A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

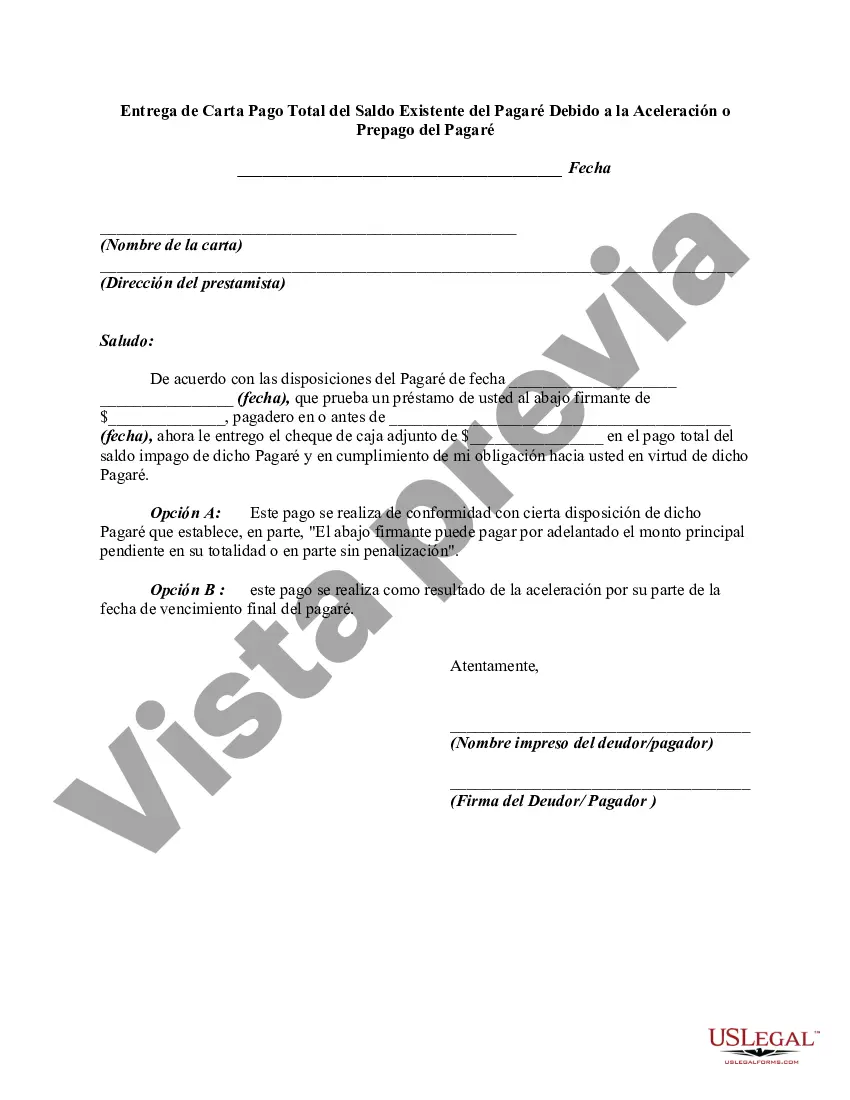

In Oakland, Michigan, a Letter Tendering Full Payment of an Existing Balance of a Promissory Note Due to Acceleration or Prepayment is a formal document used to notify the lender of the borrower's intention to pay off the remaining balance of a promissory note before its scheduled maturity date. This letter serves as a legally binding agreement between the borrower and the lender, ensuring a smooth and orderly process for the repayment of the loan. Keywords: Oakland, Michigan, letter, tendering, full payment, existing balance, promissory note, acceleration, prepayment, due, maturity date, borrower, lender, repayment, loan. There are several types of Oakland, Michigan, letters tendering full payment of an existing balance of a promissory note due to acceleration or prepayment, including: 1. Standard Letter Tendering Full Payment: This type of letter is used when a borrower wishes to pay the remaining balance of their promissory note in full before its scheduled maturity date. The letter will outline the precise amount to be paid and provide instructions on how the payment should be made. 2. Letter Tendering Full Payment Due to Acceleration: In cases where the lender has invoked an acceleration clause, demanding immediate repayment of the outstanding balance, the borrower can use this type of letter to comply with such demand. The letter will typically state the reasons for acceleration and confirm the borrower's intent to pay off the balance promptly. 3. Letter Tendering Full Payment Due to Prepayment Option: Some promissory notes include a prepayment option, which allows the borrower to repay the loan in full before the scheduled maturity date. This letter will communicate the borrower's decision to exercise the prepayment option and provide details regarding the repayment process. 4. Letter Tendering Full Payment Due to Financial Windfall: If a borrower suddenly comes into a substantial sum of money and wishes to pay off their promissory note entirely, they may use this type of letter to inform the lender of their intent and provide information about the source of funds for verification purposes. 5. Letter Tendering Full Payment with Request for Release of Lien: In situations where the promissory note is secured by a lien on a property or other collateral, the borrower can use this letter to request the lender to release the lien upon receipt of full payment. The letter will include details of the payment and the specific property or collateral subject to the lien. It is important to consult with legal professionals or financial advisors to ensure the proper drafting and execution of such letters, as specific laws and regulations may apply in Oakland, Michigan, or the jurisdiction of the promissory note agreement.In Oakland, Michigan, a Letter Tendering Full Payment of an Existing Balance of a Promissory Note Due to Acceleration or Prepayment is a formal document used to notify the lender of the borrower's intention to pay off the remaining balance of a promissory note before its scheduled maturity date. This letter serves as a legally binding agreement between the borrower and the lender, ensuring a smooth and orderly process for the repayment of the loan. Keywords: Oakland, Michigan, letter, tendering, full payment, existing balance, promissory note, acceleration, prepayment, due, maturity date, borrower, lender, repayment, loan. There are several types of Oakland, Michigan, letters tendering full payment of an existing balance of a promissory note due to acceleration or prepayment, including: 1. Standard Letter Tendering Full Payment: This type of letter is used when a borrower wishes to pay the remaining balance of their promissory note in full before its scheduled maturity date. The letter will outline the precise amount to be paid and provide instructions on how the payment should be made. 2. Letter Tendering Full Payment Due to Acceleration: In cases where the lender has invoked an acceleration clause, demanding immediate repayment of the outstanding balance, the borrower can use this type of letter to comply with such demand. The letter will typically state the reasons for acceleration and confirm the borrower's intent to pay off the balance promptly. 3. Letter Tendering Full Payment Due to Prepayment Option: Some promissory notes include a prepayment option, which allows the borrower to repay the loan in full before the scheduled maturity date. This letter will communicate the borrower's decision to exercise the prepayment option and provide details regarding the repayment process. 4. Letter Tendering Full Payment Due to Financial Windfall: If a borrower suddenly comes into a substantial sum of money and wishes to pay off their promissory note entirely, they may use this type of letter to inform the lender of their intent and provide information about the source of funds for verification purposes. 5. Letter Tendering Full Payment with Request for Release of Lien: In situations where the promissory note is secured by a lien on a property or other collateral, the borrower can use this letter to request the lender to release the lien upon receipt of full payment. The letter will include details of the payment and the specific property or collateral subject to the lien. It is important to consult with legal professionals or financial advisors to ensure the proper drafting and execution of such letters, as specific laws and regulations may apply in Oakland, Michigan, or the jurisdiction of the promissory note agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.