This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Harris Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property — Lease or Rent to Own is a legally binding contract that allows tenants the opportunity to rent a property with the option to buy and own it in the future. This unique arrangement provides flexibility for both landlords and tenants, giving them the opportunity to test the property before committing to a long-term purchase. The Harris Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property is a popular choice among individuals who want to explore homeownership but may not meet the immediate criteria for a traditional mortgage. This agreement allows tenants to build equity while renting, with the option to purchase the property at a predetermined price within a specified timeframe, usually ranging from 1 to 3 years. Several types of Harris Texas Lease or Rental Agreements of Residential Property with Option to Purchase and Own Property are available to cater to different needs and preferences: 1. Standard Lease or Rent to Own Agreement: This is the most common type of agreement, where tenants pay rent for a specific duration, typically between 12 and 36 months, and have the option to purchase the property at a pre-agreed price during or at the end of the lease term. 2. Lease-Purchase Agreement: In this variation of the agreement, a portion of the rent paid by the tenant is credited towards the purchase price of the property. This arrangement allows the tenant to accumulate funds that can be used as a down payment during the purchase phase. 3. Lease-Option Agreement: Unlike a lease-purchase agreement, a lease-option agreement provides the tenant with the right, but not the obligation, to purchase the property at a future date. This gives the tenant flexibility to walk away from the deal without penalty if they decide not to exercise the option to buy. 4. Lease-Renewal Agreement: This type of agreement is applicable when the tenant needs additional time to prepare for the purchase. It allows for a renewal of the lease term, providing the tenant with extended opportunities to qualify for a mortgage or save for a down payment. The Harris Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property — Lease or Rent to Own is designed to benefit both parties involved. Tenants benefit from the chance to build credit, save money, and test the property before making a long-term commitment. Landlords benefit from continuous rental income, the possibility of attracting more tenants, and the potential to sell the property at the predetermined price. Before entering into any lease or rental agreement, it is important for both landlords and tenants to thoroughly understand the terms, obligations, rights, and conditions outlined in the contract. Consulting with a legal professional is highly recommended ensuring that all parties are protected and well-informed. Overall, the Harris Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property — Lease or Rent to Own offers a flexible and beneficial solution for individuals aspiring to become homeowners but may need time or additional financial assistance to achieve their goal.Harris Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property — Lease or Rent to Own is a legally binding contract that allows tenants the opportunity to rent a property with the option to buy and own it in the future. This unique arrangement provides flexibility for both landlords and tenants, giving them the opportunity to test the property before committing to a long-term purchase. The Harris Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property is a popular choice among individuals who want to explore homeownership but may not meet the immediate criteria for a traditional mortgage. This agreement allows tenants to build equity while renting, with the option to purchase the property at a predetermined price within a specified timeframe, usually ranging from 1 to 3 years. Several types of Harris Texas Lease or Rental Agreements of Residential Property with Option to Purchase and Own Property are available to cater to different needs and preferences: 1. Standard Lease or Rent to Own Agreement: This is the most common type of agreement, where tenants pay rent for a specific duration, typically between 12 and 36 months, and have the option to purchase the property at a pre-agreed price during or at the end of the lease term. 2. Lease-Purchase Agreement: In this variation of the agreement, a portion of the rent paid by the tenant is credited towards the purchase price of the property. This arrangement allows the tenant to accumulate funds that can be used as a down payment during the purchase phase. 3. Lease-Option Agreement: Unlike a lease-purchase agreement, a lease-option agreement provides the tenant with the right, but not the obligation, to purchase the property at a future date. This gives the tenant flexibility to walk away from the deal without penalty if they decide not to exercise the option to buy. 4. Lease-Renewal Agreement: This type of agreement is applicable when the tenant needs additional time to prepare for the purchase. It allows for a renewal of the lease term, providing the tenant with extended opportunities to qualify for a mortgage or save for a down payment. The Harris Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property — Lease or Rent to Own is designed to benefit both parties involved. Tenants benefit from the chance to build credit, save money, and test the property before making a long-term commitment. Landlords benefit from continuous rental income, the possibility of attracting more tenants, and the potential to sell the property at the predetermined price. Before entering into any lease or rental agreement, it is important for both landlords and tenants to thoroughly understand the terms, obligations, rights, and conditions outlined in the contract. Consulting with a legal professional is highly recommended ensuring that all parties are protected and well-informed. Overall, the Harris Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property — Lease or Rent to Own offers a flexible and beneficial solution for individuals aspiring to become homeowners but may need time or additional financial assistance to achieve their goal.

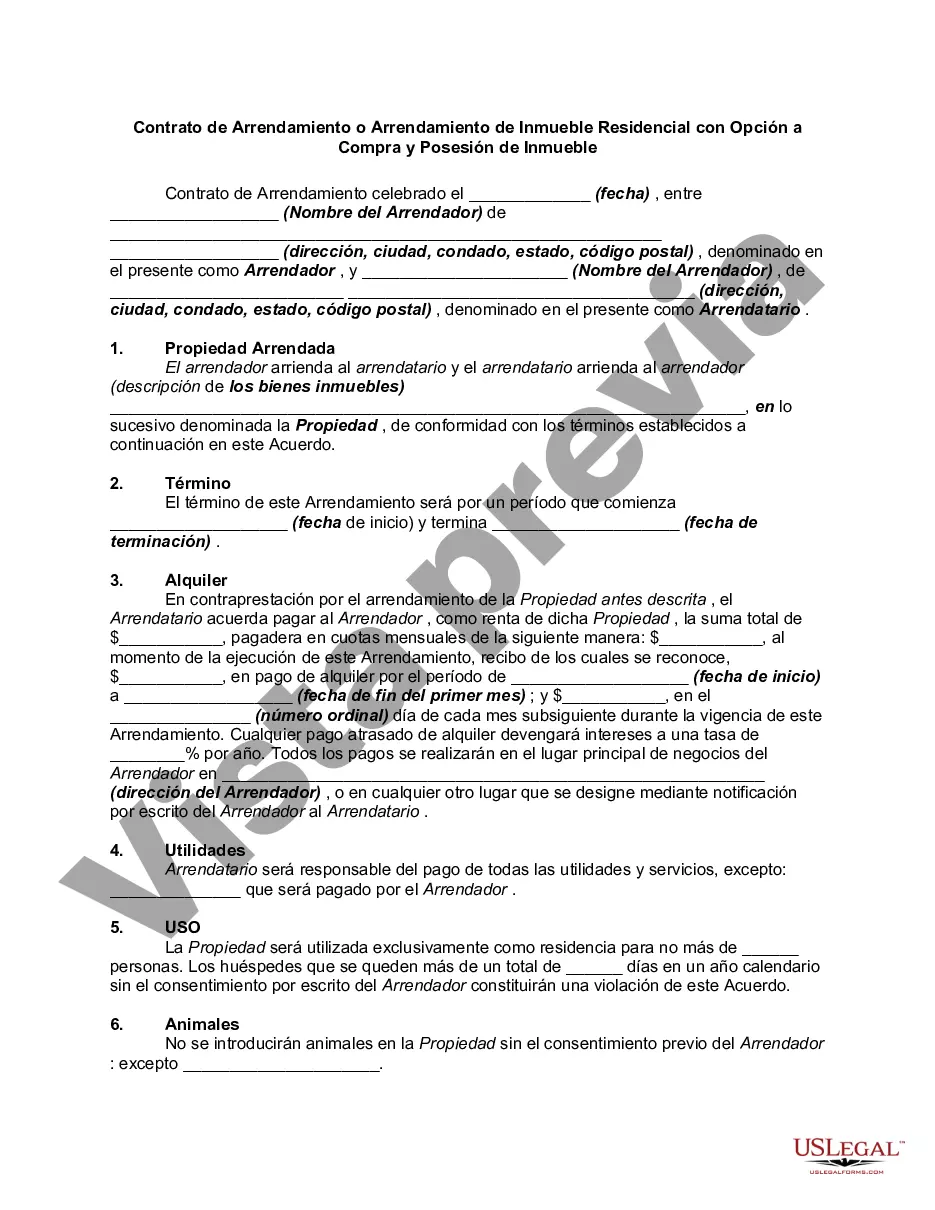

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.