With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

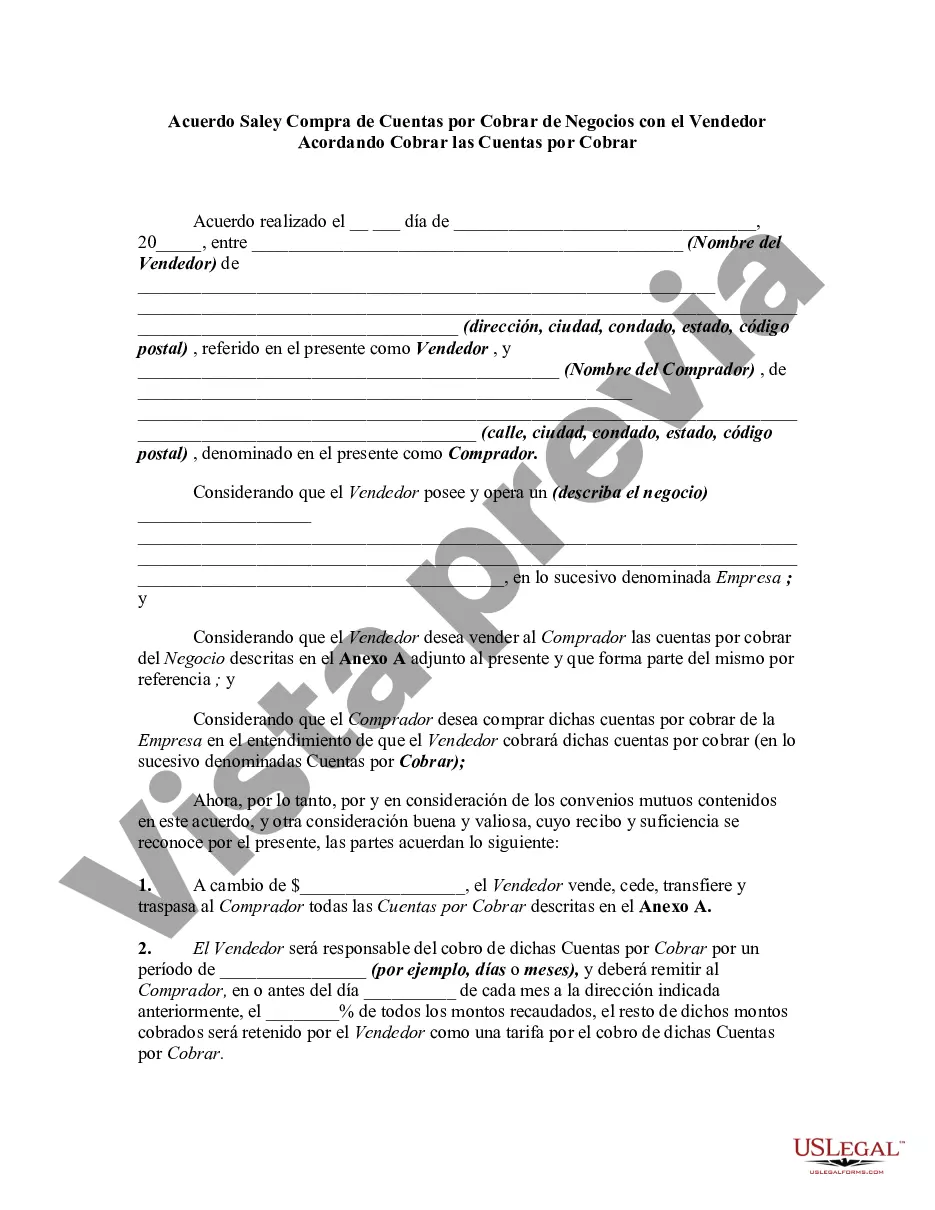

San Diego Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal contract that outlines the transaction between a buyer and seller for the purchase of accounts receivable. In this agreement, the seller agrees to transfer their outstanding receivables to the buyer in exchange for a specified amount of money. Keywords: San Diego, California, Agreement for Sale and Purchase, Accounts Receivable, Business, Seller, Collect, Legal contract, Buyer, Transaction, Outstanding receivables, Money. There are several types of San Diego Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable, which cater to different business needs: 1. Factoring Agreement: A factoring agreement is a commonly used type of accounts receivable purchase agreement where the seller, known as the "factor," sells their accounts receivable to the buyer, known as the "factored," at a discounted rate. The factored assumes the responsibility of collecting the accounts receivable from the customers of the seller. 2. Recourse Agreement: In a recourse agreement, the seller agrees to take back or repurchase any uncollectible accounts receivable from the buyer. This type of agreement provides an added layer of protection for the buyer in case of non-payment from the debtor. 3. Non-Recourse Agreement: A non-recourse agreement differs from a recourse agreement as it shifts the risk of non-payment to the buyer. The seller agrees to transfer the accounts receivable to the buyer without any obligations to repurchase uncollectible accounts. 4. Partial Assignment Agreement: A partial assignment agreement allows the seller to transfer a portion of their accounts receivable to the buyer while retaining ownership and collection responsibilities for the remaining receivables. This type of agreement provides flexibility to accommodate varying business needs. 5. Notification Agreement: A notification agreement, also known as a "notified accounts receivable agreement," is a specialized type of purchase agreement where the buyer directly notifies the debtor of the sale and subsequent ownership transfer. The seller remains responsible for the collection of accounts receivable but assigns the payment directly to the buyer. These various types of San Diego Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable offer businesses the opportunity to optimize their cash flow, reduce credit risk, and streamline collections processes while ensuring legal compliance. It is advised that businesses consult with legal professionals to determine the most suitable agreement based on their specific requirements.San Diego Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal contract that outlines the transaction between a buyer and seller for the purchase of accounts receivable. In this agreement, the seller agrees to transfer their outstanding receivables to the buyer in exchange for a specified amount of money. Keywords: San Diego, California, Agreement for Sale and Purchase, Accounts Receivable, Business, Seller, Collect, Legal contract, Buyer, Transaction, Outstanding receivables, Money. There are several types of San Diego Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable, which cater to different business needs: 1. Factoring Agreement: A factoring agreement is a commonly used type of accounts receivable purchase agreement where the seller, known as the "factor," sells their accounts receivable to the buyer, known as the "factored," at a discounted rate. The factored assumes the responsibility of collecting the accounts receivable from the customers of the seller. 2. Recourse Agreement: In a recourse agreement, the seller agrees to take back or repurchase any uncollectible accounts receivable from the buyer. This type of agreement provides an added layer of protection for the buyer in case of non-payment from the debtor. 3. Non-Recourse Agreement: A non-recourse agreement differs from a recourse agreement as it shifts the risk of non-payment to the buyer. The seller agrees to transfer the accounts receivable to the buyer without any obligations to repurchase uncollectible accounts. 4. Partial Assignment Agreement: A partial assignment agreement allows the seller to transfer a portion of their accounts receivable to the buyer while retaining ownership and collection responsibilities for the remaining receivables. This type of agreement provides flexibility to accommodate varying business needs. 5. Notification Agreement: A notification agreement, also known as a "notified accounts receivable agreement," is a specialized type of purchase agreement where the buyer directly notifies the debtor of the sale and subsequent ownership transfer. The seller remains responsible for the collection of accounts receivable but assigns the payment directly to the buyer. These various types of San Diego Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable offer businesses the opportunity to optimize their cash flow, reduce credit risk, and streamline collections processes while ensuring legal compliance. It is advised that businesses consult with legal professionals to determine the most suitable agreement based on their specific requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.