The Wayne Michigan Bill of Transfer to a Trust is a legal document that allows individuals to transfer ownership of their assets to a trust. Trusts are commonly created for estate planning purposes to ensure the efficient distribution of assets and to provide for beneficiaries after the owner's death. Here is a detailed description of what the Wayne Michigan Bill of Transfer to a Trust entails and its different types: 1. Wayne Michigan Bill of Transfer to a Revocable Living Trust: The revocable living trust is one of the most common types of trusts used in estate planning. It is created during the individual's lifetime and can be amended or revoked at any time. The Wayne Michigan Bill of Transfer to a Revocable Living Trust allows individuals to transfer the ownership of their assets, such as real estate, bank accounts, investments, and personal property, to the trust. By doing so, the assets are managed by a trustee who follows the instructions outlined in the trust document. 2. Wayne Michigan Bill of Transfer to an Irrevocable Trust: Unlike a revocable living trust, an irrevocable trust cannot be easily modified or revoked once it is established. The Wayne Michigan Bill of Transfer to an Irrevocable Trust transfers ownership of assets to the trust, which provides certain tax benefits and asset protection. The assets placed in an irrevocable trust are no longer considered part of the individual's estate, which can have tax advantages and protect against creditors or lawsuits. 3. Wayne Michigan Bill of Transfer for Real Estate to a Trust: This type of bill of transfer specifically deals with the transfer of ownership of real estate to a trust. Real estate is often one of the most significant assets individuals own, and transferring it to a trust can provide numerous benefits, such as avoiding probate, reducing estate taxes, and ensuring a smooth transfer of property to beneficiaries upon the owner's death. 4. Wayne Michigan Bill of Transfer for Personal Property to a Trust: The Wayne Michigan Bill of Transfer for Personal Property to a Trust allows individuals to transfer ownership of their personal belongings, such as vehicles, artwork, jewelry, furniture, and other valuable items, to a trust. In addition to ensuring the smooth distribution of personal property after death, transferring personal items to a trust can also help simplify the estate administration process. In conclusion, the Wayne Michigan Bill of Transfer to a Trust is a vital legal document that allows individuals to transfer ownership of their assets to a trust for estate planning purposes. Whether it is a revocable living trust, an irrevocable trust, a transfer for real estate, or personal property, the bill of transfer ensures the assets are managed and distributed according to the individual's wishes. Consulting with an experienced attorney is crucial when considering the creation of a trust and executing the corresponding Wayne Michigan Bill of Transfer to a Trust document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Factura de transferencia a un fideicomiso - Bill of Transfer to a Trust

Description

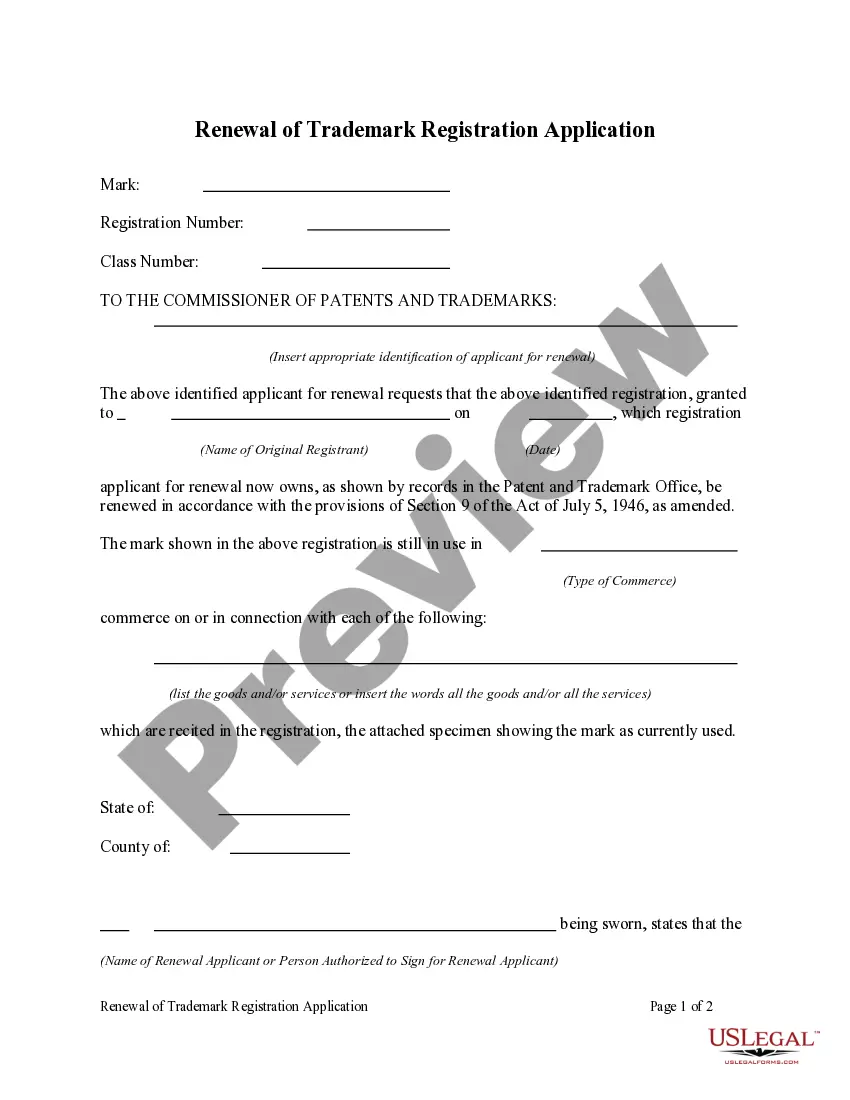

How to fill out Wayne Michigan Factura De Transferencia A Un Fideicomiso?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Wayne Bill of Transfer to a Trust, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the latest version of the Wayne Bill of Transfer to a Trust, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Wayne Bill of Transfer to a Trust:

- Glance through the page and verify there is a sample for your area.

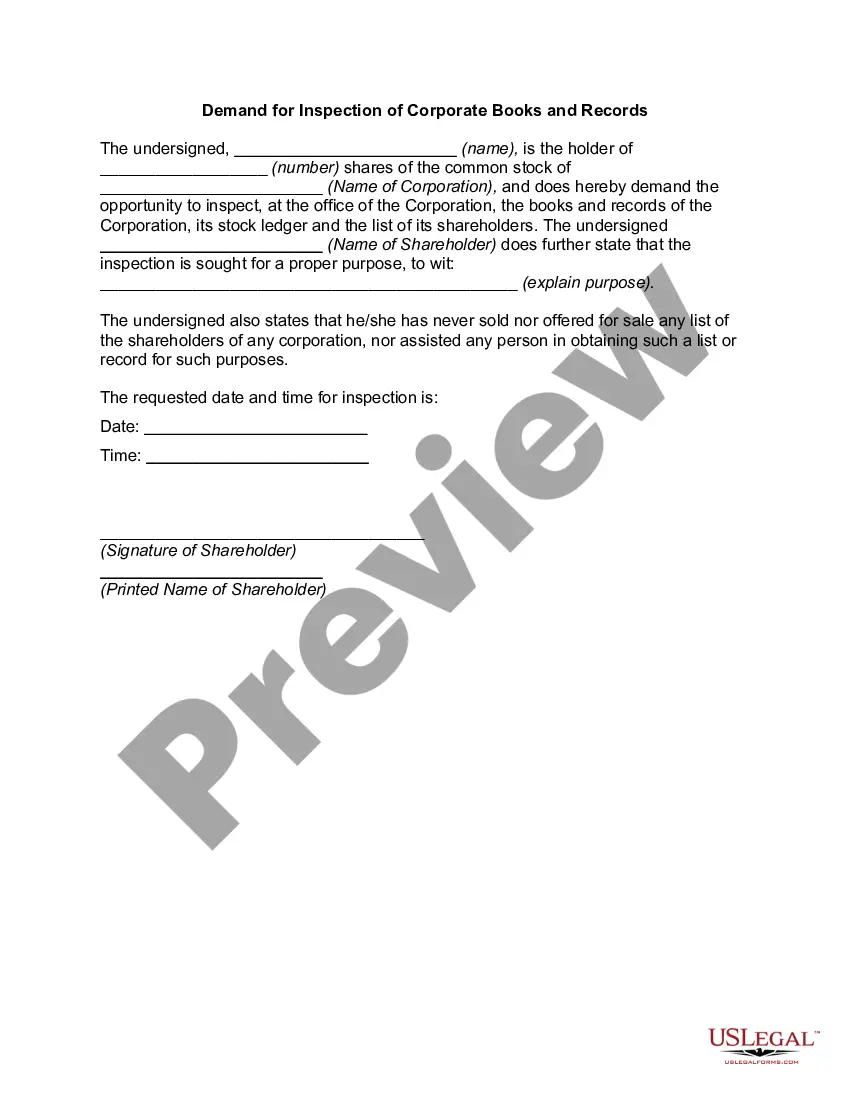

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Wayne Bill of Transfer to a Trust and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Los fideicomisos le permiten al otorgante controlar las propiedades, aun despues de su muerte. Los fideicomisos proporcionan privacidadson contratos discretos entre dos partes que raramente son partes del registro publico. Los fideicomisos pueden funcionar para eliminar la necesidad de tutores.

El pais esta mas expuesto que antes a una crisis de las finanzas federales que pueda afectar el equilibrio macroeconomico. Al 30 de junio de 2021, SHCP reporto que cuenta con 301 fideicomisos, mandatos y actos juridicos analogos sin estructura organica, los cuales suman un saldo de 508.4 mmdp.

Es un contrato mediante el cual una persona fisica o moral, nacional o extranjera; afecta ciertos bienes o derechos para un fin licito y determinado, en beneficio propio o de un tercero, encomendando la realizacion de dicho fin a una institucion fiduciaria.

Existen varias razones por las que los fideicomisos son una buena alternativa para asegurar la correcta administracion de tus bienes en el futuro: Proteges tus activos de las malas intenciones.Cuidas a tus seres queridos.Resguardas tus activos.Puedes definir un plan para que tus activos generen rentas.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Los fideicomisos le permiten al otorgante controlar las propiedades, aun despues de su muerte. Los fideicomisos proporcionan privacidadson contratos discretos entre dos partes que raramente son partes del registro publico. Los fideicomisos pueden funcionar para eliminar la necesidad de tutores.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.

El Fideicomitente trasmite la propiedad del patrimonio al FIDUCIARIO, por lo que este ultimo se vuelve el PROPIETARIO. Los activos del fideicomiso dejan de pertenecer a la persona que los origina y quedan afectados exclusivamente al fin preestablecido en el contrato.

Clases de Fideicomisos En Garantia. Inmobiliarios. Administracion o Inversion. Translativos de Propiedad. Testamentarios. Publico. Financiero. Financiero Inmobiliario.

UN FIDEICOMISO ES: Una operacion mercantil mediante la cual una persona -fisica o moral- llamada fideicomitente, destina ciertos bienes a la realizacion de un fin licito determinado, encomendando esta a una Institucion de Credito (Art. 381 de la Ley General de Titulos y Operaciones de Credito).