Nassau County, located in the state of New York, has specific guidelines and procedures in place for transferring assets to a trust. The Nassau New York Bill of Transfer to a Trust is a legal document that enables individuals to transfer ownership of property or assets to a trust entity. The bill outlines essential details such as the type of trust, the beneficiary or beneficiaries, and the assets being transferred. It serves as a legal record of the transfer and ensures that the property or assets are properly titled under the trust's ownership. There are various types of Nassau New York Bills of Transfer to a Trust that cater to different circumstances: 1. Revocable Living Trust: This type of trust allows individuals to maintain control over their assets during their lifetime while designating beneficiaries to receive those assets upon their passing. The person establishing the trust, referred to as the granter, can amend or revoke the trust at any time. 2. Irrevocable Trust: In contrast to a revocable living trust, an irrevocable trust cannot be altered or revoked once established. This type of trust transfers assets out of the granter's estate, reducing estate taxes and protecting assets from potential creditors. 3. Special Needs Trust: A special needs trust is created to provide for the care and support of individuals with disabilities. This trust allows them to receive assets or assistance without losing eligibility for government benefits. 4. Spendthrift Trust: A spendthrift trust is designed to protect assets from being wasted or irresponsibly managed by the beneficiary. It ensures that the assets are used prudently and provides long-term financial security for the beneficiary. 5. Charitable Trust: This type of trust is established to benefit charitable organizations or causes. It allows individuals to donate assets while generating tax benefits. When creating a Nassau New York Bill of Transfer to a Trust, it is crucial to consult with an experienced attorney specializing in estate planning and trust administration. They can guide individuals through the process, ensuring compliance with all legal requirements and individual intentions. Transferring assets to a trust offers numerous advantages, including asset protection, efficient estate distribution, and potential tax benefits. It is vital to understand the specific type of trust suitable for one's needs and utilize a carefully drafted bill of transfer to ensure a smooth and legally sound transfer process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Factura de transferencia a un fideicomiso - Bill of Transfer to a Trust

Description

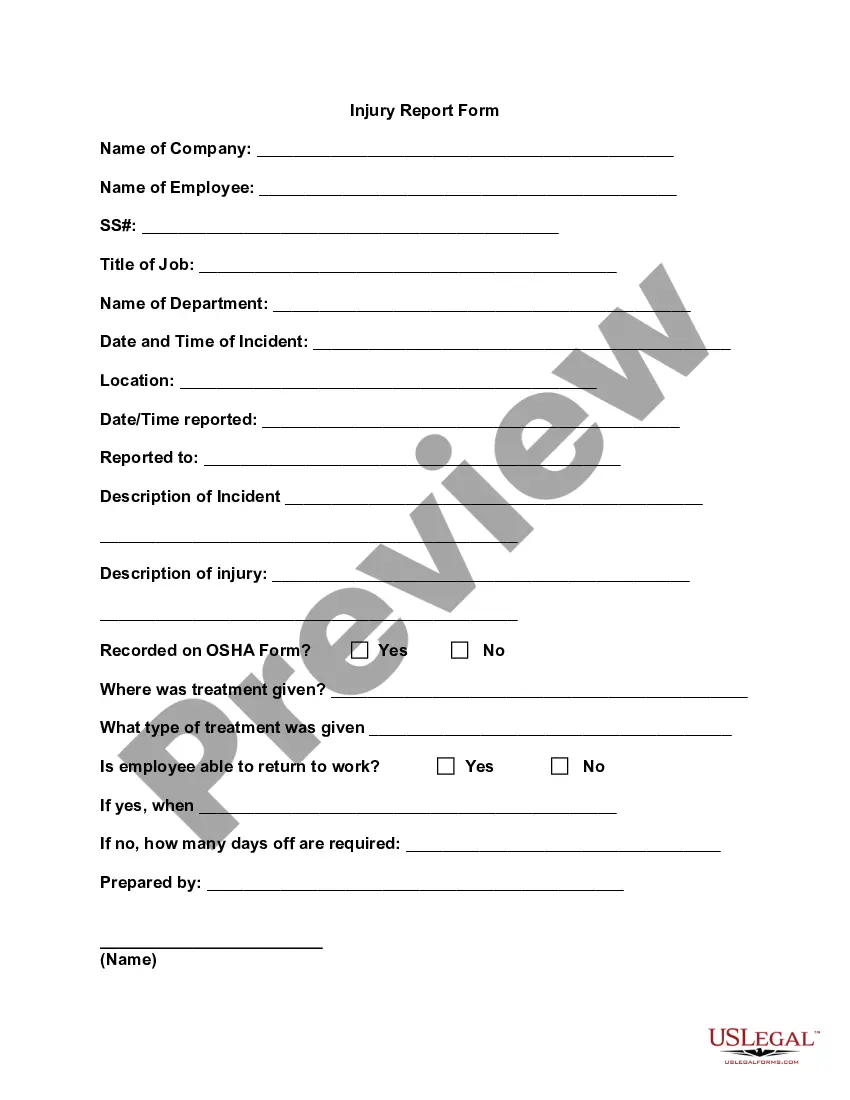

How to fill out Nassau New York Factura De Transferencia A Un Fideicomiso?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

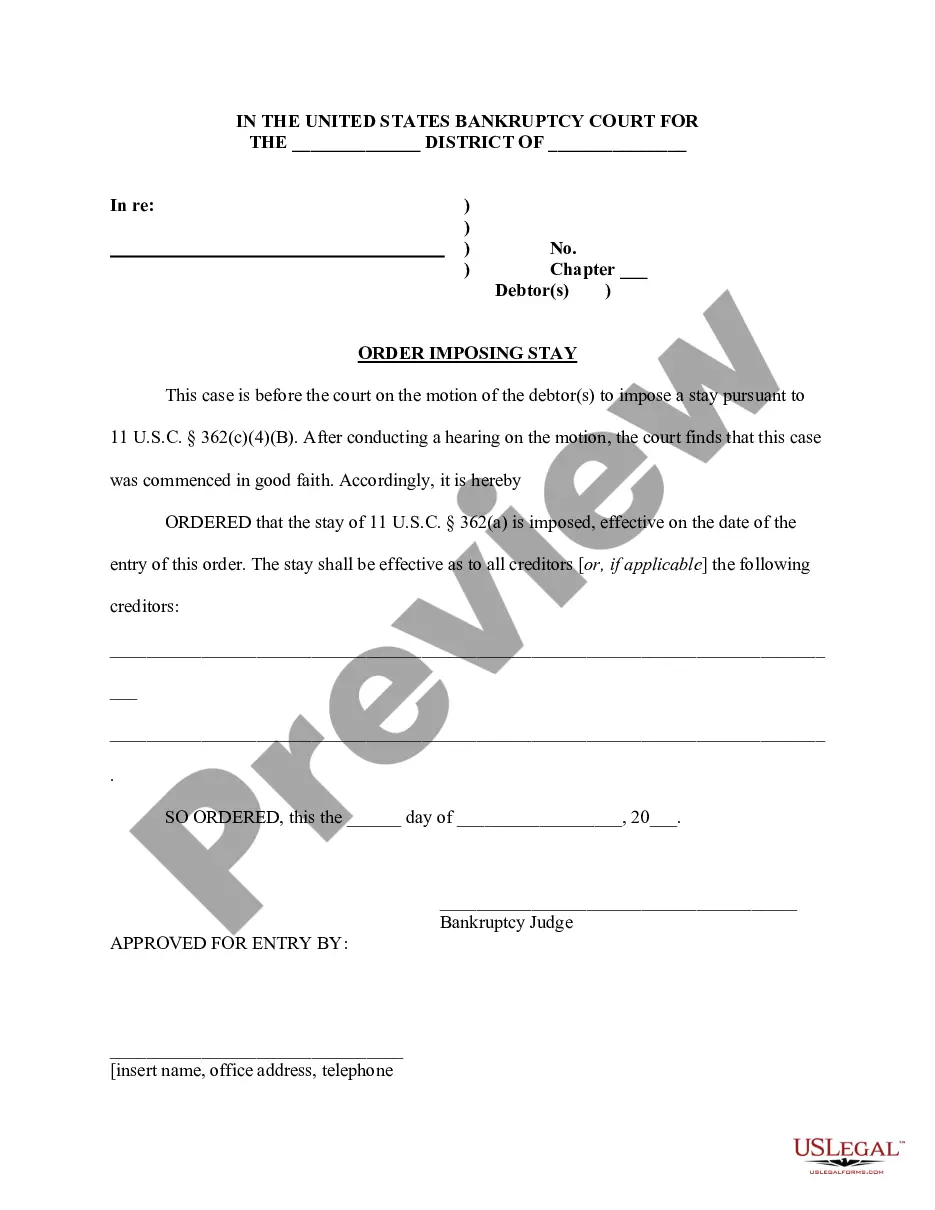

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the Nassau Bill of Transfer to a Trust.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Nassau Bill of Transfer to a Trust will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Nassau Bill of Transfer to a Trust:

- Make sure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Nassau Bill of Transfer to a Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!