This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A San Antonio Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property, also known as a Lease to Own or Rent to Own agreement, is a legally binding contract that provides tenants with the opportunity to rent a property with the option to buy it in the future. This type of agreement is commonly used by prospective homeowners who may not be able to secure traditional financing or afford a down payment immediately. It allows tenants to live in a property while saving up for a down payment or improving their credit score to qualify for a mortgage. In a San Antonio Texas Lease or Rental Agreement with Option to Purchase and Own Property, there are a few key components that need to be addressed. Firstly, the contract will specify the length of the lease term, usually ranging from one to three years, during which the tenant has the option to purchase the property. Additionally, the agreement should outline the rental price, which may be slightly higher than the average market rent, as a portion of the monthly payment may be credited towards the eventual purchase. The contract should also include the purchase price for the property, which is typically set at the time of signing the lease agreement. It's crucial to clearly state the terms of the purchase, such as the timeframe in which the tenant can exercise their option to buy, any conditions or contingencies, and the method of payment. Different types of San Antonio Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property may vary slightly depending on the specific terms and conditions set by the landlord and tenant. For example, some agreements may require the tenant to make a non-refundable option fee, which gives them the exclusive right to purchase the property within the agreed-upon timeframe. This fee is typically credited towards the down payment or purchase price if the tenant decides to buy. Another variation is the percentage of rent credited towards the purchase price. While some agreements may apply a fixed monthly amount, others may specify a percentage, such as 25% or 50%, of the monthly rent to be credited. This can significantly impact the overall affordability of the property for the tenant and should be negotiated and clearly stated in the agreement. Furthermore, the agreement should address responsibilities for maintenance and repairs during the lease term and after the purchase of the property. It should also indicate whether the tenant must obtain renter's insurance and who is responsible for property taxes, homeowners' association (HOA) fees, and other associated costs. In conclusion, a San Antonio Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property, commonly known as a Lease to Own or Rent to Own agreement, offers a flexible path to homeownership for individuals in San Antonio who may not be able to immediately secure traditional financing. By establishing clear terms and conditions, such as lease duration, rent credited towards purchase, and purchase price, both landlords and tenants can benefit from this unique arrangement.A San Antonio Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property, also known as a Lease to Own or Rent to Own agreement, is a legally binding contract that provides tenants with the opportunity to rent a property with the option to buy it in the future. This type of agreement is commonly used by prospective homeowners who may not be able to secure traditional financing or afford a down payment immediately. It allows tenants to live in a property while saving up for a down payment or improving their credit score to qualify for a mortgage. In a San Antonio Texas Lease or Rental Agreement with Option to Purchase and Own Property, there are a few key components that need to be addressed. Firstly, the contract will specify the length of the lease term, usually ranging from one to three years, during which the tenant has the option to purchase the property. Additionally, the agreement should outline the rental price, which may be slightly higher than the average market rent, as a portion of the monthly payment may be credited towards the eventual purchase. The contract should also include the purchase price for the property, which is typically set at the time of signing the lease agreement. It's crucial to clearly state the terms of the purchase, such as the timeframe in which the tenant can exercise their option to buy, any conditions or contingencies, and the method of payment. Different types of San Antonio Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property may vary slightly depending on the specific terms and conditions set by the landlord and tenant. For example, some agreements may require the tenant to make a non-refundable option fee, which gives them the exclusive right to purchase the property within the agreed-upon timeframe. This fee is typically credited towards the down payment or purchase price if the tenant decides to buy. Another variation is the percentage of rent credited towards the purchase price. While some agreements may apply a fixed monthly amount, others may specify a percentage, such as 25% or 50%, of the monthly rent to be credited. This can significantly impact the overall affordability of the property for the tenant and should be negotiated and clearly stated in the agreement. Furthermore, the agreement should address responsibilities for maintenance and repairs during the lease term and after the purchase of the property. It should also indicate whether the tenant must obtain renter's insurance and who is responsible for property taxes, homeowners' association (HOA) fees, and other associated costs. In conclusion, a San Antonio Texas Lease or Rental Agreement of Residential Property with Option to Purchase and Own Property, commonly known as a Lease to Own or Rent to Own agreement, offers a flexible path to homeownership for individuals in San Antonio who may not be able to immediately secure traditional financing. By establishing clear terms and conditions, such as lease duration, rent credited towards purchase, and purchase price, both landlords and tenants can benefit from this unique arrangement.

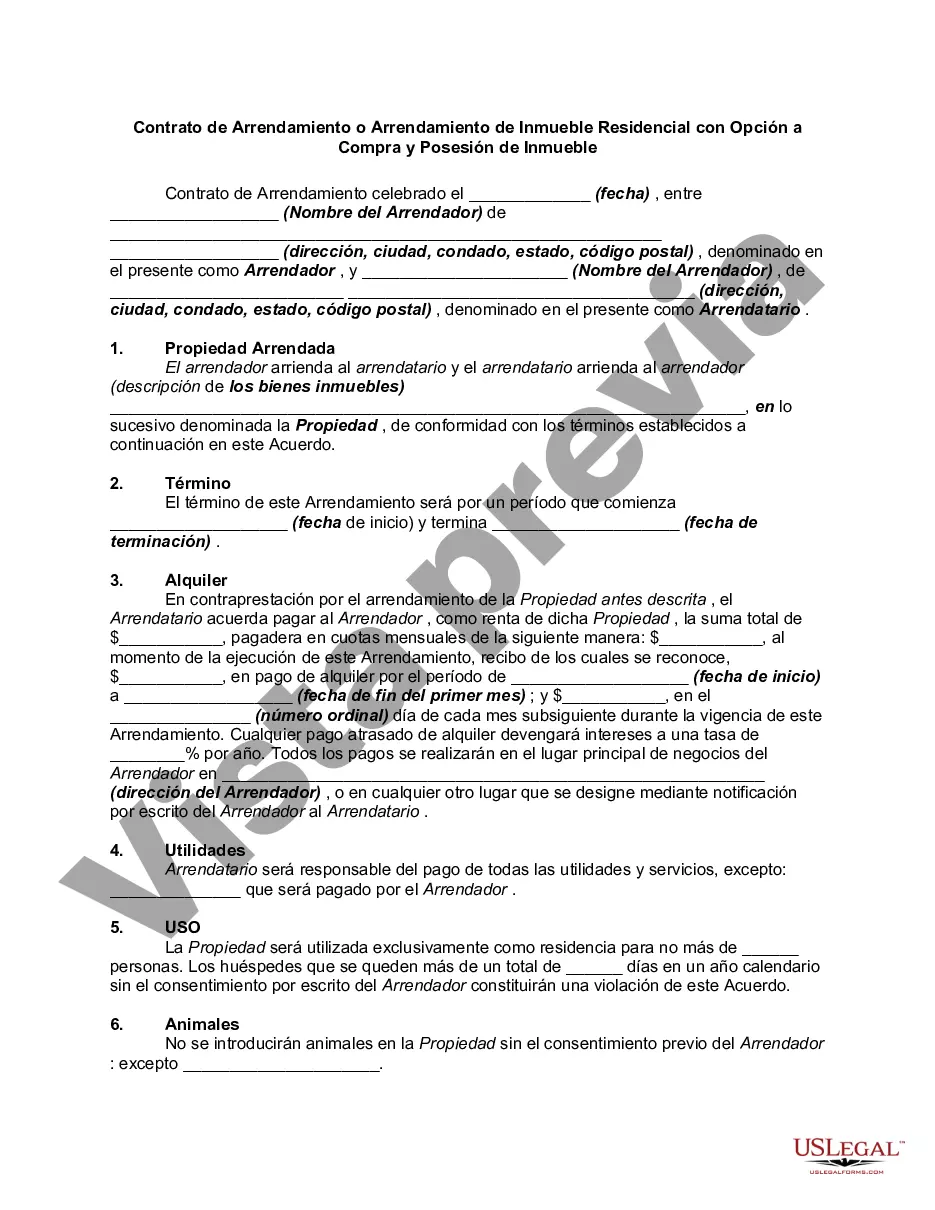

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.