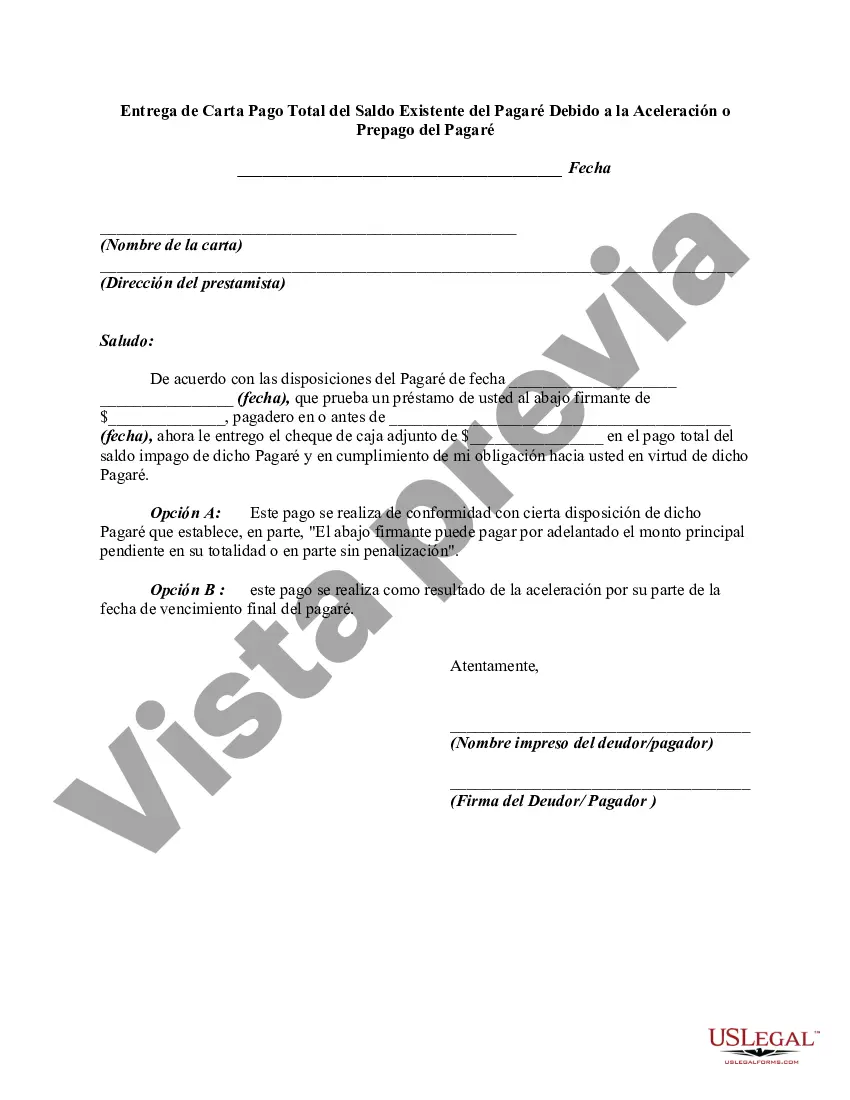

Hennepin County is located in the state of Minnesota and is the most populous county in the state. It encompasses the city of Minneapolis, the largest city in Minnesota, and several other suburbs and smaller towns. Hennepin County is known for its vibrant arts and culture scene, including numerous theaters, galleries, and music venues. A "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" is a legal document used in financial transactions. When an individual or entity makes a loan and provides a promissory note as evidence of the debt, there may be times when the borrower wishes to repay the outstanding balance before the designated maturity date. In this case, the borrower can send a letter, as required by the lender or contract, tendering full payment of the existing balance of the promissory note due to acceleration or prepayment of the note. In Hennepin County, there are different types of "Letters Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" that can be used depending on the specific circumstances: 1. Voluntary prepayment letter: This type of letter is used when the borrower decides to pay off the outstanding balance of the promissory note before the specified maturity date voluntarily. The borrower may have surplus funds or intends to refinance the loan at a more favorable interest rate. 2. Acceleration of payment letter: In certain situations, lenders may have the right to accelerate the repayment schedule of a promissory note, requiring the borrower to pay off the full balance sooner than originally agreed upon. This can happen when the borrower fails to make timely payments, breaches the terms of the agreement, or encounters financial difficulties. 3. Early payment due to refinancing letter: When the borrower obtains new financing with better terms, they may choose to repay the existing promissory note in full. This type of letter is used to communicate the intention to prepay the outstanding balance due to refinancing the debt. Regardless of the specific type of "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note," it is crucial to follow any contractual obligations and communicate the borrower's intention clearly and formally to the lender. These letters help both parties establish a clear understanding of the repayment terms and avoid any future disputes or discrepancies.Hennepin County is located in the state of Minnesota and is the most populous county in the state. It encompasses the city of Minneapolis, the largest city in Minnesota, and several other suburbs and smaller towns. Hennepin County is known for its vibrant arts and culture scene, including numerous theaters, galleries, and music venues. A "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" is a legal document used in financial transactions. When an individual or entity makes a loan and provides a promissory note as evidence of the debt, there may be times when the borrower wishes to repay the outstanding balance before the designated maturity date. In this case, the borrower can send a letter, as required by the lender or contract, tendering full payment of the existing balance of the promissory note due to acceleration or prepayment of the note. In Hennepin County, there are different types of "Letters Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" that can be used depending on the specific circumstances: 1. Voluntary prepayment letter: This type of letter is used when the borrower decides to pay off the outstanding balance of the promissory note before the specified maturity date voluntarily. The borrower may have surplus funds or intends to refinance the loan at a more favorable interest rate. 2. Acceleration of payment letter: In certain situations, lenders may have the right to accelerate the repayment schedule of a promissory note, requiring the borrower to pay off the full balance sooner than originally agreed upon. This can happen when the borrower fails to make timely payments, breaches the terms of the agreement, or encounters financial difficulties. 3. Early payment due to refinancing letter: When the borrower obtains new financing with better terms, they may choose to repay the existing promissory note in full. This type of letter is used to communicate the intention to prepay the outstanding balance due to refinancing the debt. Regardless of the specific type of "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note," it is crucial to follow any contractual obligations and communicate the borrower's intention clearly and formally to the lender. These letters help both parties establish a clear understanding of the repayment terms and avoid any future disputes or discrepancies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.