With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

The Salt Lake Utah Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legally binding contract that outlines the terms and conditions of a transaction involving the sale and purchase of accounts receivable. This agreement specifically applies to businesses located in Salt Lake City, Utah. Keyword 1: Salt Lake Utah Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable Keyword 2: Salt Lake City, Utah Keyword 3: Accounts Receivable Keyword 4: Purchase Agreement Keyword 5: Sale Agreement Keyword 6: Seller Agreement Keyword 7: Collect Accounts Receivable Keyword 8: Legal Contract Keyword 9: Business Transaction Keyword 10: Commercial Purchase In addition to the main agreement, there may also be variations or specific types of Salt Lake Utah Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable, depending on the specific circumstances or requirements of the parties involved. These could include: 1. Asset-Based Agreement for Sale and Purchase of Accounts Receivable: This type of agreement focuses on the asset-based financing aspect, where the seller agrees to sell their accounts receivable to the buyer for immediate funds. 2. Recourse Agreement for Sale and Purchase of Accounts Receivable: In a recourse agreement, the seller agrees to take full responsibility for any non-payment or default by the debtor, providing an added layer of protection for the buyer. 3. Non-Recourse Agreement for Sale and Purchase of Accounts Receivable: Unlike recourse agreements, non-recourse agreements shift the risk of non-payment or default to the buyer, absolving the seller of any liability. 4. Factoring Agreement for Sale and Purchase of Accounts Receivable: Factoring agreements involve the sale of accounts receivable to a third-party financial institution known as a factor, who purchases the receivables at a discounted price and assumes responsibility for collections. 5. Single Agreement for Sale and Purchase of Accounts Receivable: This type of agreement encompasses the general terms and conditions governing the sale and purchase of accounts receivable in a single concise contract. It's important to consult with legal professionals or specialists in sales agreements before entering into any Salt Lake Utah Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable to ensure full compliance with relevant laws and regulations.The Salt Lake Utah Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legally binding contract that outlines the terms and conditions of a transaction involving the sale and purchase of accounts receivable. This agreement specifically applies to businesses located in Salt Lake City, Utah. Keyword 1: Salt Lake Utah Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable Keyword 2: Salt Lake City, Utah Keyword 3: Accounts Receivable Keyword 4: Purchase Agreement Keyword 5: Sale Agreement Keyword 6: Seller Agreement Keyword 7: Collect Accounts Receivable Keyword 8: Legal Contract Keyword 9: Business Transaction Keyword 10: Commercial Purchase In addition to the main agreement, there may also be variations or specific types of Salt Lake Utah Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable, depending on the specific circumstances or requirements of the parties involved. These could include: 1. Asset-Based Agreement for Sale and Purchase of Accounts Receivable: This type of agreement focuses on the asset-based financing aspect, where the seller agrees to sell their accounts receivable to the buyer for immediate funds. 2. Recourse Agreement for Sale and Purchase of Accounts Receivable: In a recourse agreement, the seller agrees to take full responsibility for any non-payment or default by the debtor, providing an added layer of protection for the buyer. 3. Non-Recourse Agreement for Sale and Purchase of Accounts Receivable: Unlike recourse agreements, non-recourse agreements shift the risk of non-payment or default to the buyer, absolving the seller of any liability. 4. Factoring Agreement for Sale and Purchase of Accounts Receivable: Factoring agreements involve the sale of accounts receivable to a third-party financial institution known as a factor, who purchases the receivables at a discounted price and assumes responsibility for collections. 5. Single Agreement for Sale and Purchase of Accounts Receivable: This type of agreement encompasses the general terms and conditions governing the sale and purchase of accounts receivable in a single concise contract. It's important to consult with legal professionals or specialists in sales agreements before entering into any Salt Lake Utah Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable to ensure full compliance with relevant laws and regulations.

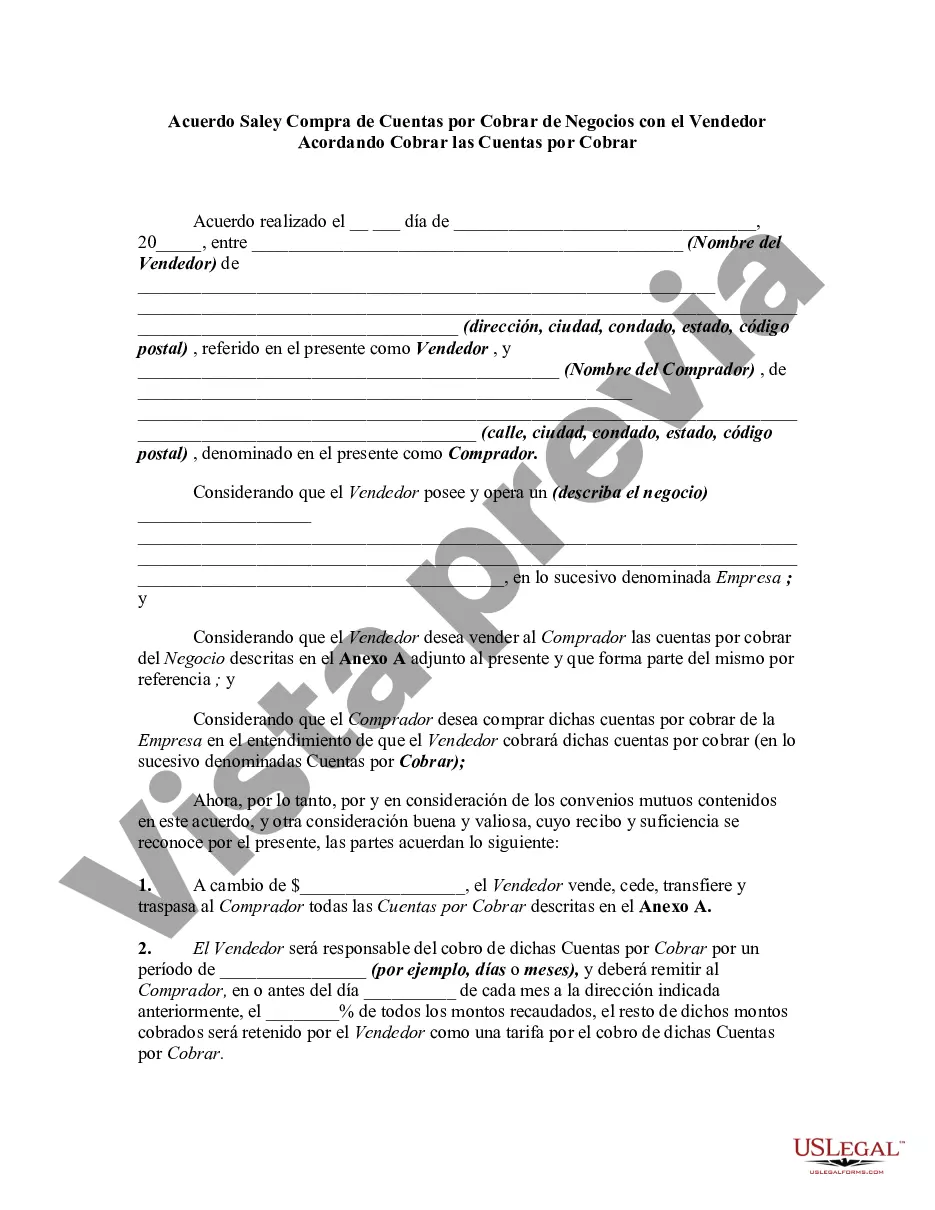

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.