Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co-partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

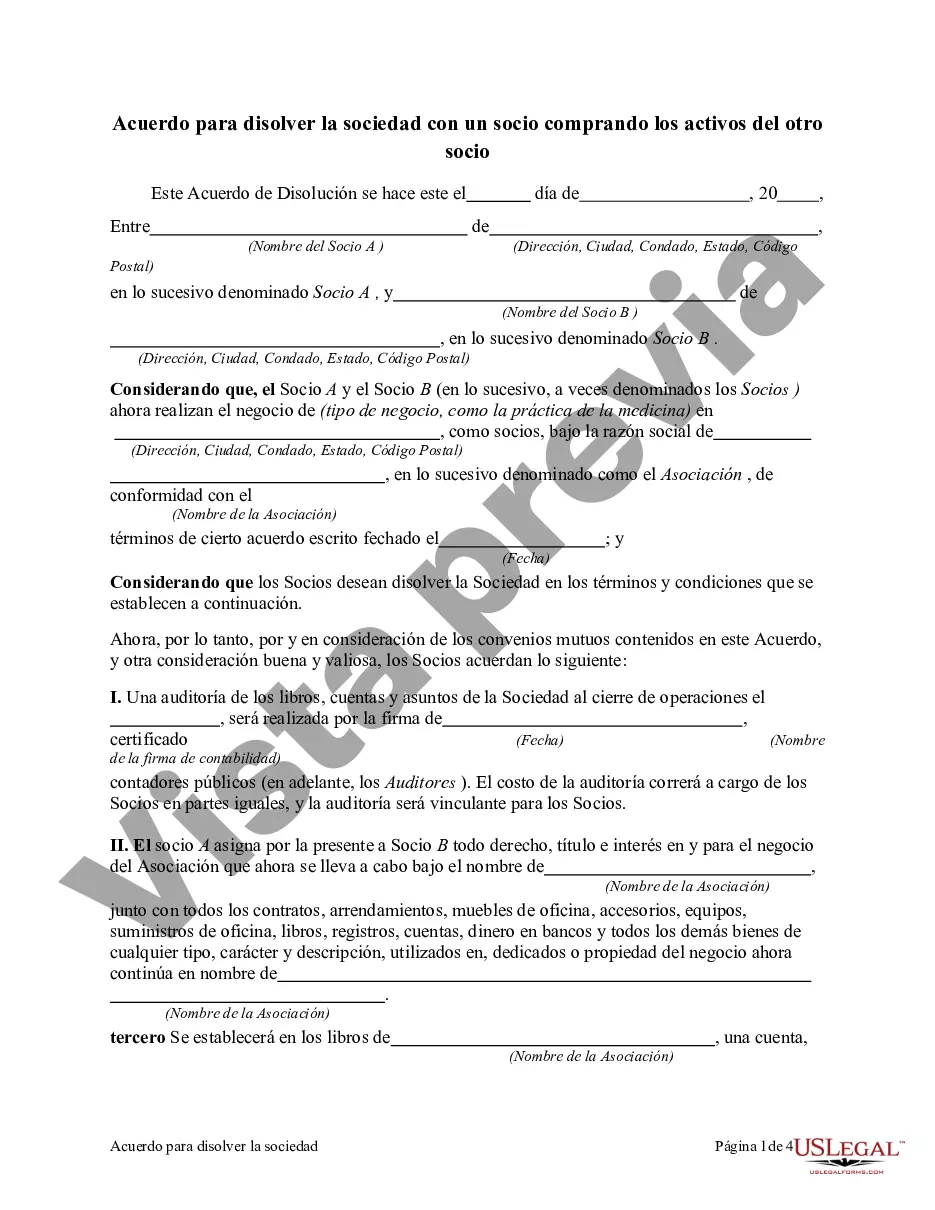

Philadelphia Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legal document that outlines the terms and conditions for the voluntary dissolution of a partnership in Philadelphia, Pennsylvania, where one partner acquires the assets of the other partner. This agreement is typically applicable in cases where the partners have decided to end their partnership and one partner wishes to continue the business by purchasing the assets being used for the partnership's operations. The Agreement to Dissolve Partnership begins with a clear identification of the parties involved, including their legal names and addresses. It also includes the effective date of the dissolution, ensuring all future actions are applicable as of this date. The agreement outlines the specific assets to be transferred, which may include tangible assets such as inventory, equipment, intellectual property, real estate, and accounts receivable. The terms and conditions of the agreement cover various aspects such as the purchase price of the assets, payment terms, and any relevant warranties or disclaimers related to the condition of the assets. The purchasing partner may agree to assume any debts or liabilities associated with the assets being transferred, or there may be a separate provision addressing how these will be handled during and after the dissolution process. Philadelphia Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner may have different variations depending on the specific circumstances and requirements of the partners involved. Some variations include: 1. Limited Partnership Dissolution: Account for additional provisions that apply to limited partnership structures, such as the distribution of profits and losses among the partners, and any obligations established in the initial partnership agreement. 2. General Partnership Dissolution: Address the dissolution process for a general partnership where all partners are equally responsible for the partnership's debts and obligations. 3. Asset Purchase Agreement: In situations where the partnership has significant assets or substantial goodwill, this type of agreement may be used to transfer and purchase the assets, including the rights to names, trademarks, and client/customer contracts. 4. Buyout Agreement: If the purchase of assets by one partner involves a buyout of the other partner's ownership, specific clauses addressing buyout terms, valuation methods, and payment schedules are included. The Philadelphia Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner allows smooth and transparent dissolution proceedings and ensures that the purchasing partner can take over the business promptly. It establishes the rights, obligations, and expectations of both parties, minimizing the potential for conflicts or misunderstandings during the dissolution process.Philadelphia Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legal document that outlines the terms and conditions for the voluntary dissolution of a partnership in Philadelphia, Pennsylvania, where one partner acquires the assets of the other partner. This agreement is typically applicable in cases where the partners have decided to end their partnership and one partner wishes to continue the business by purchasing the assets being used for the partnership's operations. The Agreement to Dissolve Partnership begins with a clear identification of the parties involved, including their legal names and addresses. It also includes the effective date of the dissolution, ensuring all future actions are applicable as of this date. The agreement outlines the specific assets to be transferred, which may include tangible assets such as inventory, equipment, intellectual property, real estate, and accounts receivable. The terms and conditions of the agreement cover various aspects such as the purchase price of the assets, payment terms, and any relevant warranties or disclaimers related to the condition of the assets. The purchasing partner may agree to assume any debts or liabilities associated with the assets being transferred, or there may be a separate provision addressing how these will be handled during and after the dissolution process. Philadelphia Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner may have different variations depending on the specific circumstances and requirements of the partners involved. Some variations include: 1. Limited Partnership Dissolution: Account for additional provisions that apply to limited partnership structures, such as the distribution of profits and losses among the partners, and any obligations established in the initial partnership agreement. 2. General Partnership Dissolution: Address the dissolution process for a general partnership where all partners are equally responsible for the partnership's debts and obligations. 3. Asset Purchase Agreement: In situations where the partnership has significant assets or substantial goodwill, this type of agreement may be used to transfer and purchase the assets, including the rights to names, trademarks, and client/customer contracts. 4. Buyout Agreement: If the purchase of assets by one partner involves a buyout of the other partner's ownership, specific clauses addressing buyout terms, valuation methods, and payment schedules are included. The Philadelphia Pennsylvania Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner allows smooth and transparent dissolution proceedings and ensures that the purchasing partner can take over the business promptly. It establishes the rights, obligations, and expectations of both parties, minimizing the potential for conflicts or misunderstandings during the dissolution process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.