With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

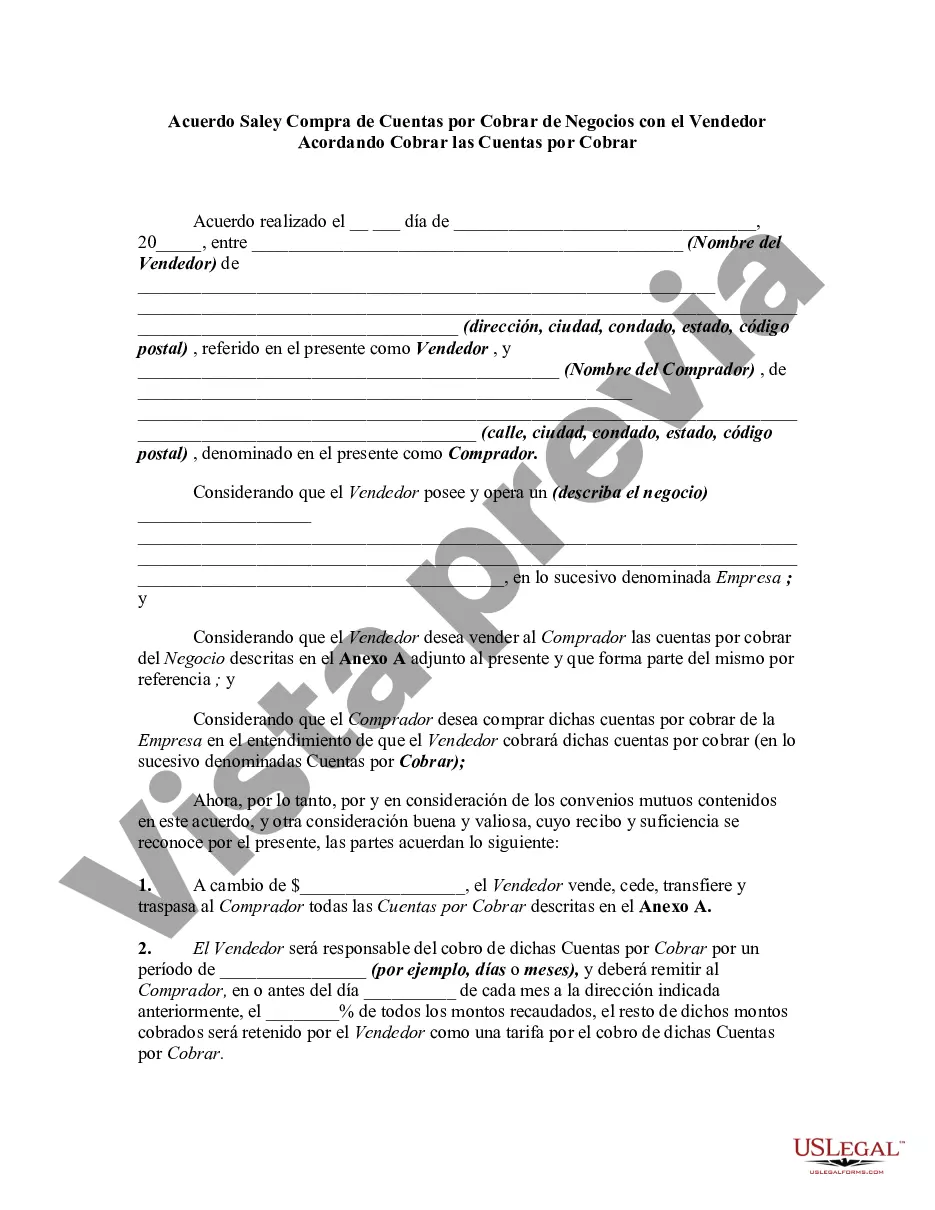

The Queens New York Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal contract that outlines the terms and conditions of selling and purchasing accounts receivable between two parties in Queens, New York. This agreement is particularly relevant for businesses that want to monetize their accounts receivable while still retaining the responsibility of collecting payments from customers. By entering into this agreement, the seller transfers their ownership rights to the accounts receivable to the buyer, who then gains the right to collect and receive payments from the customers. Here are some key points and types of Queens New York Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable: 1. Definition of Parties: The agreement clearly states the identities and contact information of the seller and the buyer involved in the transaction. 2. Description of Accounts Receivable: This section provides a detailed description of the accounts receivable being sold, including the names and contact information of the customers who owe the debts. 3. Purchase Price: The agreement specifies the purchase price agreed upon by both parties. The price may be a fixed amount, a percentage of the total accounts receivable, or a negotiated value based on various factors such as the age and quality of the debts. 4. Seller's Obligation to Collect: This clause outlines the seller's responsibility to continue collecting payments from the customers, even after the transfer of ownership has taken place. The seller acts as a collection agent on behalf of the buyer and is bound to remit the collected funds to the buyer promptly. 5. Duration and Termination: The agreement may set a time limit for the seller's obligation to collect the accounts receivable or allow either party to terminate the agreement under certain circumstances. 6. Representations and Warranties: The seller agrees to provide accurate and complete information about the accounts receivable being sold, ensuring their validity and enforceability. Any misrepresentation by the seller may lead to legal consequences. 7. Indemnification: This section delineates the responsibilities of each party regarding any claims, losses, or damages arising from the purchase and collection of accounts receivable. It is important to note that various types of Queens New York Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable may exist, depending on the specific needs and preferences of the parties involved. Some common variations may include accounts receivable factoring agreements, invoice financing agreements, or selective accounts receivable purchase agreements. Each type may have its unique terms and conditions tailored to the specific requirements and arrangements between the buyer and the seller.The Queens New York Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal contract that outlines the terms and conditions of selling and purchasing accounts receivable between two parties in Queens, New York. This agreement is particularly relevant for businesses that want to monetize their accounts receivable while still retaining the responsibility of collecting payments from customers. By entering into this agreement, the seller transfers their ownership rights to the accounts receivable to the buyer, who then gains the right to collect and receive payments from the customers. Here are some key points and types of Queens New York Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable: 1. Definition of Parties: The agreement clearly states the identities and contact information of the seller and the buyer involved in the transaction. 2. Description of Accounts Receivable: This section provides a detailed description of the accounts receivable being sold, including the names and contact information of the customers who owe the debts. 3. Purchase Price: The agreement specifies the purchase price agreed upon by both parties. The price may be a fixed amount, a percentage of the total accounts receivable, or a negotiated value based on various factors such as the age and quality of the debts. 4. Seller's Obligation to Collect: This clause outlines the seller's responsibility to continue collecting payments from the customers, even after the transfer of ownership has taken place. The seller acts as a collection agent on behalf of the buyer and is bound to remit the collected funds to the buyer promptly. 5. Duration and Termination: The agreement may set a time limit for the seller's obligation to collect the accounts receivable or allow either party to terminate the agreement under certain circumstances. 6. Representations and Warranties: The seller agrees to provide accurate and complete information about the accounts receivable being sold, ensuring their validity and enforceability. Any misrepresentation by the seller may lead to legal consequences. 7. Indemnification: This section delineates the responsibilities of each party regarding any claims, losses, or damages arising from the purchase and collection of accounts receivable. It is important to note that various types of Queens New York Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable may exist, depending on the specific needs and preferences of the parties involved. Some common variations may include accounts receivable factoring agreements, invoice financing agreements, or selective accounts receivable purchase agreements. Each type may have its unique terms and conditions tailored to the specific requirements and arrangements between the buyer and the seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.