A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

San Jose, California, known as the "Capital of Silicon Valley," is a vibrant city nestled in the heart of the Bay Area. It is renowned for its technological advancements, diverse culture, and stunning landscapes. In this city, residents and visitors alike can experience the perfect blend of urban amenities and natural beauty. When it comes to financial matters, such as the tendering of a full payment for an existing balance of a promissory note due to acceleration or prepayment, it is crucial to understand the legal aspects surrounding such transactions. This transaction involves a debtor settling their debt in full, ahead of the scheduled maturity date. By doing so, they effectively negate any future interest payments and fulfill their financial obligations. In San Jose, there are various situations where individuals or organizations may find themselves in need of tendering full payment for a promissory note. These situations may include: 1. Business Transactions: Entrepreneurs or corporations engaging in mergers, acquisitions, or partnerships may require a letter tendering full payment to settle outstanding promissory notes related to the transaction. Keywords: business transactions, mergers, acquisitions, partnerships, outstanding promissory notes. 2. Real Estate Transactions: Homebuyers or property owners wishing to pay off their mortgage early can tender full payment for the existing balance of their promissory note, allowing them to own the property outright. Keywords: real estate transactions, mortgage, property owners, existing balance. 3. Debt Settlement: Individuals facing financial hardship or those who have come into a windfall may choose to tender full payment for their promissory notes to settle debts and avoid future interest accrual. Keywords: debt settlement, financial hardship, windfall, avoid future interest. 4. Estate Planning: Executors or beneficiaries of a deceased person's estate may need to tender full payment for promissory notes held within the estate to ensure all financial matters are settled appropriately. Keywords: estate planning, executors, beneficiaries, financial matters. 5. Investment Opportunities: Savvy investors analyzing portfolio diversification may choose to tender full payment for promissory notes to reallocate funds into potentially more lucrative investments. Keywords: investment opportunities, portfolio diversification, reallocate funds, lucrative investments. Regardless of the specific circumstances, it is essential to craft a professional and detailed letter tendering full payment for the existing balance of a promissory note due to acceleration or prepayment. The letter should include necessary information, such as the exact amount being paid, the promissory note number, the purpose of the payment, and any instructions regarding the release of collateral or lien removal. In conclusion, in San Jose, California, individuals and organizations may find themselves needing to tender full payment for the existing balance of a promissory note due to acceleration or prepayment. Whether it's a business transaction, real estate deal, debt settlement, estate planning, or investment opportunity, having a comprehensive understanding of the process and writing a well-crafted letter is essential.San Jose, California, known as the "Capital of Silicon Valley," is a vibrant city nestled in the heart of the Bay Area. It is renowned for its technological advancements, diverse culture, and stunning landscapes. In this city, residents and visitors alike can experience the perfect blend of urban amenities and natural beauty. When it comes to financial matters, such as the tendering of a full payment for an existing balance of a promissory note due to acceleration or prepayment, it is crucial to understand the legal aspects surrounding such transactions. This transaction involves a debtor settling their debt in full, ahead of the scheduled maturity date. By doing so, they effectively negate any future interest payments and fulfill their financial obligations. In San Jose, there are various situations where individuals or organizations may find themselves in need of tendering full payment for a promissory note. These situations may include: 1. Business Transactions: Entrepreneurs or corporations engaging in mergers, acquisitions, or partnerships may require a letter tendering full payment to settle outstanding promissory notes related to the transaction. Keywords: business transactions, mergers, acquisitions, partnerships, outstanding promissory notes. 2. Real Estate Transactions: Homebuyers or property owners wishing to pay off their mortgage early can tender full payment for the existing balance of their promissory note, allowing them to own the property outright. Keywords: real estate transactions, mortgage, property owners, existing balance. 3. Debt Settlement: Individuals facing financial hardship or those who have come into a windfall may choose to tender full payment for their promissory notes to settle debts and avoid future interest accrual. Keywords: debt settlement, financial hardship, windfall, avoid future interest. 4. Estate Planning: Executors or beneficiaries of a deceased person's estate may need to tender full payment for promissory notes held within the estate to ensure all financial matters are settled appropriately. Keywords: estate planning, executors, beneficiaries, financial matters. 5. Investment Opportunities: Savvy investors analyzing portfolio diversification may choose to tender full payment for promissory notes to reallocate funds into potentially more lucrative investments. Keywords: investment opportunities, portfolio diversification, reallocate funds, lucrative investments. Regardless of the specific circumstances, it is essential to craft a professional and detailed letter tendering full payment for the existing balance of a promissory note due to acceleration or prepayment. The letter should include necessary information, such as the exact amount being paid, the promissory note number, the purpose of the payment, and any instructions regarding the release of collateral or lien removal. In conclusion, in San Jose, California, individuals and organizations may find themselves needing to tender full payment for the existing balance of a promissory note due to acceleration or prepayment. Whether it's a business transaction, real estate deal, debt settlement, estate planning, or investment opportunity, having a comprehensive understanding of the process and writing a well-crafted letter is essential.

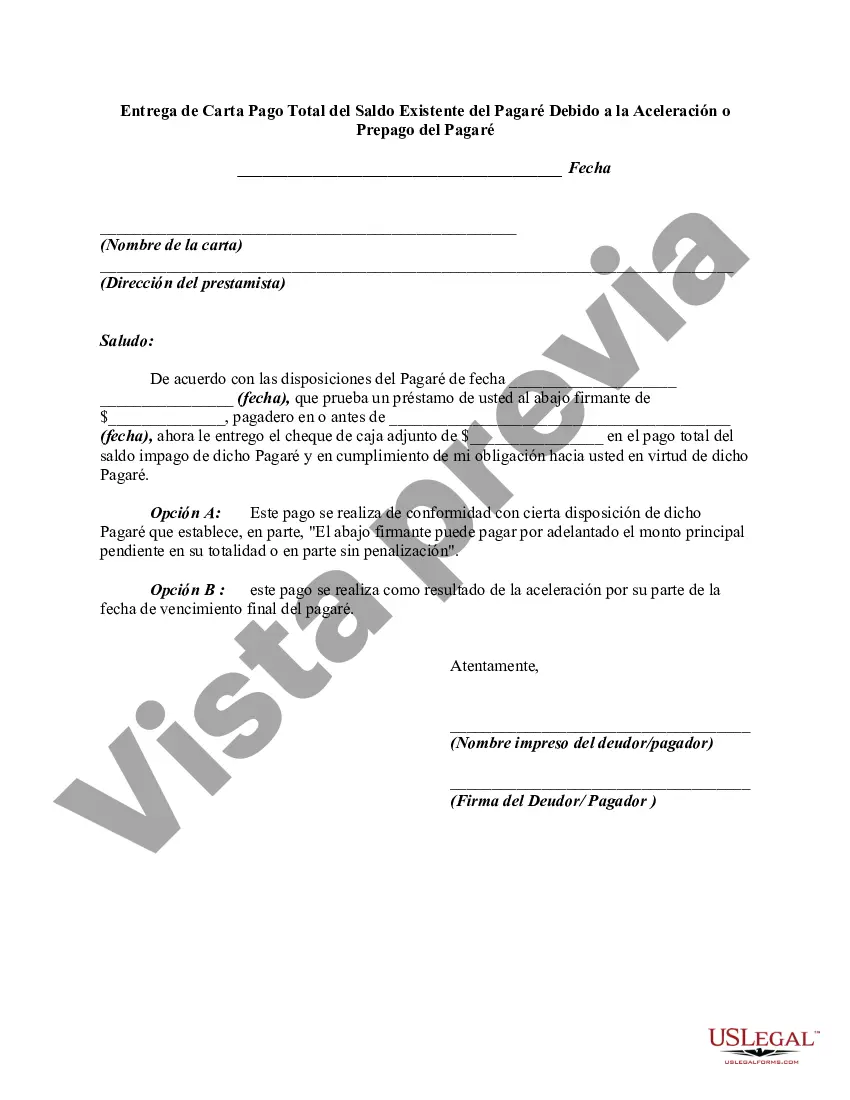

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.