A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

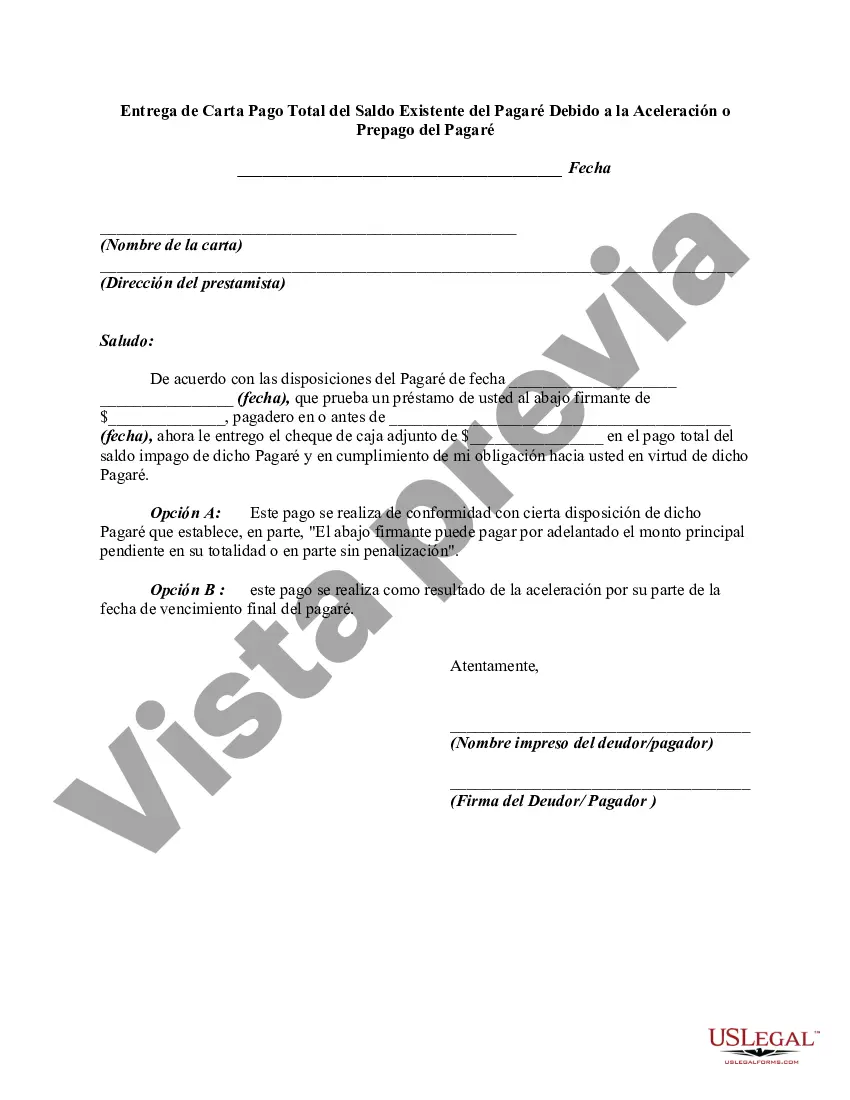

Title: Salt Lake City, Utah — Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note Introduction: Salt Lake City, located in the state of Utah, is an enchanting destination known for its stunning natural beauty, vibrant city life, and thriving economic opportunities. This article will provide a detailed description of Salt Lake City while exploring the various types of letters tendering full payment of an existing balance of a promissory note, specifically due to acceleration or prepayment. 1. Salt Lake City, Utah: Salt Lake City is the capital and most populous city in the state of Utah. Nestled amidst the picturesque Wasatch Mountains, Salt Lake City offers breathtaking scenery, world-class skiing, and a wealth of outdoor activities. Moreover, the city boasts a rich cultural heritage, with attractions such as the renowned Temple Square, Utah State Capitol, and the Utah Museum of Fine Arts. 2. Promissory Note: A promissory note is a legally binding document that records one party's promise to repay a debt or loan to another party. This written agreement outlines the terms and conditions of repayment, including the balance, interest rate, and repayment period. 3. Letter Tendering Full Payment: A letter tendering full payment serves as a formal communication between the borrower and the lender, expressing the borrower's intention to settle the entire outstanding balance of the promissory note. It serves as proof of the borrower's commitment to fulfill their financial obligations and provides a record of the transaction. 4. Acceleration of Note: Acceleration of a promissory note refers to the lender's right to demand immediate repayment of the outstanding balance due to the borrower's failure to meet the agreed-upon payment terms. In such cases, a letter tendering full payment due to the acceleration of the note is necessary to settle the debt promptly. 5. Prepayment of Note: Prepayment of a promissory note involves the borrower choosing to pay off the remaining balance before the due date specified in the agreement. This may occur when the borrower has available funds or intends to refinance the loan. A letter tendering full payment due to prepayment signals the borrower's intent to clear the debt ahead of schedule. Conclusion: When it comes to Salt Lake City, Utah, the city offers a diverse range of activities, breathtaking scenery, and a thriving economy, making it an attractive destination. Understanding the various types of letters tendering full payment of an existing balance of a promissory note, due to acceleration or prepayment, can streamline financial processes and ensure efficient debt settlement.Title: Salt Lake City, Utah — Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note Introduction: Salt Lake City, located in the state of Utah, is an enchanting destination known for its stunning natural beauty, vibrant city life, and thriving economic opportunities. This article will provide a detailed description of Salt Lake City while exploring the various types of letters tendering full payment of an existing balance of a promissory note, specifically due to acceleration or prepayment. 1. Salt Lake City, Utah: Salt Lake City is the capital and most populous city in the state of Utah. Nestled amidst the picturesque Wasatch Mountains, Salt Lake City offers breathtaking scenery, world-class skiing, and a wealth of outdoor activities. Moreover, the city boasts a rich cultural heritage, with attractions such as the renowned Temple Square, Utah State Capitol, and the Utah Museum of Fine Arts. 2. Promissory Note: A promissory note is a legally binding document that records one party's promise to repay a debt or loan to another party. This written agreement outlines the terms and conditions of repayment, including the balance, interest rate, and repayment period. 3. Letter Tendering Full Payment: A letter tendering full payment serves as a formal communication between the borrower and the lender, expressing the borrower's intention to settle the entire outstanding balance of the promissory note. It serves as proof of the borrower's commitment to fulfill their financial obligations and provides a record of the transaction. 4. Acceleration of Note: Acceleration of a promissory note refers to the lender's right to demand immediate repayment of the outstanding balance due to the borrower's failure to meet the agreed-upon payment terms. In such cases, a letter tendering full payment due to the acceleration of the note is necessary to settle the debt promptly. 5. Prepayment of Note: Prepayment of a promissory note involves the borrower choosing to pay off the remaining balance before the due date specified in the agreement. This may occur when the borrower has available funds or intends to refinance the loan. A letter tendering full payment due to prepayment signals the borrower's intent to clear the debt ahead of schedule. Conclusion: When it comes to Salt Lake City, Utah, the city offers a diverse range of activities, breathtaking scenery, and a thriving economy, making it an attractive destination. Understanding the various types of letters tendering full payment of an existing balance of a promissory note, due to acceleration or prepayment, can streamline financial processes and ensure efficient debt settlement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.