With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

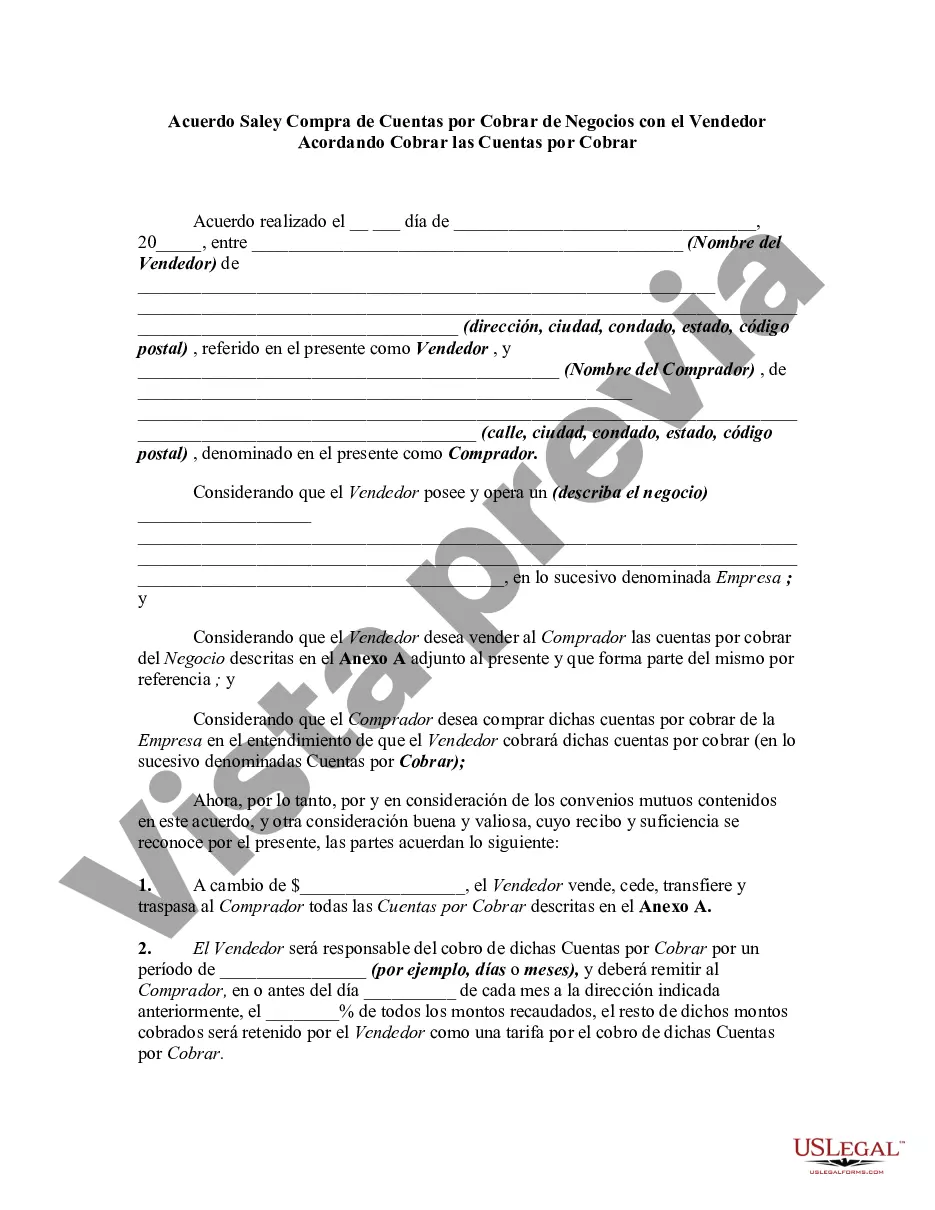

The Fulton Georgia Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions for the sale and purchase of accounts receivable between a seller and a buyer. This agreement allows the seller to transfer their outstanding invoices to the buyer, who will then be responsible for collecting payment from the debtor. Fulton Georgia, as the jurisdiction where this agreement is applicable, has specific rules and regulations that govern such transactions. The agreement ensures that both parties are aware of their rights and obligations, providing clarity and protection for each party involved. Some important keywords related to the Fulton Georgia Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable include: 1. Accounts Receivable: It refers to the outstanding invoices or debts owed to a business for goods or services provided. 2. Seller: The party that currently owns the accounts receivable and wishes to sell them to a buyer. 3. Buyer: The party interested in purchasing the accounts receivable from the seller. 4. Agreement: The legally binding document that outlines the terms and conditions of the sale and purchase transaction. 5. Purchase Price: The agreed-upon amount that the buyer will pay the seller to acquire the accounts receivable. 6. Collection Period: The duration during which the seller agrees to collect the accounts receivable on behalf of the buyer. 7. Debtor: The individual or business entity that owes payment on the accounts receivable. Different types of Fulton Georgia Agreements for Sale and Purchase of Accounts Receivable with Seller Agreeing to Collect the Accounts Receivable could include variations in terms, conditions, or specific provisions tailored to each unique business situation. For example, the agreement might differ in terms of the purchase price calculation formula, the extent of seller assistance in debt collection, or any additional warranties provided by the seller. Overall, the Fulton Georgia Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a crucial legal instrument that facilitates the transfer of accounts receivable from one party to another, ensuring a clear understanding of the rights, responsibilities, and obligations of all parties involved.The Fulton Georgia Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions for the sale and purchase of accounts receivable between a seller and a buyer. This agreement allows the seller to transfer their outstanding invoices to the buyer, who will then be responsible for collecting payment from the debtor. Fulton Georgia, as the jurisdiction where this agreement is applicable, has specific rules and regulations that govern such transactions. The agreement ensures that both parties are aware of their rights and obligations, providing clarity and protection for each party involved. Some important keywords related to the Fulton Georgia Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable include: 1. Accounts Receivable: It refers to the outstanding invoices or debts owed to a business for goods or services provided. 2. Seller: The party that currently owns the accounts receivable and wishes to sell them to a buyer. 3. Buyer: The party interested in purchasing the accounts receivable from the seller. 4. Agreement: The legally binding document that outlines the terms and conditions of the sale and purchase transaction. 5. Purchase Price: The agreed-upon amount that the buyer will pay the seller to acquire the accounts receivable. 6. Collection Period: The duration during which the seller agrees to collect the accounts receivable on behalf of the buyer. 7. Debtor: The individual or business entity that owes payment on the accounts receivable. Different types of Fulton Georgia Agreements for Sale and Purchase of Accounts Receivable with Seller Agreeing to Collect the Accounts Receivable could include variations in terms, conditions, or specific provisions tailored to each unique business situation. For example, the agreement might differ in terms of the purchase price calculation formula, the extent of seller assistance in debt collection, or any additional warranties provided by the seller. Overall, the Fulton Georgia Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a crucial legal instrument that facilitates the transfer of accounts receivable from one party to another, ensuring a clear understanding of the rights, responsibilities, and obligations of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.