With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

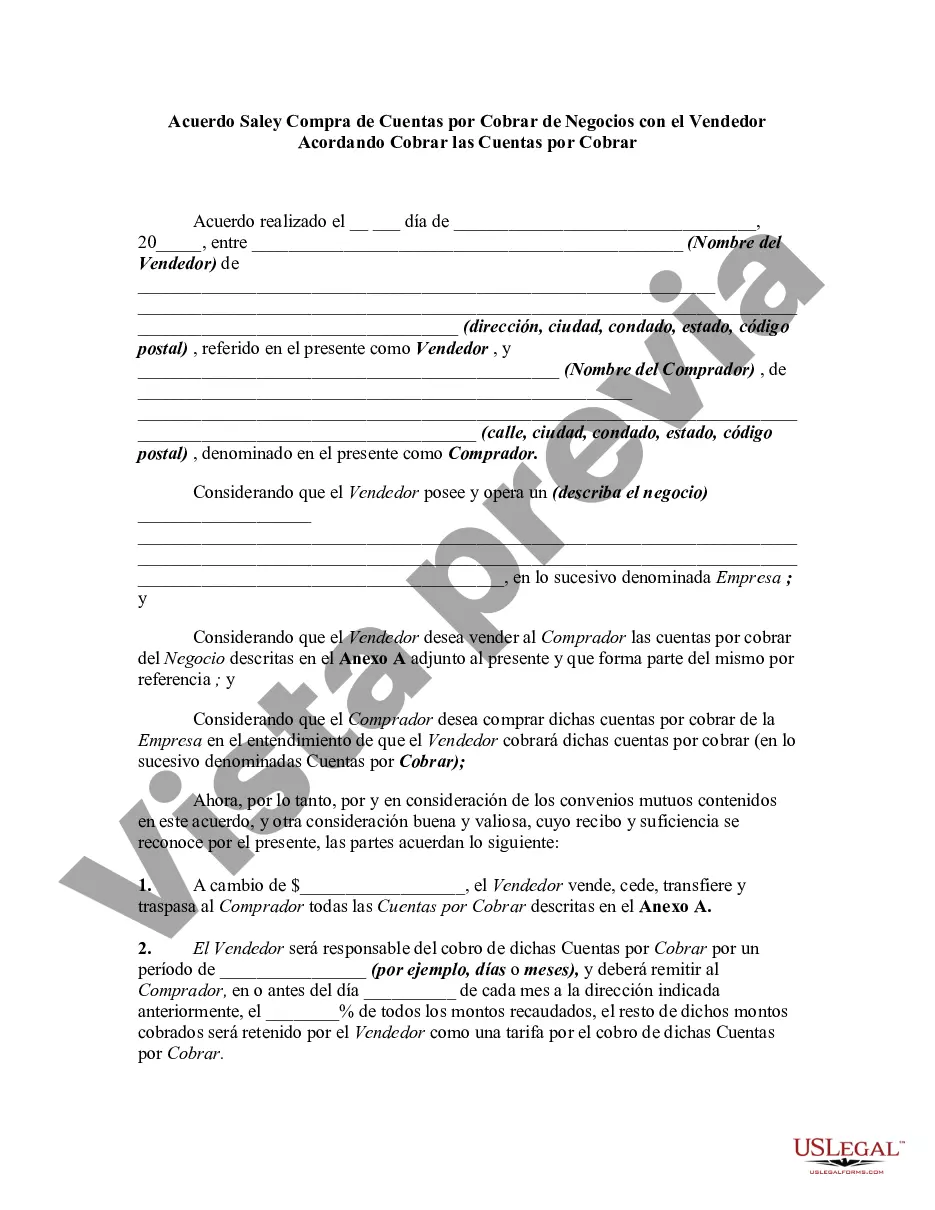

Santa Clara California Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions for the sale and purchase of accounts receivable of a business located in Santa Clara, California. This agreement is designed to facilitate the transfer of outstanding invoices and receivables from the seller (the business) to the buyer (the purchaser) while ensuring that the seller agrees to continue collecting these accounts receivable. The Santa Clara California Agreement for Sale and Purchase of Accounts Receivable may include several types of agreements, depending on the specific needs and circumstances of the involved parties. Some possible variations of this agreement include: 1. Standard Agreement for Sale and Purchase of Accounts Receivable: This is the most common type of agreement, which outlines the basic terms of the sale and purchase of accounts receivable, including the purchase price, payment terms, and the method of collection. 2. Factoring Agreement: This agreement may be used when the seller wants immediate cash flow and decides to sell their accounts receivable at a discount to a factoring company. The factoring company takes over the responsibility of collecting the accounts receivable and pays the seller a percentage of the receivables' value upfront. 3. Recourse Agreement: In this type of agreement, the seller agrees to repurchase any uncollectible accounts receivable from the buyer within a specified time frame. This provides a measure of protection for the buyer in case of non-payment by the debtor. 4. Non-Recourse Agreement: Unlike the recourse agreement, the seller is not responsible for repurchasing any uncollectible accounts receivable. The buyer assumes the risk of non-collection, making it a more favorable option for the seller. These various types of Santa Clara California agreements for sale and purchase of accounts receivable highlight the flexibility of this legal document, enabling businesses to tailor the terms and conditions to their specific requirements. It is essential for all parties involved to seek professional legal advice to ensure compliance with local laws and regulations and protect their respective interests.Santa Clara California Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions for the sale and purchase of accounts receivable of a business located in Santa Clara, California. This agreement is designed to facilitate the transfer of outstanding invoices and receivables from the seller (the business) to the buyer (the purchaser) while ensuring that the seller agrees to continue collecting these accounts receivable. The Santa Clara California Agreement for Sale and Purchase of Accounts Receivable may include several types of agreements, depending on the specific needs and circumstances of the involved parties. Some possible variations of this agreement include: 1. Standard Agreement for Sale and Purchase of Accounts Receivable: This is the most common type of agreement, which outlines the basic terms of the sale and purchase of accounts receivable, including the purchase price, payment terms, and the method of collection. 2. Factoring Agreement: This agreement may be used when the seller wants immediate cash flow and decides to sell their accounts receivable at a discount to a factoring company. The factoring company takes over the responsibility of collecting the accounts receivable and pays the seller a percentage of the receivables' value upfront. 3. Recourse Agreement: In this type of agreement, the seller agrees to repurchase any uncollectible accounts receivable from the buyer within a specified time frame. This provides a measure of protection for the buyer in case of non-payment by the debtor. 4. Non-Recourse Agreement: Unlike the recourse agreement, the seller is not responsible for repurchasing any uncollectible accounts receivable. The buyer assumes the risk of non-collection, making it a more favorable option for the seller. These various types of Santa Clara California agreements for sale and purchase of accounts receivable highlight the flexibility of this legal document, enabling businesses to tailor the terms and conditions to their specific requirements. It is essential for all parties involved to seek professional legal advice to ensure compliance with local laws and regulations and protect their respective interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.