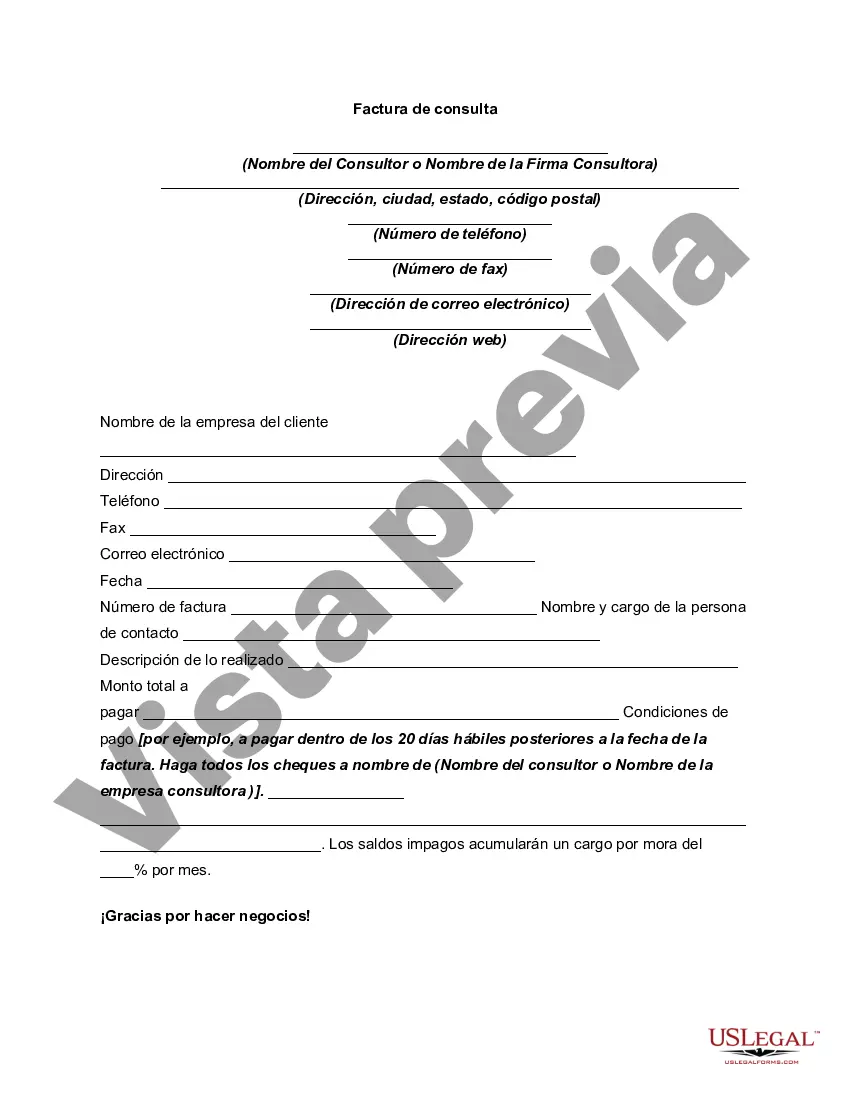

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Travis Texas Consulting Invoice is a professional document issued by Travis Texas Consulting Services to its clients. It provides a detailed breakdown of the services rendered by the consultancy along with the corresponding costs and payment terms. This invoice serves as a formal request for payment for the services provided. The Travis Texas Consulting Invoice typically includes key information such as the company's name, address, and contact details. It also mentions the client's details, including their name, address, and any specific reference or project number for easy identification and tracking. Additionally, the invoice includes an invoice number and issue date, which aids in record-keeping and reference purposes. The invoice itemizes the consulting services provided, clearly describing each service or task along with the associated quantity, rate, and total. This breakdown allows clients to easily understand and verify the charges incurred. The invoice may also include any applicable taxes, such as sales tax or value-added tax (VAT), depending on the jurisdiction. Travis Texas Consulting Invoices may come in various types, depending on the nature of the services provided and the arrangement with the client. Some common types include: 1. Hourly Rate Invoice: This type of invoice is commonly used when the consultancy charges clients based on the number of hours worked on a particular project or task. It reflects the number of hours spent by each consultant, their hourly rate, and the resulting total. 2. Fixed Fee Invoice: If the consultancy charges a prepared fixed fee for a particular project or service, a fixed fee invoice is utilized. It outlines the agreed-upon fee, without detailing the hours or specific tasks involved. 3. Retainer Invoice: This type of invoice is common for ongoing consulting services where the client pays a fixed amount upfront for a specific period, such as a month or quarter. The retainer invoice specifies the retainer fee, number of hours or services covered, and any additional charges, if applicable. 4. Expense Invoice: In some cases, Travis Texas Consulting may incur expenses on behalf of the client, such as travel expenses or purchasing specialized software. An expense invoice details the incurred expenses, providing relevant receipts or supporting documents for each expense, and includes these costs in addition to the consulting services. Regardless of the format or type, Travis Texas Consulting Invoice is designed to be clear, accurate, and transparent, providing all necessary information for the client to process payment efficiently. It is crucial for maintaining a healthy business-client relationship and ensuring timely payment for services rendered.Travis Texas Consulting Invoice is a professional document issued by Travis Texas Consulting Services to its clients. It provides a detailed breakdown of the services rendered by the consultancy along with the corresponding costs and payment terms. This invoice serves as a formal request for payment for the services provided. The Travis Texas Consulting Invoice typically includes key information such as the company's name, address, and contact details. It also mentions the client's details, including their name, address, and any specific reference or project number for easy identification and tracking. Additionally, the invoice includes an invoice number and issue date, which aids in record-keeping and reference purposes. The invoice itemizes the consulting services provided, clearly describing each service or task along with the associated quantity, rate, and total. This breakdown allows clients to easily understand and verify the charges incurred. The invoice may also include any applicable taxes, such as sales tax or value-added tax (VAT), depending on the jurisdiction. Travis Texas Consulting Invoices may come in various types, depending on the nature of the services provided and the arrangement with the client. Some common types include: 1. Hourly Rate Invoice: This type of invoice is commonly used when the consultancy charges clients based on the number of hours worked on a particular project or task. It reflects the number of hours spent by each consultant, their hourly rate, and the resulting total. 2. Fixed Fee Invoice: If the consultancy charges a prepared fixed fee for a particular project or service, a fixed fee invoice is utilized. It outlines the agreed-upon fee, without detailing the hours or specific tasks involved. 3. Retainer Invoice: This type of invoice is common for ongoing consulting services where the client pays a fixed amount upfront for a specific period, such as a month or quarter. The retainer invoice specifies the retainer fee, number of hours or services covered, and any additional charges, if applicable. 4. Expense Invoice: In some cases, Travis Texas Consulting may incur expenses on behalf of the client, such as travel expenses or purchasing specialized software. An expense invoice details the incurred expenses, providing relevant receipts or supporting documents for each expense, and includes these costs in addition to the consulting services. Regardless of the format or type, Travis Texas Consulting Invoice is designed to be clear, accurate, and transparent, providing all necessary information for the client to process payment efficiently. It is crucial for maintaining a healthy business-client relationship and ensuring timely payment for services rendered.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.