A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

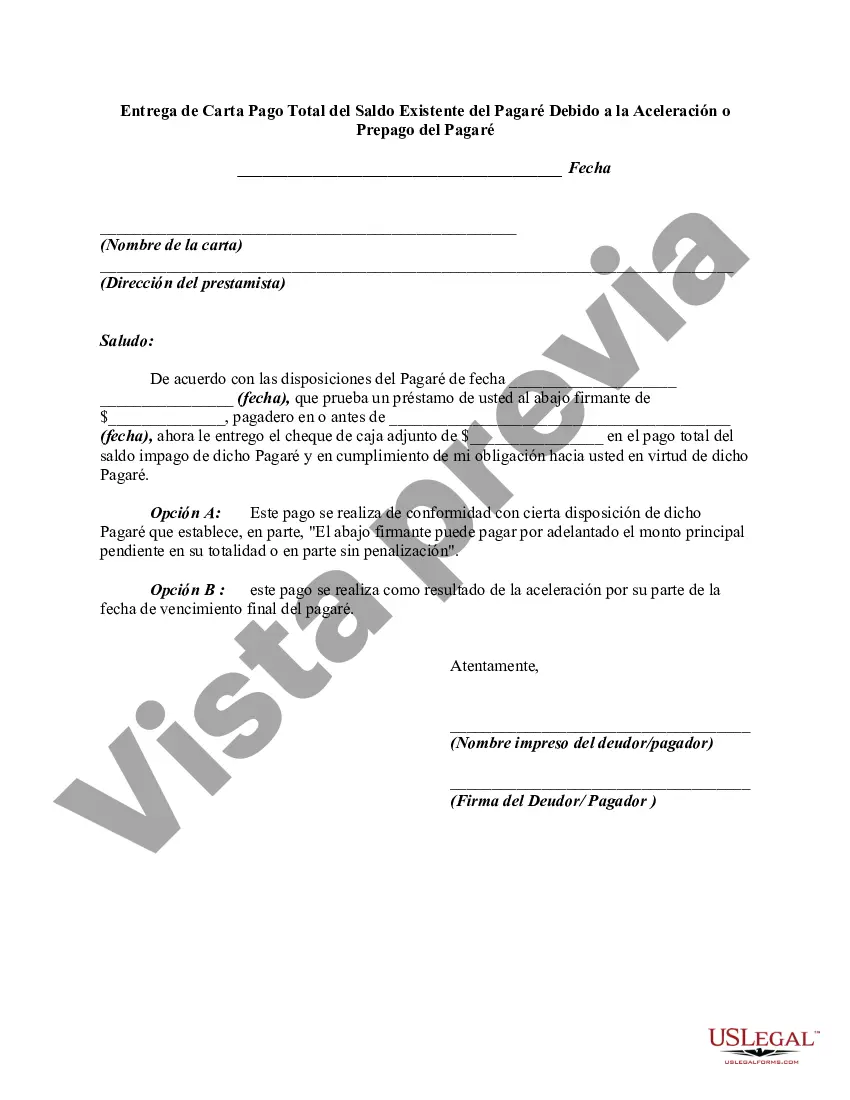

Hillsborough Florida is a county located in the state of Florida, known for its vibrant communities, scenic beauty, and rich history. In the financial realm, Hillsborough County is also home to various financial institutions and lending establishments. A Hillsborough Florida Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note is a formal document that serves as a written notice to the lender, indicating the borrower's intent to repay their outstanding promissory note balance in full. This type of letter is typically sent when the borrower wishes to either accelerate the repayment process or make a prepayment on their note. When it comes to different types of Hillsborough Florida Letters Tendering Full Payment, they are often differentiated by their specific purpose or the circumstances of the repayment: 1. Hillsborough Florida Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration: This type of letter is used when the borrower wishes to pay off the remaining balance of their promissory note before the originally agreed-upon maturity date. This might be triggered by various reasons, such as obtaining a lump sum of money or receiving a substantial windfall. 2. Hillsborough Florida Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Prepayment: This variation of the letter is employed when the borrower wants to repay the outstanding balance before the specified due date, but within the terms outlined in the promissory note agreement. Unlike acceleration, prepayment adheres to predetermined prepayment penalties or clauses specified in the note. Regardless of the type of letter, it should typically include crucial information such as the borrower's name and contact information, the lender's name and contact information, the promissory note details (including the principal amount, interest rate, maturity date, and any applicable penalties or prepayment clauses), and the specific reason for the early repayment. Lastly, it is essential to consult legal or financial professionals or refer to specific guidelines provided by the lending institution to ensure the letter accurately reflects the borrower's intent and meets all necessary requirements.Hillsborough Florida is a county located in the state of Florida, known for its vibrant communities, scenic beauty, and rich history. In the financial realm, Hillsborough County is also home to various financial institutions and lending establishments. A Hillsborough Florida Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note is a formal document that serves as a written notice to the lender, indicating the borrower's intent to repay their outstanding promissory note balance in full. This type of letter is typically sent when the borrower wishes to either accelerate the repayment process or make a prepayment on their note. When it comes to different types of Hillsborough Florida Letters Tendering Full Payment, they are often differentiated by their specific purpose or the circumstances of the repayment: 1. Hillsborough Florida Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration: This type of letter is used when the borrower wishes to pay off the remaining balance of their promissory note before the originally agreed-upon maturity date. This might be triggered by various reasons, such as obtaining a lump sum of money or receiving a substantial windfall. 2. Hillsborough Florida Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Prepayment: This variation of the letter is employed when the borrower wants to repay the outstanding balance before the specified due date, but within the terms outlined in the promissory note agreement. Unlike acceleration, prepayment adheres to predetermined prepayment penalties or clauses specified in the note. Regardless of the type of letter, it should typically include crucial information such as the borrower's name and contact information, the lender's name and contact information, the promissory note details (including the principal amount, interest rate, maturity date, and any applicable penalties or prepayment clauses), and the specific reason for the early repayment. Lastly, it is essential to consult legal or financial professionals or refer to specific guidelines provided by the lending institution to ensure the letter accurately reflects the borrower's intent and meets all necessary requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.