Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co-partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

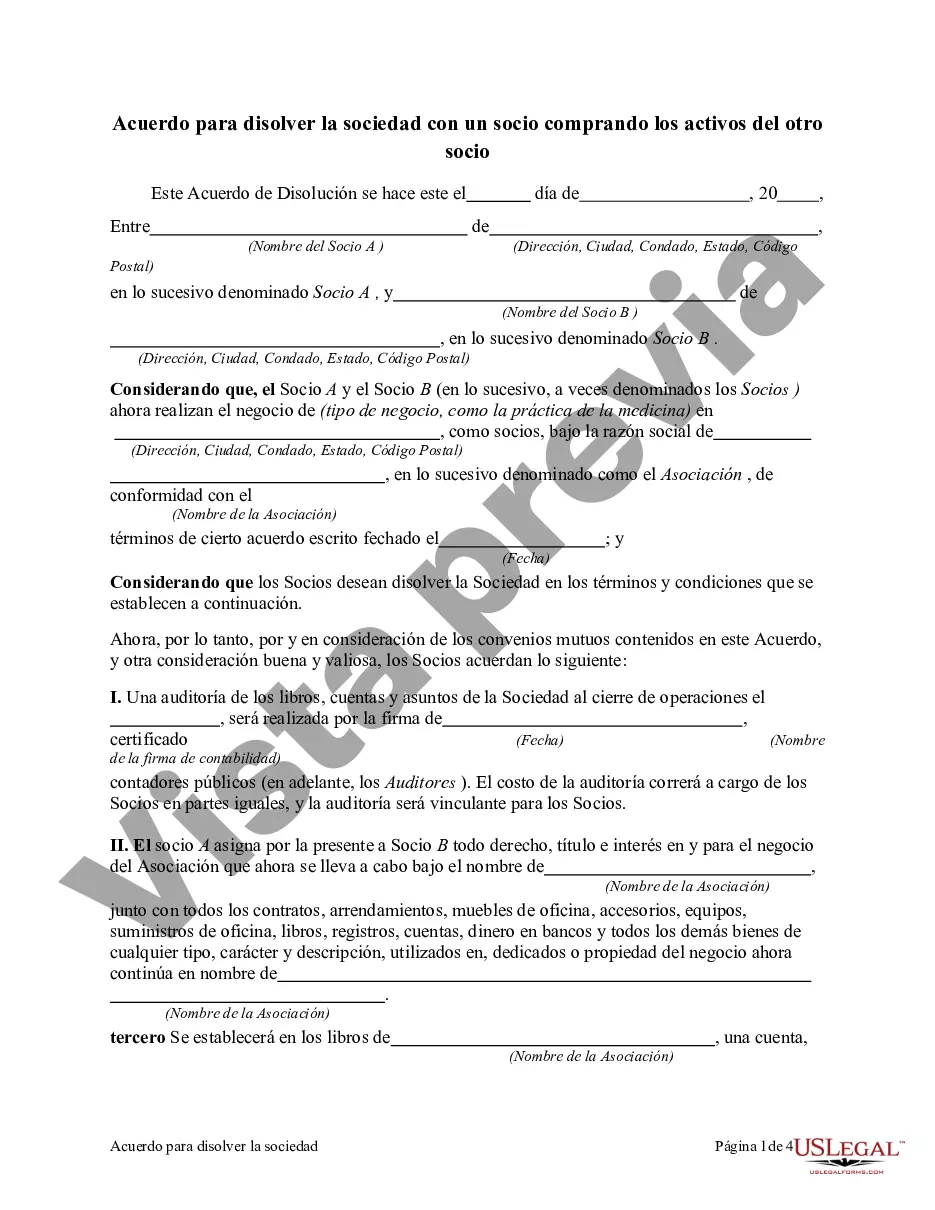

Title: The Contra Costa California Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner: Understanding the Process and Types Introduction: The Contra Costa California Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner refers to a legal document that outlines the dissolution of a partnership in Contra Costa County, California, with one partner acquiring the assets of the other partner. This detailed description aims to provide insights into the process, elements included in the agreement, and different types of such agreements. 1. Key Elements in the Agreement: — Parties involved: Clearly identify the partners and their respective roles in the partnership dissolution. — Asset valuation: Determine the fair market value of all assets owned by the partnership. — Liability assessment: Identify and allocate the liabilities to be assumed by the purchasing partner. — Asset transfer: Specify the transfer process of assets from the selling partner to the purchasing partner. — Consideration: Determine the payment method and amount for the assets being acquired. — Terms and conditions: Establish the terms and conditions of the agreement, including dispute resolution mechanisms, confidentiality, and non-compete clauses, if applicable. 2. Type 1: Voluntary Dissolution with Partner Buying Out: This type of agreement occurs when both partners mutually agree to dissolve the partnership, resulting in one partner buying the other partner's interest in the business. It involves a negotiated transfer of assets, liabilities, and ownership interest. 3. Type 2: Dissolution Due to Partner Disagreement with Asset Purchase: In cases where partners can no longer work together due to significant disagreements, this type of agreement helps facilitate the dissolution of the partnership. However, instead of both partners agreeing to dissolve, only one partner executes the purchase of the other partner's assets to continue business operations on their own. 4. Type 3: Forced Dissolution with Asset Purchase: In extreme cases, one partner may seek to dissolve the partnership and purchase the assets of the other partner against their will. This usually arises from the breach of partnership agreement terms, misconduct, or failure to fulfill obligations. Legal procedures and court involvement may be necessary to enforce the purchase of assets. Conclusion: The Contra Costa California Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a crucial legal document that ensures a smooth transition during a partnership dissolution. Understanding the key elements and the different types of such agreements can help partners navigate the process effectively and protect their interests. It is advisable to seek legal counsel to ensure the agreement aligns with California laws and serves the best interests of all parties involved.Title: The Contra Costa California Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner: Understanding the Process and Types Introduction: The Contra Costa California Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner refers to a legal document that outlines the dissolution of a partnership in Contra Costa County, California, with one partner acquiring the assets of the other partner. This detailed description aims to provide insights into the process, elements included in the agreement, and different types of such agreements. 1. Key Elements in the Agreement: — Parties involved: Clearly identify the partners and their respective roles in the partnership dissolution. — Asset valuation: Determine the fair market value of all assets owned by the partnership. — Liability assessment: Identify and allocate the liabilities to be assumed by the purchasing partner. — Asset transfer: Specify the transfer process of assets from the selling partner to the purchasing partner. — Consideration: Determine the payment method and amount for the assets being acquired. — Terms and conditions: Establish the terms and conditions of the agreement, including dispute resolution mechanisms, confidentiality, and non-compete clauses, if applicable. 2. Type 1: Voluntary Dissolution with Partner Buying Out: This type of agreement occurs when both partners mutually agree to dissolve the partnership, resulting in one partner buying the other partner's interest in the business. It involves a negotiated transfer of assets, liabilities, and ownership interest. 3. Type 2: Dissolution Due to Partner Disagreement with Asset Purchase: In cases where partners can no longer work together due to significant disagreements, this type of agreement helps facilitate the dissolution of the partnership. However, instead of both partners agreeing to dissolve, only one partner executes the purchase of the other partner's assets to continue business operations on their own. 4. Type 3: Forced Dissolution with Asset Purchase: In extreme cases, one partner may seek to dissolve the partnership and purchase the assets of the other partner against their will. This usually arises from the breach of partnership agreement terms, misconduct, or failure to fulfill obligations. Legal procedures and court involvement may be necessary to enforce the purchase of assets. Conclusion: The Contra Costa California Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a crucial legal document that ensures a smooth transition during a partnership dissolution. Understanding the key elements and the different types of such agreements can help partners navigate the process effectively and protect their interests. It is advisable to seek legal counsel to ensure the agreement aligns with California laws and serves the best interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.