With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

Hennepin Minnesota Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions surrounding the buying and selling of accounts receivable by a business located in Hennepin County, Minnesota. This agreement allows the seller to transfer their accounts receivable to the buyer, while also agreeing to continue collecting the receivables on behalf of the buyer. The main purpose of this agreement is to provide a means for businesses to quickly access funds by selling their outstanding invoices or accounts receivable to a buyer, who then assumes the responsibility of collecting the payments from the customers who owe the money. This can be advantageous for businesses that need immediate cash flow to cover operating expenses or fund growth initiatives. The Hennepin Minnesota Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable can be customized based on specific requirements and preferences. Some variations or types of this agreement include: 1. Recourse agreement: In this type of agreement, the seller agrees to purchase back any uncollectible accounts receivable from the buyer. This puts the seller at some risk but may allow for a higher purchase price for the receivables. 2. Non-recourse agreement: Here, the buyer assumes all the risk associated with uncollectible accounts receivable. If any invoices become uncollectible, the buyer cannot seek reimbursement from the seller. However, non-recourse agreements often come with a slightly lower purchase price for the receivables. 3. Partial purchase agreement: This agreement allows the seller to sell only a portion of their accounts receivable while retaining the right to collect the remaining invoices independently. It provides flexibility to businesses that don't want to entirely rely on the buyer for collections. 4. Notification agreement: With this type of agreement, the buyer notifies the customers of the business about the accounts receivable purchase and the subsequent change in collection arrangements. The seller still takes responsibility for collections, but notifies customers of the new payment instructions. Overall, the Hennepin Minnesota Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable provides a legal framework for businesses to transfer their outstanding invoices to a buyer while continuing to manage the collections process. It offers various customizable options to suit the specific needs of businesses in Hennepin County, Minnesota.Hennepin Minnesota Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions surrounding the buying and selling of accounts receivable by a business located in Hennepin County, Minnesota. This agreement allows the seller to transfer their accounts receivable to the buyer, while also agreeing to continue collecting the receivables on behalf of the buyer. The main purpose of this agreement is to provide a means for businesses to quickly access funds by selling their outstanding invoices or accounts receivable to a buyer, who then assumes the responsibility of collecting the payments from the customers who owe the money. This can be advantageous for businesses that need immediate cash flow to cover operating expenses or fund growth initiatives. The Hennepin Minnesota Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable can be customized based on specific requirements and preferences. Some variations or types of this agreement include: 1. Recourse agreement: In this type of agreement, the seller agrees to purchase back any uncollectible accounts receivable from the buyer. This puts the seller at some risk but may allow for a higher purchase price for the receivables. 2. Non-recourse agreement: Here, the buyer assumes all the risk associated with uncollectible accounts receivable. If any invoices become uncollectible, the buyer cannot seek reimbursement from the seller. However, non-recourse agreements often come with a slightly lower purchase price for the receivables. 3. Partial purchase agreement: This agreement allows the seller to sell only a portion of their accounts receivable while retaining the right to collect the remaining invoices independently. It provides flexibility to businesses that don't want to entirely rely on the buyer for collections. 4. Notification agreement: With this type of agreement, the buyer notifies the customers of the business about the accounts receivable purchase and the subsequent change in collection arrangements. The seller still takes responsibility for collections, but notifies customers of the new payment instructions. Overall, the Hennepin Minnesota Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable provides a legal framework for businesses to transfer their outstanding invoices to a buyer while continuing to manage the collections process. It offers various customizable options to suit the specific needs of businesses in Hennepin County, Minnesota.

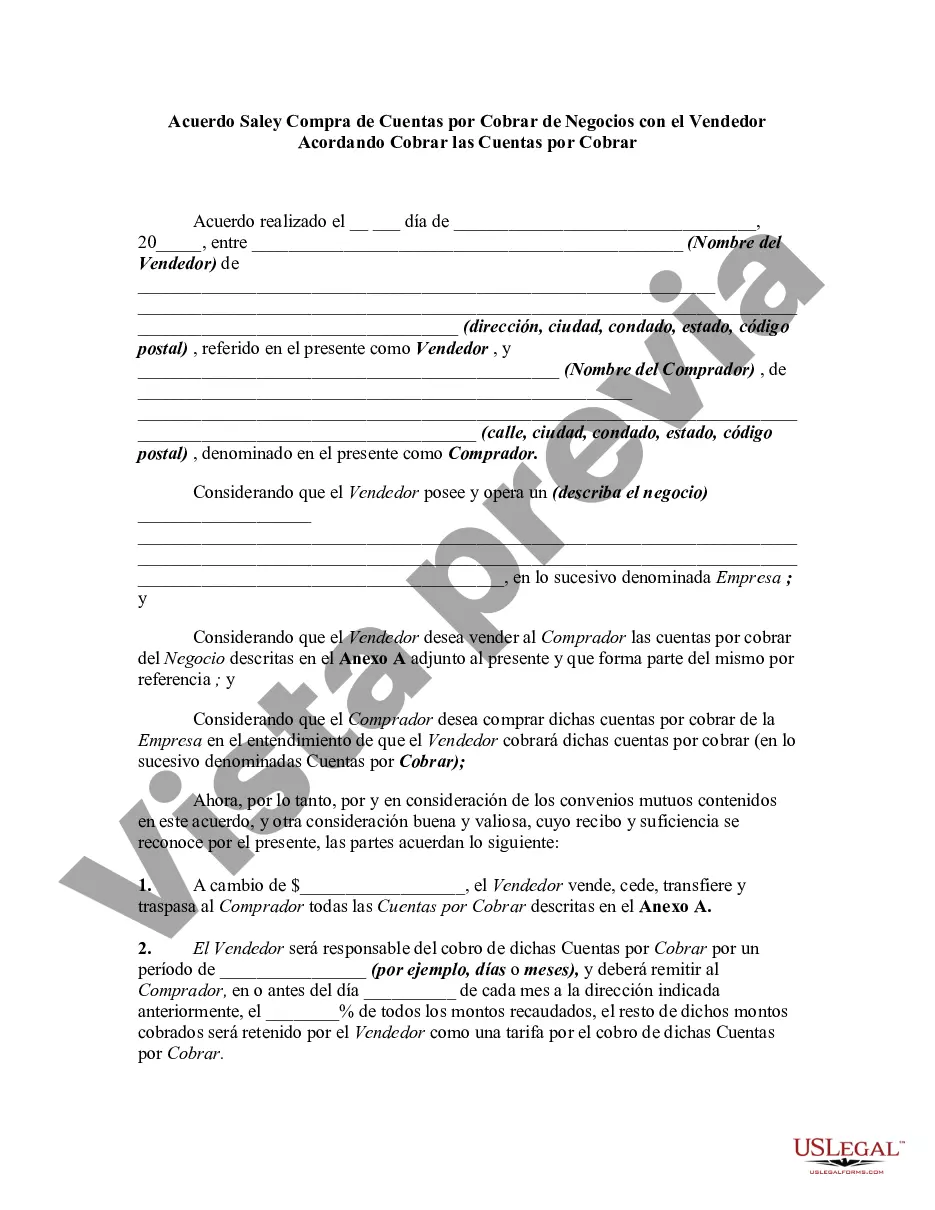

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.