With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

The Harris Texas Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legally binding document that outlines the terms and conditions of the sale and purchase of accounts receivable between a buyer and a seller in the state of Texas. This agreement is specifically designed for businesses located in Harris County, Texas, and serves as a tool to facilitate the buying and selling of accounts receivable while ensuring that the seller agrees to collect the outstanding payments from the customers identified in the agreement. Some relevant keywords for this topic include: 1. Harris Texas Agreement for Sale and Purchase: This refers to the specific region and document type, indicating that the agreement is tailored for businesses in Harris County, Texas, and pertains to the sale and purchase of accounts receivable. 2. Accounts Receivable: This term refers to the money owed by customers or clients to a business for goods or services provided on credit. The agreement outlines the details of these accounts receivable that are being sold. 3. Seller: The party selling their accounts receivable is referred to as the seller. They are responsible for collecting the payments from customers as agreed upon in the agreement. 4. Buyer: The party purchasing the accounts receivable from the seller is referred to as the buyer. They acquire the rights to collect the outstanding payments in exchange for a predetermined purchase price. 5. Purchase Price: This refers to the agreed-upon amount that the buyer will pay the seller for the accounts receivable. It may be a lump sum or a percentage of the total outstanding receivables. Different variations or types of the Harris Texas Agreement for Sale and Purchase of Accounts Receivable may exist depending on individual circumstances or specific requirements. They might include variations in payment terms, additional clauses for dispute resolution, exclusivity clauses, or provisions for the assignment of the agreement to a third party. These specific variations would depend on the negotiation and agreement between the buyer and the seller.The Harris Texas Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legally binding document that outlines the terms and conditions of the sale and purchase of accounts receivable between a buyer and a seller in the state of Texas. This agreement is specifically designed for businesses located in Harris County, Texas, and serves as a tool to facilitate the buying and selling of accounts receivable while ensuring that the seller agrees to collect the outstanding payments from the customers identified in the agreement. Some relevant keywords for this topic include: 1. Harris Texas Agreement for Sale and Purchase: This refers to the specific region and document type, indicating that the agreement is tailored for businesses in Harris County, Texas, and pertains to the sale and purchase of accounts receivable. 2. Accounts Receivable: This term refers to the money owed by customers or clients to a business for goods or services provided on credit. The agreement outlines the details of these accounts receivable that are being sold. 3. Seller: The party selling their accounts receivable is referred to as the seller. They are responsible for collecting the payments from customers as agreed upon in the agreement. 4. Buyer: The party purchasing the accounts receivable from the seller is referred to as the buyer. They acquire the rights to collect the outstanding payments in exchange for a predetermined purchase price. 5. Purchase Price: This refers to the agreed-upon amount that the buyer will pay the seller for the accounts receivable. It may be a lump sum or a percentage of the total outstanding receivables. Different variations or types of the Harris Texas Agreement for Sale and Purchase of Accounts Receivable may exist depending on individual circumstances or specific requirements. They might include variations in payment terms, additional clauses for dispute resolution, exclusivity clauses, or provisions for the assignment of the agreement to a third party. These specific variations would depend on the negotiation and agreement between the buyer and the seller.

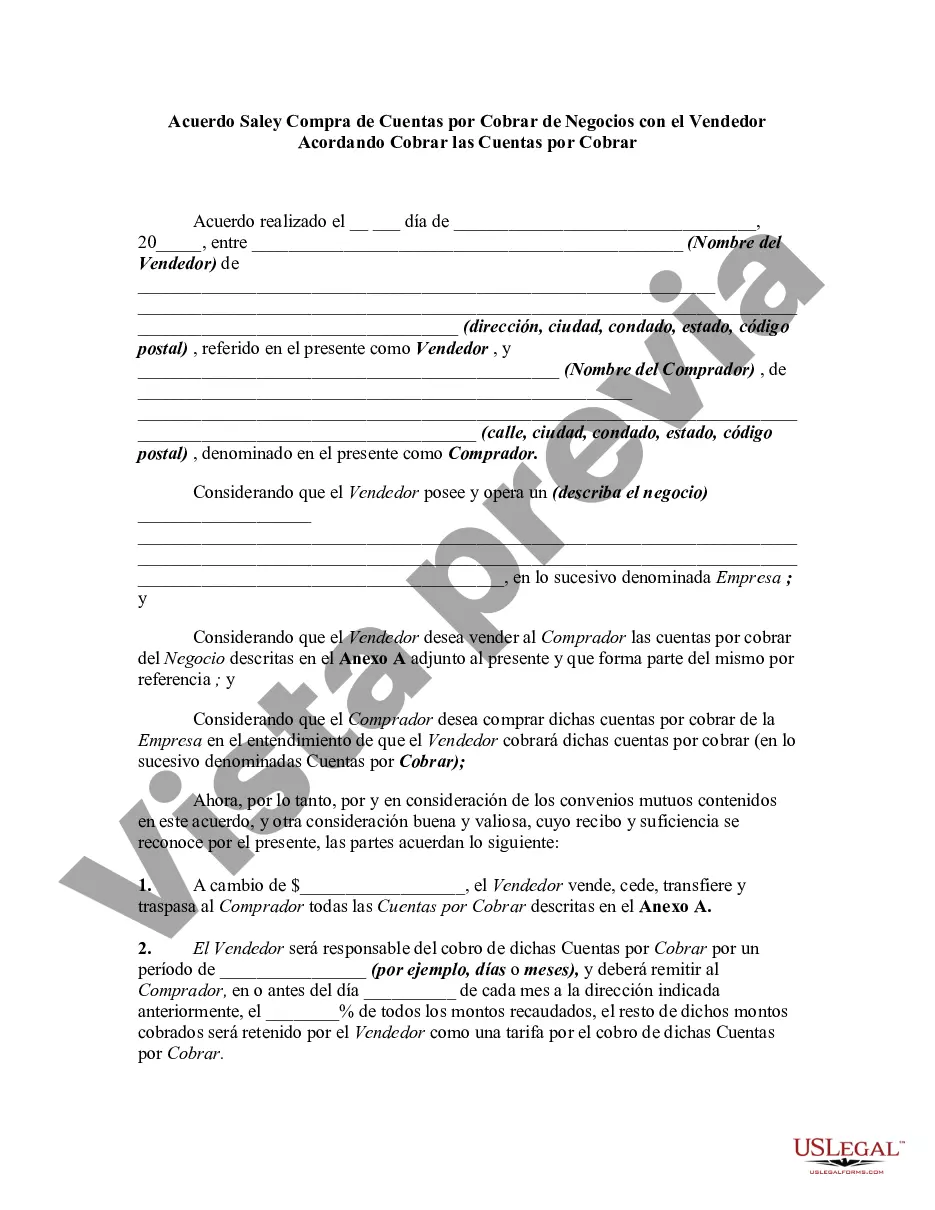

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.