Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co-partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

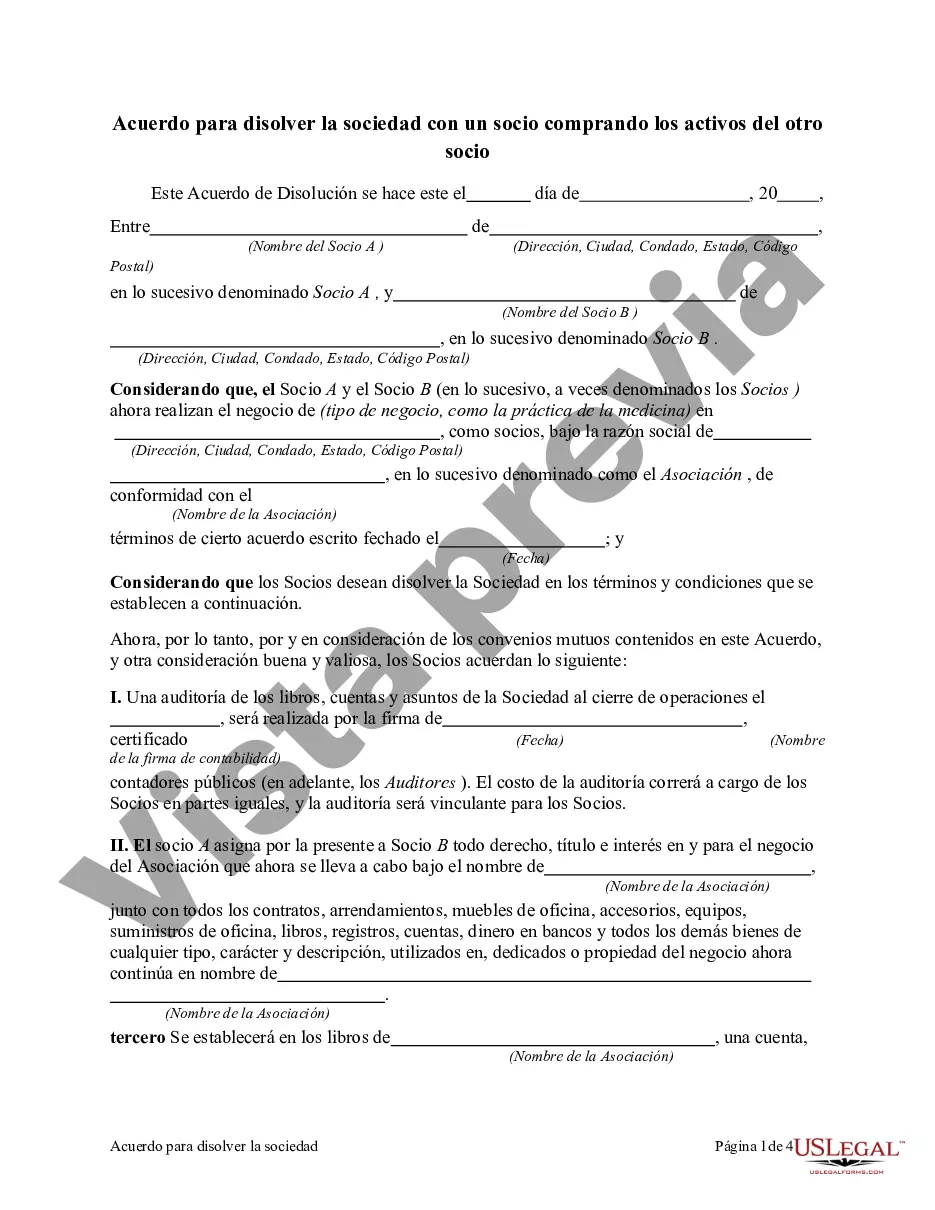

One type of agreement commonly used in Harris, Texas, for dissolving a partnership is the Partnership Dissolution Agreement with One Partner Purchasing the Assets of the Other Partner. This agreement outlines the terms and conditions under which one partner will buy out the other partner's share of the assets, effectively dissolving the partnership. Keywords: Harris Texas, agreement to dissolve partnership, one partner purchasing assets, partnership dissolution agreement, buying out partner's share, partnership dissolution terms and conditions. In this type of agreement, the partners mutually decide to end their business partnership and transfer the ownership of partnership assets to one partner while compensating the other partner for their share. This agreement is frequently used when one partner wishes to continue the business or take sole ownership of the assets and liabilities. The Harris Texas Agreement to Dissolve Partnership with One Partner Purchasing the Assets of the Other Partner typically includes the following information: 1. Identification of the Parties: The agreement states the names and contact details of the partners involved in the dissolution. 2. Effective Date: The date on which the dissolution becomes effective is mentioned. 3. Purpose and Intent: The agreement clearly states the intention to dissolve the partnership and sell the assets to one partner. 4. Asset Valuation: The process for determining the value of the partnership assets is outlined, which can include accounting methods, appraisals, or agreed-upon valuations. 5. Purchase and Sale of Assets: The agreement specifies the assets being transferred and the purchase price. It includes details on how and when the payment will be made, whether in a lump sum or installments. 6. Release and Indemnification: This section outlines the release of liabilities and the indemnification of the partner who is not purchasing the assets, protecting them from any future claims or obligations related to the business. 7. Allocation of Liabilities: The agreement addresses the allocation of joint debts, expenses, and other liabilities, ensuring that the partner buying the assets assumes responsibility for their share. 8. Confidentiality: Any confidential business information, trade secrets, or proprietary information shared during the partnership remains confidential even after dissolution. 9. Governing Law and Jurisdiction: The agreement mentions that it will be governed by the laws of Harris, Texas, and any legal disputes will be resolved within the jurisdiction. 10. Execution and Counterparts: The document is executed by all partners involved and may include provisions for electronic signatures, multiple counterparts, or witnesses. It is important to consult with a qualified attorney and seek professional advice when drafting or entering into a Harris Texas Agreement to Dissolve Partnership with One Partner Purchasing the Assets of the Other Partner. The exact terms and conditions may vary depending on the specific circumstances and requirements of the partners involved.One type of agreement commonly used in Harris, Texas, for dissolving a partnership is the Partnership Dissolution Agreement with One Partner Purchasing the Assets of the Other Partner. This agreement outlines the terms and conditions under which one partner will buy out the other partner's share of the assets, effectively dissolving the partnership. Keywords: Harris Texas, agreement to dissolve partnership, one partner purchasing assets, partnership dissolution agreement, buying out partner's share, partnership dissolution terms and conditions. In this type of agreement, the partners mutually decide to end their business partnership and transfer the ownership of partnership assets to one partner while compensating the other partner for their share. This agreement is frequently used when one partner wishes to continue the business or take sole ownership of the assets and liabilities. The Harris Texas Agreement to Dissolve Partnership with One Partner Purchasing the Assets of the Other Partner typically includes the following information: 1. Identification of the Parties: The agreement states the names and contact details of the partners involved in the dissolution. 2. Effective Date: The date on which the dissolution becomes effective is mentioned. 3. Purpose and Intent: The agreement clearly states the intention to dissolve the partnership and sell the assets to one partner. 4. Asset Valuation: The process for determining the value of the partnership assets is outlined, which can include accounting methods, appraisals, or agreed-upon valuations. 5. Purchase and Sale of Assets: The agreement specifies the assets being transferred and the purchase price. It includes details on how and when the payment will be made, whether in a lump sum or installments. 6. Release and Indemnification: This section outlines the release of liabilities and the indemnification of the partner who is not purchasing the assets, protecting them from any future claims or obligations related to the business. 7. Allocation of Liabilities: The agreement addresses the allocation of joint debts, expenses, and other liabilities, ensuring that the partner buying the assets assumes responsibility for their share. 8. Confidentiality: Any confidential business information, trade secrets, or proprietary information shared during the partnership remains confidential even after dissolution. 9. Governing Law and Jurisdiction: The agreement mentions that it will be governed by the laws of Harris, Texas, and any legal disputes will be resolved within the jurisdiction. 10. Execution and Counterparts: The document is executed by all partners involved and may include provisions for electronic signatures, multiple counterparts, or witnesses. It is important to consult with a qualified attorney and seek professional advice when drafting or entering into a Harris Texas Agreement to Dissolve Partnership with One Partner Purchasing the Assets of the Other Partner. The exact terms and conditions may vary depending on the specific circumstances and requirements of the partners involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.