Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co-partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

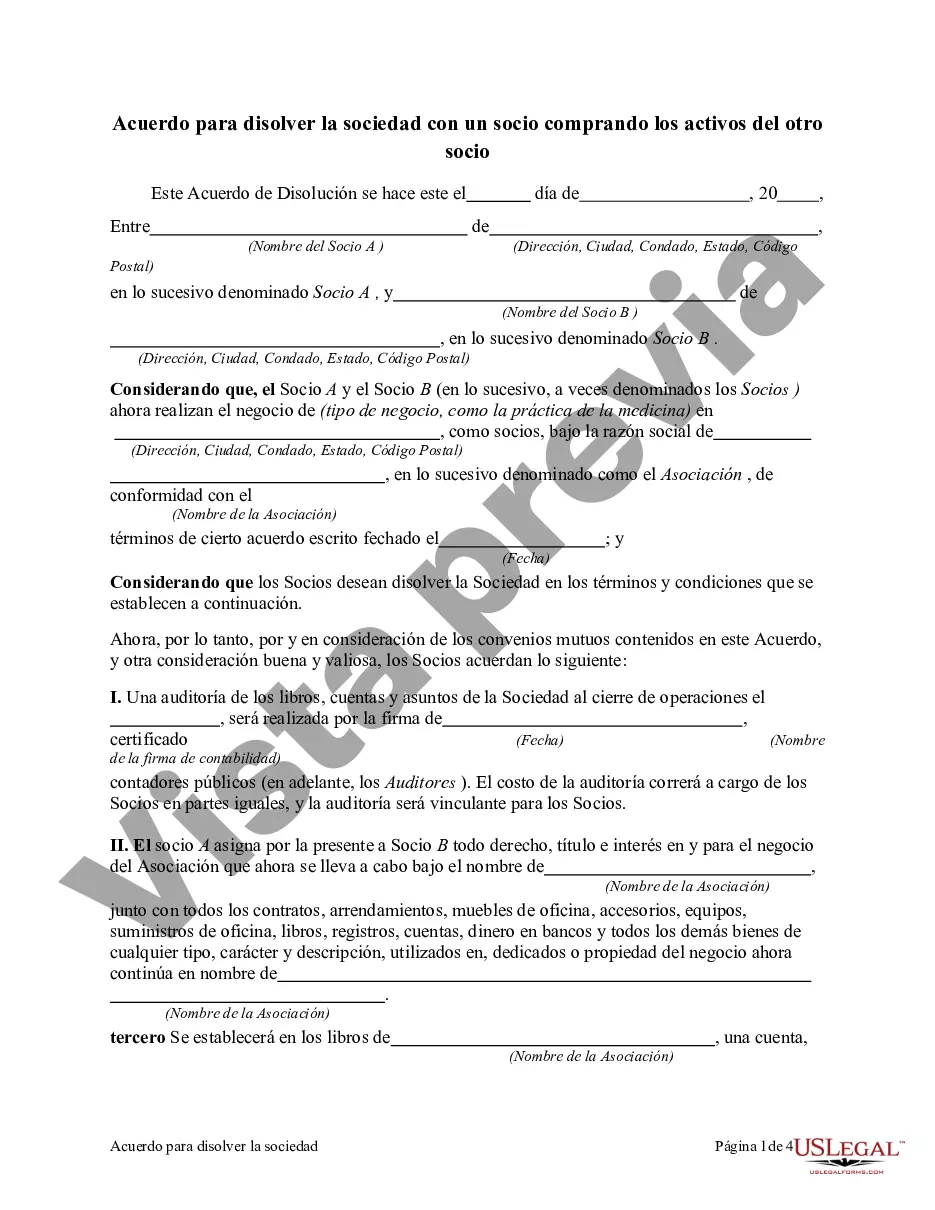

Allegheny Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner Allegheny County, located in the Commonwealth of Pennsylvania, offers a legal framework for partners looking to dissolve their existing partnership while enabling one partner to acquire the assets of the other partner. The Allegheny Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legally binding document that outlines the terms and conditions of the dissolution, asset transfer, and the subsequent division of responsibilities and liabilities between the partners. This agreement is relevant for businesses operating in Allegheny County, including partnerships looking to discontinue their collaboration or partnerships wanting to restructure their operations by transferring assets from one partner to another. This dissolution agreement comes into play when one partner expresses an interest in purchasing the assets of the other partner, facilitating a smooth and mutually agreed-upon resolution to dissolve the partnership. There may be different types of Allegheny Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner, which can include: 1. Complete Asset Acquisition: In this scenario, one partner fully purchases and acquires all the assets of the other partner, excluding liabilities, debts, and obligations. This agreement specifies the fair market value of the assets, payment terms, and details regarding the transfer of ownership. 2. Partial Asset Acquisition: Alternatively, partners may opt for a partial asset acquisition where one partner purchases only specific assets agreed upon, for example, intellectual property rights, equipment, or real estate. This agreement outlines the assets to be transferred, their valuation, and the procedure for completing the transfer. 3. Liability Allocation: Along with asset transfer, this agreement also addresses the allocation of existing liabilities between the partners. It clarifies how debt, accounts payable, and other financial obligations will be assigned, ensuring a fair distribution of responsibilities as the partnership dissolves. 4. Partners' Roles Post-Dissolution: Additionally, this agreement may define the responsibilities and roles of the partners after the dissolution. It can outline any ongoing obligations, restrictive covenants, non-compete clauses, or confidentiality agreements that are necessary for maintaining business confidentiality or preserving the partners' interests. The Allegheny Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is composed of various key elements. These typically include the identification of the involved partners, a detailed list of assets to be transferred, valuation mechanisms, payment terms, the effective date of the dissolution, provisions for dispute resolution, and any relevant legal disclaimers. Partnerships may seek legal assistance to draft this agreement accurately, ensuring compliance with Allegheny County and Pennsylvania laws. By following this structured process, partners can smoothly dissolve their partnership, allowing one partner to acquire the desired assets while preserving the rights and interests of both parties involved in the transaction.Allegheny Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner Allegheny County, located in the Commonwealth of Pennsylvania, offers a legal framework for partners looking to dissolve their existing partnership while enabling one partner to acquire the assets of the other partner. The Allegheny Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legally binding document that outlines the terms and conditions of the dissolution, asset transfer, and the subsequent division of responsibilities and liabilities between the partners. This agreement is relevant for businesses operating in Allegheny County, including partnerships looking to discontinue their collaboration or partnerships wanting to restructure their operations by transferring assets from one partner to another. This dissolution agreement comes into play when one partner expresses an interest in purchasing the assets of the other partner, facilitating a smooth and mutually agreed-upon resolution to dissolve the partnership. There may be different types of Allegheny Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner, which can include: 1. Complete Asset Acquisition: In this scenario, one partner fully purchases and acquires all the assets of the other partner, excluding liabilities, debts, and obligations. This agreement specifies the fair market value of the assets, payment terms, and details regarding the transfer of ownership. 2. Partial Asset Acquisition: Alternatively, partners may opt for a partial asset acquisition where one partner purchases only specific assets agreed upon, for example, intellectual property rights, equipment, or real estate. This agreement outlines the assets to be transferred, their valuation, and the procedure for completing the transfer. 3. Liability Allocation: Along with asset transfer, this agreement also addresses the allocation of existing liabilities between the partners. It clarifies how debt, accounts payable, and other financial obligations will be assigned, ensuring a fair distribution of responsibilities as the partnership dissolves. 4. Partners' Roles Post-Dissolution: Additionally, this agreement may define the responsibilities and roles of the partners after the dissolution. It can outline any ongoing obligations, restrictive covenants, non-compete clauses, or confidentiality agreements that are necessary for maintaining business confidentiality or preserving the partners' interests. The Allegheny Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is composed of various key elements. These typically include the identification of the involved partners, a detailed list of assets to be transferred, valuation mechanisms, payment terms, the effective date of the dissolution, provisions for dispute resolution, and any relevant legal disclaimers. Partnerships may seek legal assistance to draft this agreement accurately, ensuring compliance with Allegheny County and Pennsylvania laws. By following this structured process, partners can smoothly dissolve their partnership, allowing one partner to acquire the desired assets while preserving the rights and interests of both parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.