Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co-partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

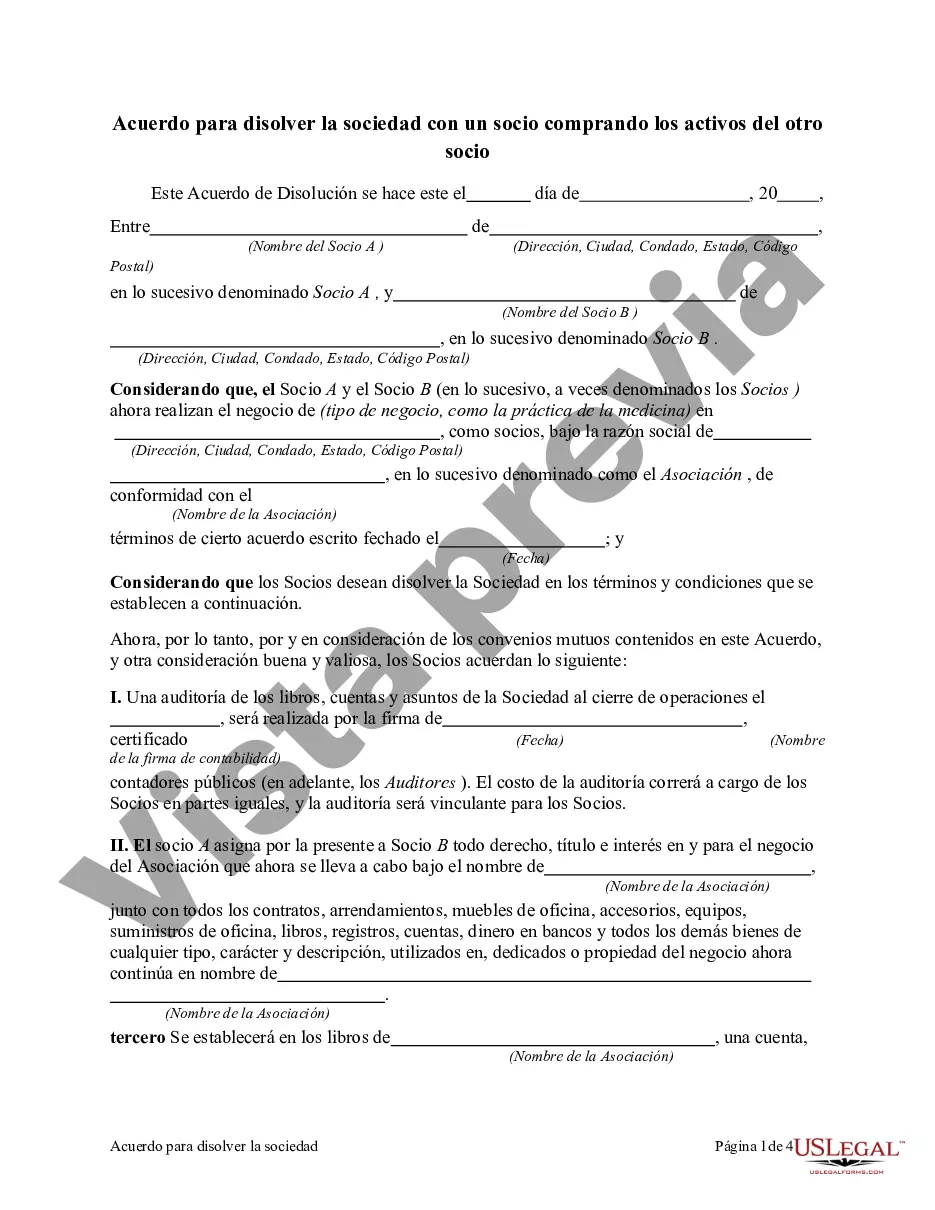

Mecklenburg North Carolina Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legal document that outlines the terms and conditions for dissolving a partnership in Mecklenburg County, North Carolina, while allowing one partner to buy out the assets of the other partner. This agreement is commonly used when one partner wishes to continue operating the business or take ownership of its assets, while the other partner seeks to exit the partnership. This dissolution agreement typically includes various clauses and provisions to ensure a smooth transition and protect the interests of both partners involved. Some of the essential elements that may be addressed in this agreement include: 1. Effective Date: The agreement will specify the effective date upon which the partnership will dissolve and the buyout process will commence. 2. Partner Buyout: The agreement will outline the terms of the buyout, including the purchase price for the assets, payment method, and any agreed-upon terms for installment payments or financing. 3. Asset Valuation: To determine the purchase price, the agreement may mention an agreed-upon method of valuing the partnership assets. This can include a detailed inventory, independent appraisal, or consultation with financial experts. 4. Allocation of Liabilities: The partners must decide on how the partnership's debts, obligations, and liabilities will be allocated between them. This may involve the assumption of certain debts by the purchasing partner or the negotiation of a separate agreement for debt settlement. 5. Employee and Staffing: If the purchased assets include employees or staff members, the agreement may address the terms of employment for these individuals. It may specify whether employment offers will be made by the purchasing partner and if any existing employee agreements will be honored or transferred. 6. Intellectual Property: If the partnership holds any intellectual property rights, such as patents, copyrights, or trademarks, the agreement will outline how these assets will be handled and whether they will be transferred to the purchasing partner or remain jointly owned. 7. Competing with the Dissolved Partnership: To protect the interests of the purchasing partner, the agreement may include non-compete and non-solicitation clauses, preventing the exiting partner from engaging in similar business activities that could harm the partnership's operations. Types of Mecklenburg North Carolina Agreements to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner may vary depending on the specific circumstances and details involved. Some possible variations could include agreements tailored for partnerships in different industries, agreements addressing the dissolution of limited partnerships or general partnerships, or agreements specifically designed to address tax implications or the transfer of substantial assets. It is crucial to consult with a qualified attorney specializing in business law to ensure that any Mecklenburg North Carolina Agreement to Dissolve Partnership fits your unique situation, complies with local laws, and adequately addresses your rights and obligations as a partner.Mecklenburg North Carolina Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legal document that outlines the terms and conditions for dissolving a partnership in Mecklenburg County, North Carolina, while allowing one partner to buy out the assets of the other partner. This agreement is commonly used when one partner wishes to continue operating the business or take ownership of its assets, while the other partner seeks to exit the partnership. This dissolution agreement typically includes various clauses and provisions to ensure a smooth transition and protect the interests of both partners involved. Some of the essential elements that may be addressed in this agreement include: 1. Effective Date: The agreement will specify the effective date upon which the partnership will dissolve and the buyout process will commence. 2. Partner Buyout: The agreement will outline the terms of the buyout, including the purchase price for the assets, payment method, and any agreed-upon terms for installment payments or financing. 3. Asset Valuation: To determine the purchase price, the agreement may mention an agreed-upon method of valuing the partnership assets. This can include a detailed inventory, independent appraisal, or consultation with financial experts. 4. Allocation of Liabilities: The partners must decide on how the partnership's debts, obligations, and liabilities will be allocated between them. This may involve the assumption of certain debts by the purchasing partner or the negotiation of a separate agreement for debt settlement. 5. Employee and Staffing: If the purchased assets include employees or staff members, the agreement may address the terms of employment for these individuals. It may specify whether employment offers will be made by the purchasing partner and if any existing employee agreements will be honored or transferred. 6. Intellectual Property: If the partnership holds any intellectual property rights, such as patents, copyrights, or trademarks, the agreement will outline how these assets will be handled and whether they will be transferred to the purchasing partner or remain jointly owned. 7. Competing with the Dissolved Partnership: To protect the interests of the purchasing partner, the agreement may include non-compete and non-solicitation clauses, preventing the exiting partner from engaging in similar business activities that could harm the partnership's operations. Types of Mecklenburg North Carolina Agreements to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner may vary depending on the specific circumstances and details involved. Some possible variations could include agreements tailored for partnerships in different industries, agreements addressing the dissolution of limited partnerships or general partnerships, or agreements specifically designed to address tax implications or the transfer of substantial assets. It is crucial to consult with a qualified attorney specializing in business law to ensure that any Mecklenburg North Carolina Agreement to Dissolve Partnership fits your unique situation, complies with local laws, and adequately addresses your rights and obligations as a partner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.