A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

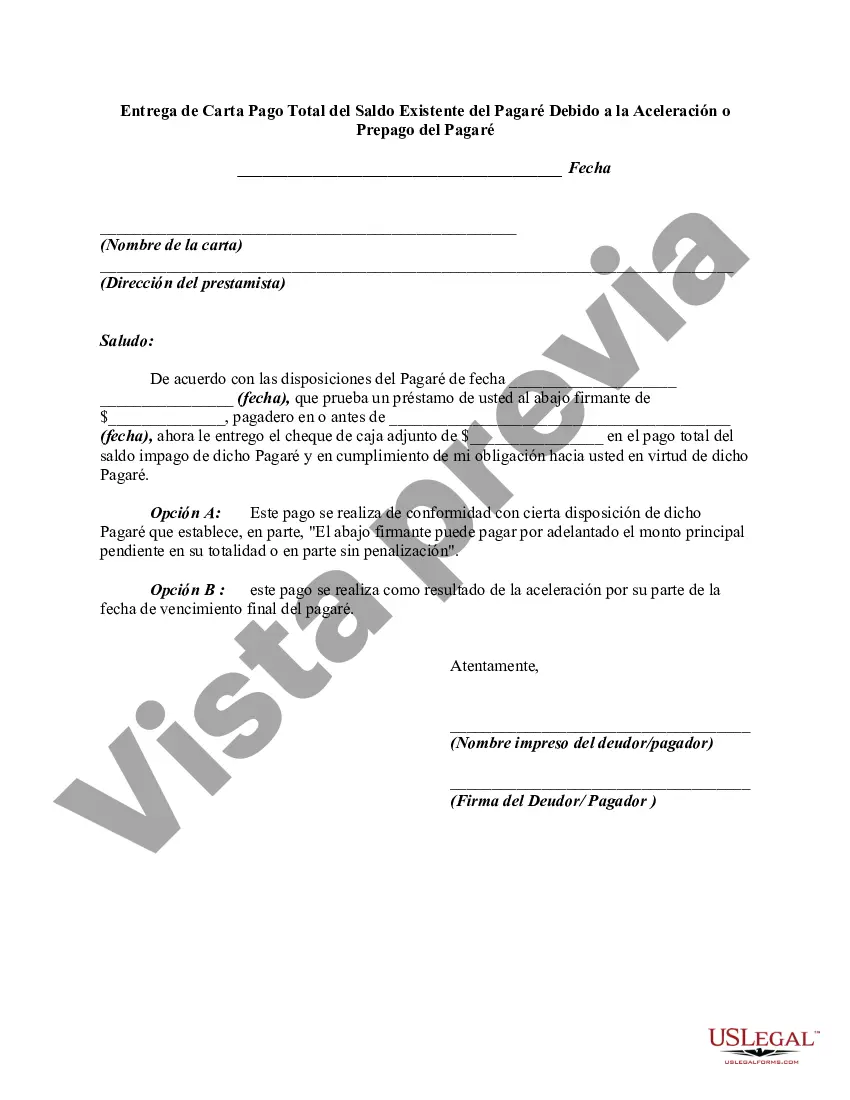

Philadelphia, Pennsylvania, is one of the most vibrant and historic cities in the United States. Known for its rich cultural heritage, iconic landmarks, and thriving arts scene, this city has a unique charm that attracts tourists and residents alike. Philadelphia, often referred to as the "City of Brotherly Love," offers a diverse range of attractions, from world-class museums and art galleries to iconic historical sites like Independence Hall and the Liberty Bell. When it comes to business transactions, Philadelphia is no stranger to financial dealings, including promissory notes. A promissory note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender within a specified timeframe. The borrower may choose to prepay or accelerate the note by paying the entire balance before the agreed-upon due date. To formalize the process of tendering full payment of the existing balance of a promissory note due to either acceleration or prepayment, individuals or entities often employ a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note." This document serves as a written notice to the lender, confirming the borrower's intention to pay off the promissory note in its entirety. The main purpose of this letter is to communicate the borrower's commitment to settle the debt, ensuring a smooth transition from the current financial arrangement. It is crucial to include specific details such as the loan's initial terms, the original repayment schedule, the current outstanding balance, the desired date of full payment, and any necessary instructions for the lender to acknowledge and process the payment. There are no distinct types of these letters; their contents remain consistent, regardless of the variation in factors such as loan type, parties involved, or payment maturity. However, it is recommended to consult legal professionals or financial advisors to review and tailor the letter according to the specific promissory note and individual circumstances. In conclusion, Philadelphia, Pennsylvania, a city steeped in history and culture, offers a thriving environment for financial activities such as promissory notes. To settle such loans through acceleration or prepayment, a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" is a crucial written notice to the lender. Properly constructing this letter with accurate details ensures a smooth process and helps both parties efficiently conclude the financial agreement.Philadelphia, Pennsylvania, is one of the most vibrant and historic cities in the United States. Known for its rich cultural heritage, iconic landmarks, and thriving arts scene, this city has a unique charm that attracts tourists and residents alike. Philadelphia, often referred to as the "City of Brotherly Love," offers a diverse range of attractions, from world-class museums and art galleries to iconic historical sites like Independence Hall and the Liberty Bell. When it comes to business transactions, Philadelphia is no stranger to financial dealings, including promissory notes. A promissory note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender within a specified timeframe. The borrower may choose to prepay or accelerate the note by paying the entire balance before the agreed-upon due date. To formalize the process of tendering full payment of the existing balance of a promissory note due to either acceleration or prepayment, individuals or entities often employ a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note." This document serves as a written notice to the lender, confirming the borrower's intention to pay off the promissory note in its entirety. The main purpose of this letter is to communicate the borrower's commitment to settle the debt, ensuring a smooth transition from the current financial arrangement. It is crucial to include specific details such as the loan's initial terms, the original repayment schedule, the current outstanding balance, the desired date of full payment, and any necessary instructions for the lender to acknowledge and process the payment. There are no distinct types of these letters; their contents remain consistent, regardless of the variation in factors such as loan type, parties involved, or payment maturity. However, it is recommended to consult legal professionals or financial advisors to review and tailor the letter according to the specific promissory note and individual circumstances. In conclusion, Philadelphia, Pennsylvania, a city steeped in history and culture, offers a thriving environment for financial activities such as promissory notes. To settle such loans through acceleration or prepayment, a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" is a crucial written notice to the lender. Properly constructing this letter with accurate details ensures a smooth process and helps both parties efficiently conclude the financial agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.