A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

Phoenix Arizona is a vibrant city located in the southwestern United States, known for its beautiful desert landscapes, sunny weather, and rich cultural heritage. It is the capital of Arizona and serves as the county seat of Maricopa County. With a population of over 1.7 million people, it is the fifth-largest city in the United States. A "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" is a legal document sent to a lender or creditor in Phoenix, Arizona, requesting to make a complete payment on a promissory note before its original maturity date. This letter is often used when a borrower wishes to pay off their debt early, either due to financial circumstances or to take advantage of lower interest rates. There are different types of "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" in Phoenix, Arizona, depending on the specific situation. These may include: 1. Individual borrower's letter: This is a letter written by an individual borrower to the lender, expressing their intention to make a full payment on the promissory note, including the existing balance and any accrued interest. 2. Corporate borrower's letter: In the case of a corporate borrower, this letter is written on behalf of the corporation, notifying the lender of their intent to prepay the full amount of the promissory note. 3. Real estate transaction letter: This type of letter may be used in a real estate transaction, where the buyer wishes to prepay the balance of a promissory note secured by the property being purchased. 4. Loan refinancing letter: If a borrower wants to refinance their loan and pay off the existing promissory note with a new loan, they may send a letter informing the lender of their intention to tender full payment. Regardless of the specific type, a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" typically outlines the borrower's full name, contact information, promissory note details, the existing balance, and the proposed date of full payment. It also includes a request for the lender to provide instructions on how the payment should be made and any necessary documentation to formalize the payoff.Phoenix Arizona is a vibrant city located in the southwestern United States, known for its beautiful desert landscapes, sunny weather, and rich cultural heritage. It is the capital of Arizona and serves as the county seat of Maricopa County. With a population of over 1.7 million people, it is the fifth-largest city in the United States. A "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" is a legal document sent to a lender or creditor in Phoenix, Arizona, requesting to make a complete payment on a promissory note before its original maturity date. This letter is often used when a borrower wishes to pay off their debt early, either due to financial circumstances or to take advantage of lower interest rates. There are different types of "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" in Phoenix, Arizona, depending on the specific situation. These may include: 1. Individual borrower's letter: This is a letter written by an individual borrower to the lender, expressing their intention to make a full payment on the promissory note, including the existing balance and any accrued interest. 2. Corporate borrower's letter: In the case of a corporate borrower, this letter is written on behalf of the corporation, notifying the lender of their intent to prepay the full amount of the promissory note. 3. Real estate transaction letter: This type of letter may be used in a real estate transaction, where the buyer wishes to prepay the balance of a promissory note secured by the property being purchased. 4. Loan refinancing letter: If a borrower wants to refinance their loan and pay off the existing promissory note with a new loan, they may send a letter informing the lender of their intention to tender full payment. Regardless of the specific type, a "Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note" typically outlines the borrower's full name, contact information, promissory note details, the existing balance, and the proposed date of full payment. It also includes a request for the lender to provide instructions on how the payment should be made and any necessary documentation to formalize the payoff.

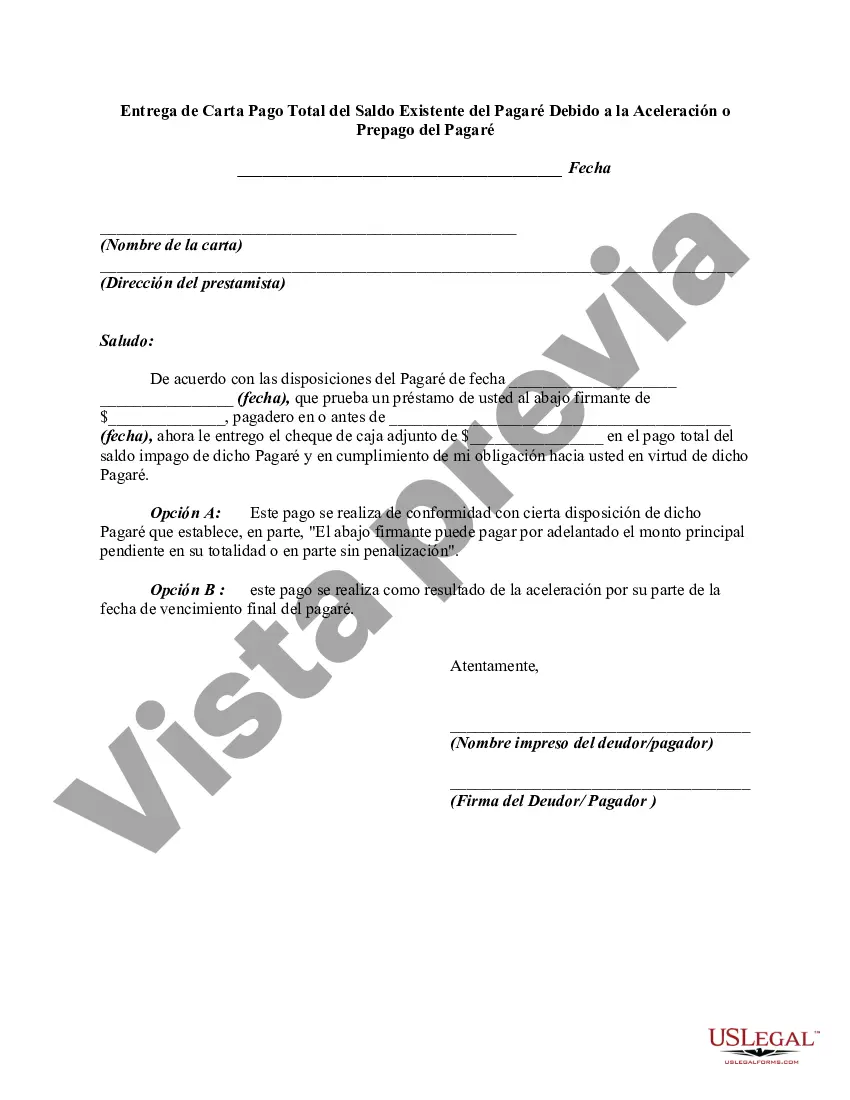

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.