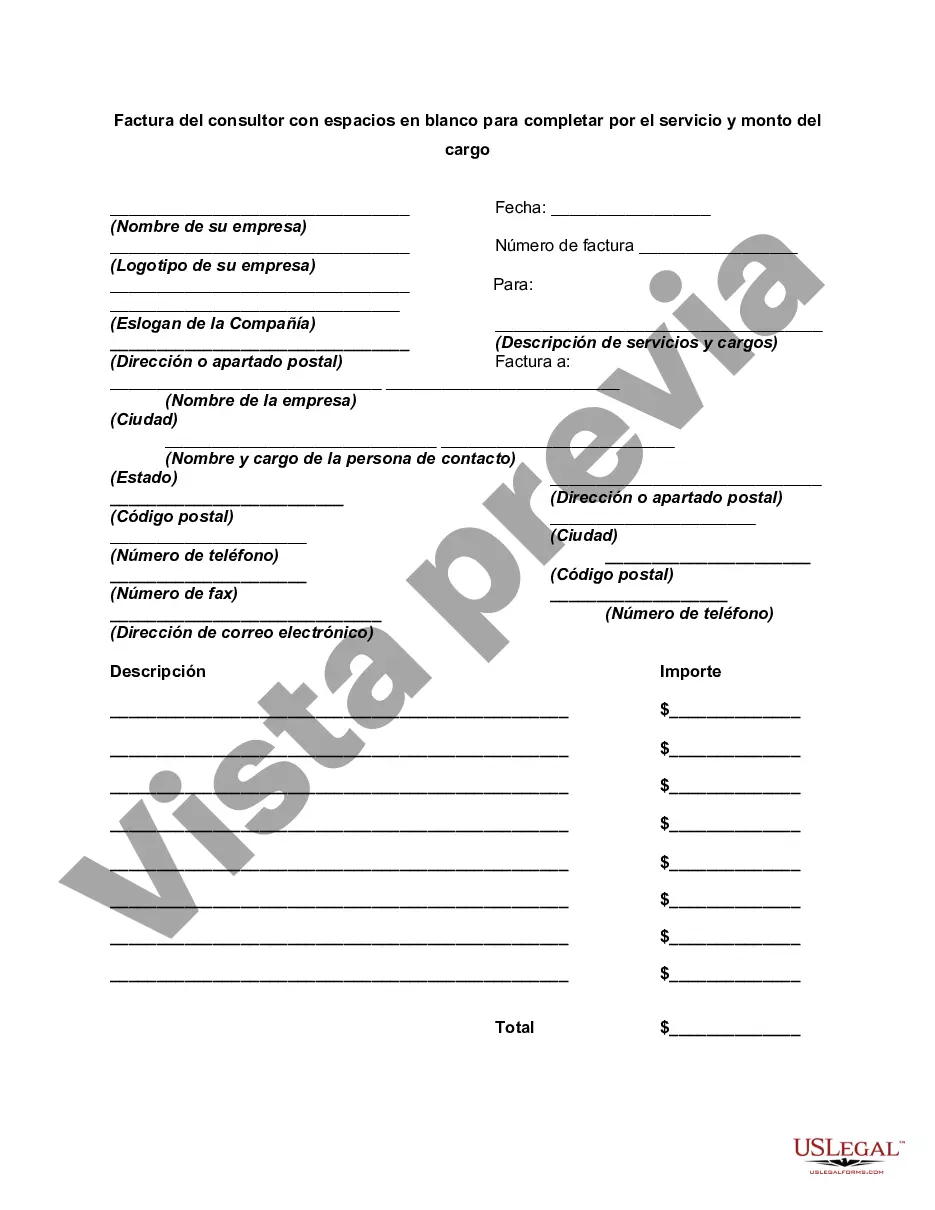

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose California Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge: An invoice is a crucial document used in business transactions that outlines the services rendered by a consultant and the corresponding charges. San Jose, California, being the hub of technological innovation and entrepreneurship, is home to a plethora of consultants offering their expertise across various industries. These consultants cater to businesses seeking specialized guidance and support to thrive in a highly competitive market. Invoices in San Jose, California, typically follow a standardized format, encompassing essential details and adhering to legal requirements. The primary purpose of an invoice is to provide a comprehensive breakdown of services rendered and the corresponding charges to ensure transparency and facilitate seamless financial transactions between the consultant and the recipient. The invoice template used in San Jose, California, usually consists of several key components. These include: 1. Consultant Details: The top section of the invoice contains relevant information about the consultant, including their name, address, contact details, and any associated identification numbers, such as their business license or tax identification number. 2. Client Details: The next section is reserved for the client's information, including their name, address, and contact details. This ensures accurate record-keeping and enables easy identification of the recipient. 3. Invoice Number and Date: Each invoice is assigned a unique invoice number, allowing for easy tracking and referencing in subsequent correspondence or payment discussions. The invoice also includes the date it was issued to establish the timeline of the transaction. 4. Itemized Services: This section provides a detailed breakdown of the services provided by the consultant. It typically comprises a list of specific tasks or deliverables, accompanied by a brief description to ensure clarity. Each service is assigned a numerical or alphanumeric code, which facilitates efficient invoicing and bookkeeping. 5. Quantity and Rate: For each service listed, the invoice includes the quantity or duration of the service rendered and the corresponding rate or hourly fee agreed upon between the consultant and the client. 6. Subtotal and Taxes: The subtotal is calculated by multiplying the quantity or duration of each service by its respective rate. In San Jose, California, the applicable taxes, such as sales tax or service tax, are added to the subtotal to determine the total amount due. 7. Payment Terms and Methods: The invoice should clearly outline the payment terms, including the due date and accepted payment methods. This information ensures that both parties are aware of the expectations regarding timely payment and the available payment options. Different types of San Jose California Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge may include: 1. Professional Services Invoice: This type of invoice is used when a consultant provides specialized professional services, such as legal advice, accounting services, marketing consultation, or IT consulting. 2. Project-Based Invoice: In cases where a consultant is engaged for a specific project, a project-based invoice may be used. This invoice highlights the project details, milestones, and the corresponding charges for each phase or deliverable. 3. Hourly Rate Invoice: Consultants who charge their clients based on an hourly rate would utilize this type of invoice. It entails documenting the number of hours worked, including a breakdown of tasks performed during each hour, along with the corresponding charge per hour. 4. Retainer Invoice: Some consultants work on a retainer basis, where clients pay a fixed fee upfront to secure the consultant's services over a specific period. The retainer invoice outlines the retainer fee, the duration it covers, and any additional charges for services rendered beyond the retainer scope. 5. Subscription-based Invoice: This type of invoice is used when consultants offer subscription-based services, such as ongoing marketing management or IT support. The invoice indicates the subscription details, including the billing cycle, fees, and any additional charges based on usage or add-on services. In conclusion, San Jose, California invoices of consultants play a crucial role in transparently documenting services rendered and charges incurred. By providing essential details and adhering to legal requirements, these invoices facilitate efficient financial transactions, ensuring a fair and satisfactory relationship between the consultant and the client.San Jose California Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge: An invoice is a crucial document used in business transactions that outlines the services rendered by a consultant and the corresponding charges. San Jose, California, being the hub of technological innovation and entrepreneurship, is home to a plethora of consultants offering their expertise across various industries. These consultants cater to businesses seeking specialized guidance and support to thrive in a highly competitive market. Invoices in San Jose, California, typically follow a standardized format, encompassing essential details and adhering to legal requirements. The primary purpose of an invoice is to provide a comprehensive breakdown of services rendered and the corresponding charges to ensure transparency and facilitate seamless financial transactions between the consultant and the recipient. The invoice template used in San Jose, California, usually consists of several key components. These include: 1. Consultant Details: The top section of the invoice contains relevant information about the consultant, including their name, address, contact details, and any associated identification numbers, such as their business license or tax identification number. 2. Client Details: The next section is reserved for the client's information, including their name, address, and contact details. This ensures accurate record-keeping and enables easy identification of the recipient. 3. Invoice Number and Date: Each invoice is assigned a unique invoice number, allowing for easy tracking and referencing in subsequent correspondence or payment discussions. The invoice also includes the date it was issued to establish the timeline of the transaction. 4. Itemized Services: This section provides a detailed breakdown of the services provided by the consultant. It typically comprises a list of specific tasks or deliverables, accompanied by a brief description to ensure clarity. Each service is assigned a numerical or alphanumeric code, which facilitates efficient invoicing and bookkeeping. 5. Quantity and Rate: For each service listed, the invoice includes the quantity or duration of the service rendered and the corresponding rate or hourly fee agreed upon between the consultant and the client. 6. Subtotal and Taxes: The subtotal is calculated by multiplying the quantity or duration of each service by its respective rate. In San Jose, California, the applicable taxes, such as sales tax or service tax, are added to the subtotal to determine the total amount due. 7. Payment Terms and Methods: The invoice should clearly outline the payment terms, including the due date and accepted payment methods. This information ensures that both parties are aware of the expectations regarding timely payment and the available payment options. Different types of San Jose California Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge may include: 1. Professional Services Invoice: This type of invoice is used when a consultant provides specialized professional services, such as legal advice, accounting services, marketing consultation, or IT consulting. 2. Project-Based Invoice: In cases where a consultant is engaged for a specific project, a project-based invoice may be used. This invoice highlights the project details, milestones, and the corresponding charges for each phase or deliverable. 3. Hourly Rate Invoice: Consultants who charge their clients based on an hourly rate would utilize this type of invoice. It entails documenting the number of hours worked, including a breakdown of tasks performed during each hour, along with the corresponding charge per hour. 4. Retainer Invoice: Some consultants work on a retainer basis, where clients pay a fixed fee upfront to secure the consultant's services over a specific period. The retainer invoice outlines the retainer fee, the duration it covers, and any additional charges for services rendered beyond the retainer scope. 5. Subscription-based Invoice: This type of invoice is used when consultants offer subscription-based services, such as ongoing marketing management or IT support. The invoice indicates the subscription details, including the billing cycle, fees, and any additional charges based on usage or add-on services. In conclusion, San Jose, California invoices of consultants play a crucial role in transparently documenting services rendered and charges incurred. By providing essential details and adhering to legal requirements, these invoices facilitate efficient financial transactions, ensuring a fair and satisfactory relationship between the consultant and the client.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.