Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co-partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

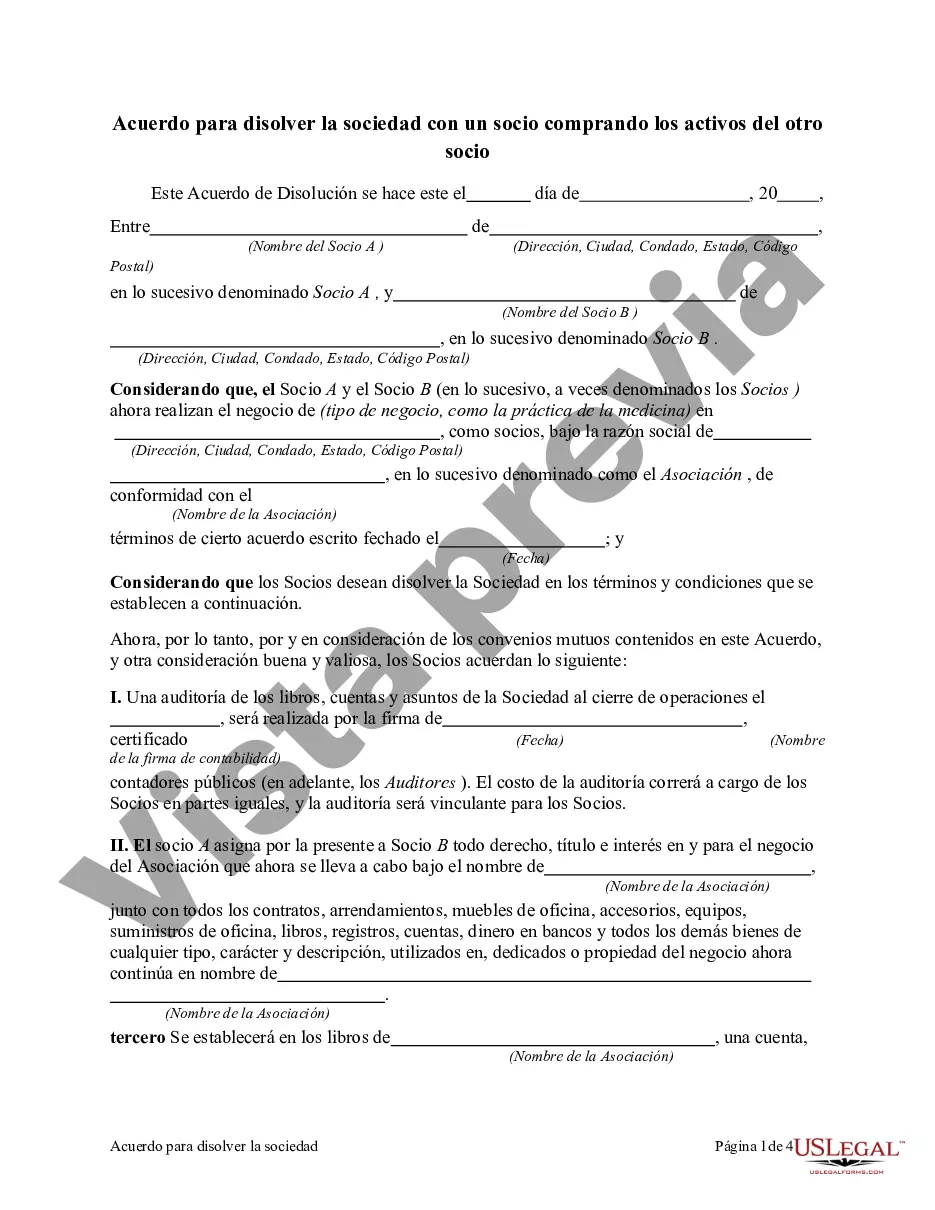

The Salt Lake Utah Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legal contract that outlines the process of ending a partnership and transferring the assets from one partner to another in Salt Lake City, Utah. This agreement is crucial in ensuring a smooth dissolution of the partnership and a fair and equitable distribution of assets. There are different types of agreements that fall under this category, depending on the specific circumstances of the partnership and the intentions of the partners. These may include: 1. General Partnership Dissolution Agreement: This type of agreement is used when all partners decide to dissolve the partnership and one partner agrees to buy out the other partner's share of the assets. It includes provisions for the valuation and payment of the assets, as well as the terms for winding up the partnership affairs. 2. Limited Partnership Dissolution Agreement: A limited partnership consists of general partners who manage the day-to-day operations and limited partners who provide capital but have no management authority. In this case, the agreement will outline the process for the dissolution of the limited partnership, including the buyout of the limited partner by the general partner. 3. Partnership Buyout Agreement: This agreement is utilized when one partner wishes to exit the partnership and sell their portion of the assets to the remaining partner. It defines the purchase price, payment terms, and any conditions or restrictions on the sale. 4. Partnership Asset Transfer Agreement: When a partner wishes to purchase only specific assets of the other partner, rather than the entire partnership, an asset transfer agreement is used. It outlines the assets to be transferred, the purchase price, and any warranties or guarantees regarding the assets' condition. Regardless of the specific type of agreement, the Salt Lake Utah Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner typically includes the following key provisions: — Identification of the parties involved, including their roles in the partnership. — Purpose and effective date of the agreement. — Terms and conditions for the dissolution of the partnership, including the sale and transfer of assets. — Asset valuation methods and mechanism for determining the purchase price. — Payment terms, whether in a lump sum or installments, including any interest or financing arrangements. — Non-competition and non-solicitation clauses if applicable, to prevent the departing partner from competing or soliciting the partnership's clients. — Confidentiality provisions to protect sensitive business information. — Indemnification and release clauses to address any liabilities or claims arising from the partnership. — Governing law and dispute resolution mechanisms. It is essential for all parties involved to seek legal counsel when drafting or entering into a Salt Lake Utah Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner, as the specifics of the agreement will vary depending on the unique circumstances of the partnership.The Salt Lake Utah Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legal contract that outlines the process of ending a partnership and transferring the assets from one partner to another in Salt Lake City, Utah. This agreement is crucial in ensuring a smooth dissolution of the partnership and a fair and equitable distribution of assets. There are different types of agreements that fall under this category, depending on the specific circumstances of the partnership and the intentions of the partners. These may include: 1. General Partnership Dissolution Agreement: This type of agreement is used when all partners decide to dissolve the partnership and one partner agrees to buy out the other partner's share of the assets. It includes provisions for the valuation and payment of the assets, as well as the terms for winding up the partnership affairs. 2. Limited Partnership Dissolution Agreement: A limited partnership consists of general partners who manage the day-to-day operations and limited partners who provide capital but have no management authority. In this case, the agreement will outline the process for the dissolution of the limited partnership, including the buyout of the limited partner by the general partner. 3. Partnership Buyout Agreement: This agreement is utilized when one partner wishes to exit the partnership and sell their portion of the assets to the remaining partner. It defines the purchase price, payment terms, and any conditions or restrictions on the sale. 4. Partnership Asset Transfer Agreement: When a partner wishes to purchase only specific assets of the other partner, rather than the entire partnership, an asset transfer agreement is used. It outlines the assets to be transferred, the purchase price, and any warranties or guarantees regarding the assets' condition. Regardless of the specific type of agreement, the Salt Lake Utah Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner typically includes the following key provisions: — Identification of the parties involved, including their roles in the partnership. — Purpose and effective date of the agreement. — Terms and conditions for the dissolution of the partnership, including the sale and transfer of assets. — Asset valuation methods and mechanism for determining the purchase price. — Payment terms, whether in a lump sum or installments, including any interest or financing arrangements. — Non-competition and non-solicitation clauses if applicable, to prevent the departing partner from competing or soliciting the partnership's clients. — Confidentiality provisions to protect sensitive business information. — Indemnification and release clauses to address any liabilities or claims arising from the partnership. — Governing law and dispute resolution mechanisms. It is essential for all parties involved to seek legal counsel when drafting or entering into a Salt Lake Utah Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner, as the specifics of the agreement will vary depending on the unique circumstances of the partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.