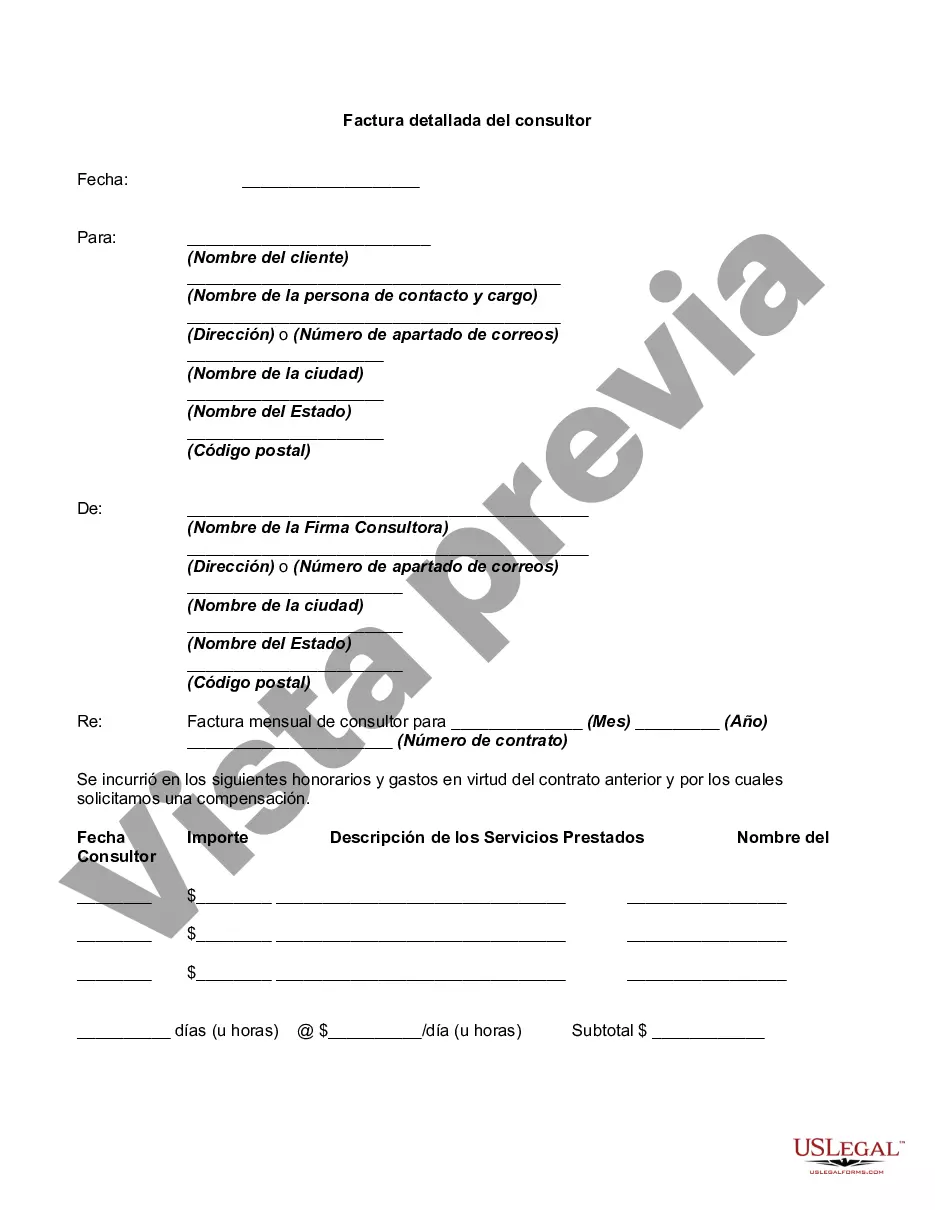

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Santa Clara California Detailed Consultant Invoice is a comprehensive and itemized document that outlines the services provided by a consultant located in Santa Clara, California. This type of invoice serves as a detailed record of the services rendered, ensuring transparency and facilitating efficient payment processing. The invoice is typically generated by a professional consultant or consultancy firm offering specialized expertise in various fields, such as technology, marketing, finance, human resources, or management. A typical Santa Clara California Detailed Consultant Invoice includes the following components: 1. Contact Information: The invoice begins with the consultant's contact details, including the name, address, phone number, and email. 2. Client Information: This section includes the client's details, such as their name, company name, address, and contact information. It is important to accurately communicate this information for proper identification and billing purposes. 3. Invoice Number and Date: Each invoice is assigned a unique identification number and features the date it was issued. This assists in tracking payments and streamlining administrative tasks. 4. Detailed Services: This is the most crucial part of the invoice and highlights the specific services provided by the consultant. Each service is listed individually, along with a brief description, the total hours or units worked, the hourly rate (if applicable), and the subtotal for each service. This level of detail helps clients understand the value they are receiving and can be utilized for reference or dispute resolution if needed. 5. Expenses: Consultants may include any additional expenses incurred during the course of their work, such as travel expenses, accommodation, or specific materials required for the project. These expenses are listed separately, with a description and the corresponding cost. 6. Taxes and Total Amount: Any applicable taxes or sales tax rates are calculated and added to the subtotal. The overall total amount owed is then clearly displayed, including all services rendered and incurred expenses. 7. Payment Terms and Methods: The invoice should specify the payment terms, such as the due date, late payment penalties (if applicable), and accepted payment methods (e.g., check, electronic funds transfer, credit card). Types of Santa Clara California Detailed Consultant Invoices: 1. Technology Consultant Invoice: This type of invoice is relevant to consultants specializing in IT services, software development, or computer systems implementation and maintenance. 2. Marketing Consultant Invoice: Consultants offering marketing services, including market research, social media management, or advertising campaigns, use this invoice type. 3. Financial Consultant Invoice: Financial advisors, accountants, or tax consultants generate this invoice when providing services related to financial planning, investment analysis, or tax preparation. 4. Human Resources Consultant Invoice: This type of invoice is used by consultants who provide HR support, such as talent acquisition, employee training, or compliance audits. 5. Management Consultant Invoice: Management consultants create this invoice when delivering services related to organizational strategy, process improvement, or change management. By employing a Santa Clara California Detailed Consultant Invoice, both the consultant and the client can maintain a clear and comprehensive record of the services provided, creating a strong basis for payment processing and building trust within the business relationship.A Santa Clara California Detailed Consultant Invoice is a comprehensive and itemized document that outlines the services provided by a consultant located in Santa Clara, California. This type of invoice serves as a detailed record of the services rendered, ensuring transparency and facilitating efficient payment processing. The invoice is typically generated by a professional consultant or consultancy firm offering specialized expertise in various fields, such as technology, marketing, finance, human resources, or management. A typical Santa Clara California Detailed Consultant Invoice includes the following components: 1. Contact Information: The invoice begins with the consultant's contact details, including the name, address, phone number, and email. 2. Client Information: This section includes the client's details, such as their name, company name, address, and contact information. It is important to accurately communicate this information for proper identification and billing purposes. 3. Invoice Number and Date: Each invoice is assigned a unique identification number and features the date it was issued. This assists in tracking payments and streamlining administrative tasks. 4. Detailed Services: This is the most crucial part of the invoice and highlights the specific services provided by the consultant. Each service is listed individually, along with a brief description, the total hours or units worked, the hourly rate (if applicable), and the subtotal for each service. This level of detail helps clients understand the value they are receiving and can be utilized for reference or dispute resolution if needed. 5. Expenses: Consultants may include any additional expenses incurred during the course of their work, such as travel expenses, accommodation, or specific materials required for the project. These expenses are listed separately, with a description and the corresponding cost. 6. Taxes and Total Amount: Any applicable taxes or sales tax rates are calculated and added to the subtotal. The overall total amount owed is then clearly displayed, including all services rendered and incurred expenses. 7. Payment Terms and Methods: The invoice should specify the payment terms, such as the due date, late payment penalties (if applicable), and accepted payment methods (e.g., check, electronic funds transfer, credit card). Types of Santa Clara California Detailed Consultant Invoices: 1. Technology Consultant Invoice: This type of invoice is relevant to consultants specializing in IT services, software development, or computer systems implementation and maintenance. 2. Marketing Consultant Invoice: Consultants offering marketing services, including market research, social media management, or advertising campaigns, use this invoice type. 3. Financial Consultant Invoice: Financial advisors, accountants, or tax consultants generate this invoice when providing services related to financial planning, investment analysis, or tax preparation. 4. Human Resources Consultant Invoice: This type of invoice is used by consultants who provide HR support, such as talent acquisition, employee training, or compliance audits. 5. Management Consultant Invoice: Management consultants create this invoice when delivering services related to organizational strategy, process improvement, or change management. By employing a Santa Clara California Detailed Consultant Invoice, both the consultant and the client can maintain a clear and comprehensive record of the services provided, creating a strong basis for payment processing and building trust within the business relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.