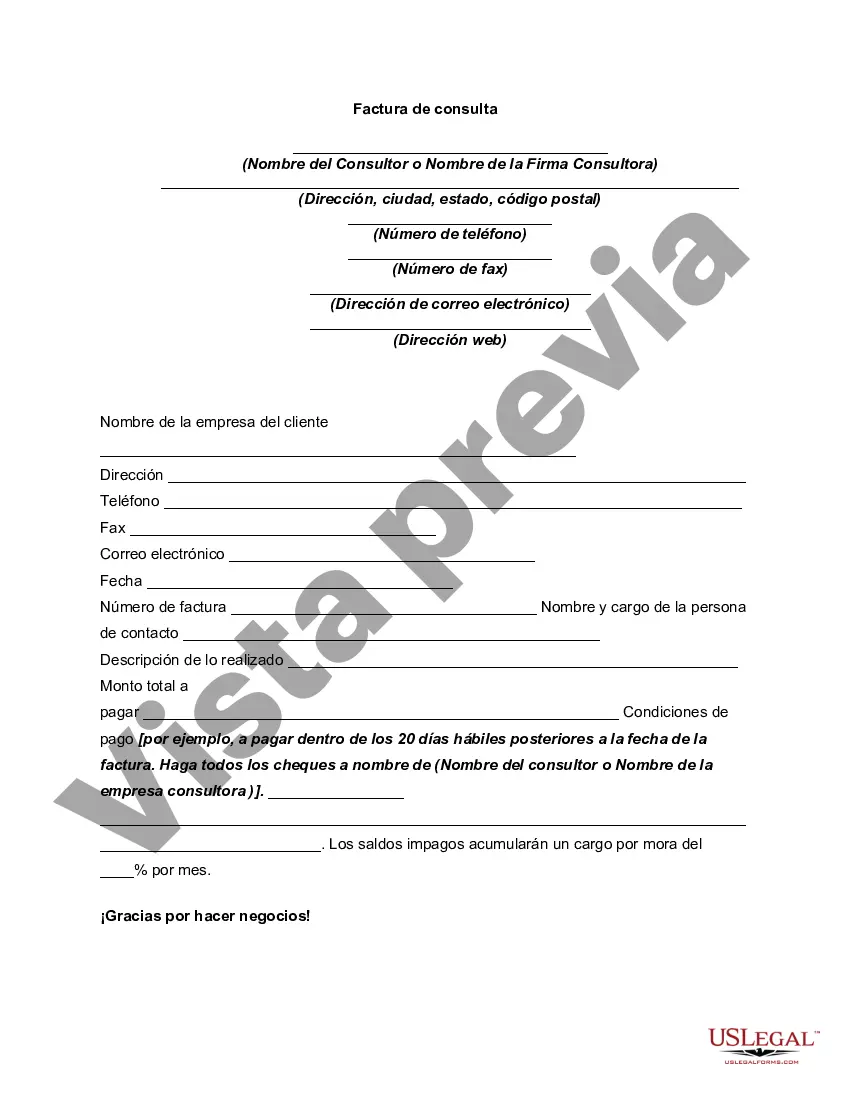

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A San Diego California Consulting Invoice refers to a detailed document that outlines the services rendered by a consulting firm or consultant to a client based in San Diego, California. This invoice serves as a formal request for payment and includes information about the services provided, their corresponding fees, and the payment terms agreed upon by both parties. It is an essential tool in ensuring timely and accurate payment for consulting services provided. The San Diego California Consulting Invoice typically includes the following key details to facilitate smooth financial transactions: 1. Consultant Information: This section includes the name, address, contact details, and any applicable licenses or certifications of the consulting firm or individual consultant. 2. Client Information: The invoice identifies the name, address, and contact details of the client or the organization receiving the consulting services in San Diego, California. 3. Invoice Number and Date: A unique identifier is assigned to each invoice, along with the date it was issued. These details help both parties track the payment and maintain accurate records. 4. Description of Services: It is crucial to clearly outline the consulting services provided, including the scope, duration, and any specific deliverables. A comprehensive description ensures the client understands the value received from the consulting engagement. 5. Fees and Rates: This section specifies the price for each service rendered, the quantity or duration involved, and the total charges incurred. It may also include any applicable taxes, such as sales tax, and any additional expenses or disbursements. 6. Payment Terms: The invoice indicates the payment due date and the preferred method of payment, such as bank transfer, check, or online payment systems. It may also include any late payment penalties or discounts offered for early payment. 7. Terms and Conditions: This section lays out the contractual terms agreed upon by both parties, such as liability limitations, confidentiality requirements, and ownership of intellectual property. 8. Company Logo and Branding: Many consulting firms include their logo, address, and branding elements to personalize the invoice and promote brand recognition. Types of San Diego California Consulting Invoices: 1. Hourly Rate Consulting Invoice: This type of invoice is commonly used when charging clients based on the number of hours spent on providing consulting services. 2. Fixed Fee Consulting Invoice: For projects with a pre-determined scope or fixed deliverables, a fixed fee invoice is issued, indicating a total amount owed for the entire engagement. 3. Expense-based Consulting Invoice: In cases where consultants incur additional expenses on behalf of the client, such as travel costs or material expenses, these are itemized in this invoice type alongside the consulting fees. 4. Retainer Consulting Invoice: For ongoing consulting engagements, a retainer invoice is generated, reflecting the prepared monthly or quarterly retainer fee paid in advance. By utilizing a San Diego California Consulting Invoice, both consultants and clients can maintain financial transparency, ensure proper record-keeping, and facilitate timely payments for the valuable consulting services provided.A San Diego California Consulting Invoice refers to a detailed document that outlines the services rendered by a consulting firm or consultant to a client based in San Diego, California. This invoice serves as a formal request for payment and includes information about the services provided, their corresponding fees, and the payment terms agreed upon by both parties. It is an essential tool in ensuring timely and accurate payment for consulting services provided. The San Diego California Consulting Invoice typically includes the following key details to facilitate smooth financial transactions: 1. Consultant Information: This section includes the name, address, contact details, and any applicable licenses or certifications of the consulting firm or individual consultant. 2. Client Information: The invoice identifies the name, address, and contact details of the client or the organization receiving the consulting services in San Diego, California. 3. Invoice Number and Date: A unique identifier is assigned to each invoice, along with the date it was issued. These details help both parties track the payment and maintain accurate records. 4. Description of Services: It is crucial to clearly outline the consulting services provided, including the scope, duration, and any specific deliverables. A comprehensive description ensures the client understands the value received from the consulting engagement. 5. Fees and Rates: This section specifies the price for each service rendered, the quantity or duration involved, and the total charges incurred. It may also include any applicable taxes, such as sales tax, and any additional expenses or disbursements. 6. Payment Terms: The invoice indicates the payment due date and the preferred method of payment, such as bank transfer, check, or online payment systems. It may also include any late payment penalties or discounts offered for early payment. 7. Terms and Conditions: This section lays out the contractual terms agreed upon by both parties, such as liability limitations, confidentiality requirements, and ownership of intellectual property. 8. Company Logo and Branding: Many consulting firms include their logo, address, and branding elements to personalize the invoice and promote brand recognition. Types of San Diego California Consulting Invoices: 1. Hourly Rate Consulting Invoice: This type of invoice is commonly used when charging clients based on the number of hours spent on providing consulting services. 2. Fixed Fee Consulting Invoice: For projects with a pre-determined scope or fixed deliverables, a fixed fee invoice is issued, indicating a total amount owed for the entire engagement. 3. Expense-based Consulting Invoice: In cases where consultants incur additional expenses on behalf of the client, such as travel costs or material expenses, these are itemized in this invoice type alongside the consulting fees. 4. Retainer Consulting Invoice: For ongoing consulting engagements, a retainer invoice is generated, reflecting the prepared monthly or quarterly retainer fee paid in advance. By utilizing a San Diego California Consulting Invoice, both consultants and clients can maintain financial transparency, ensure proper record-keeping, and facilitate timely payments for the valuable consulting services provided.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.