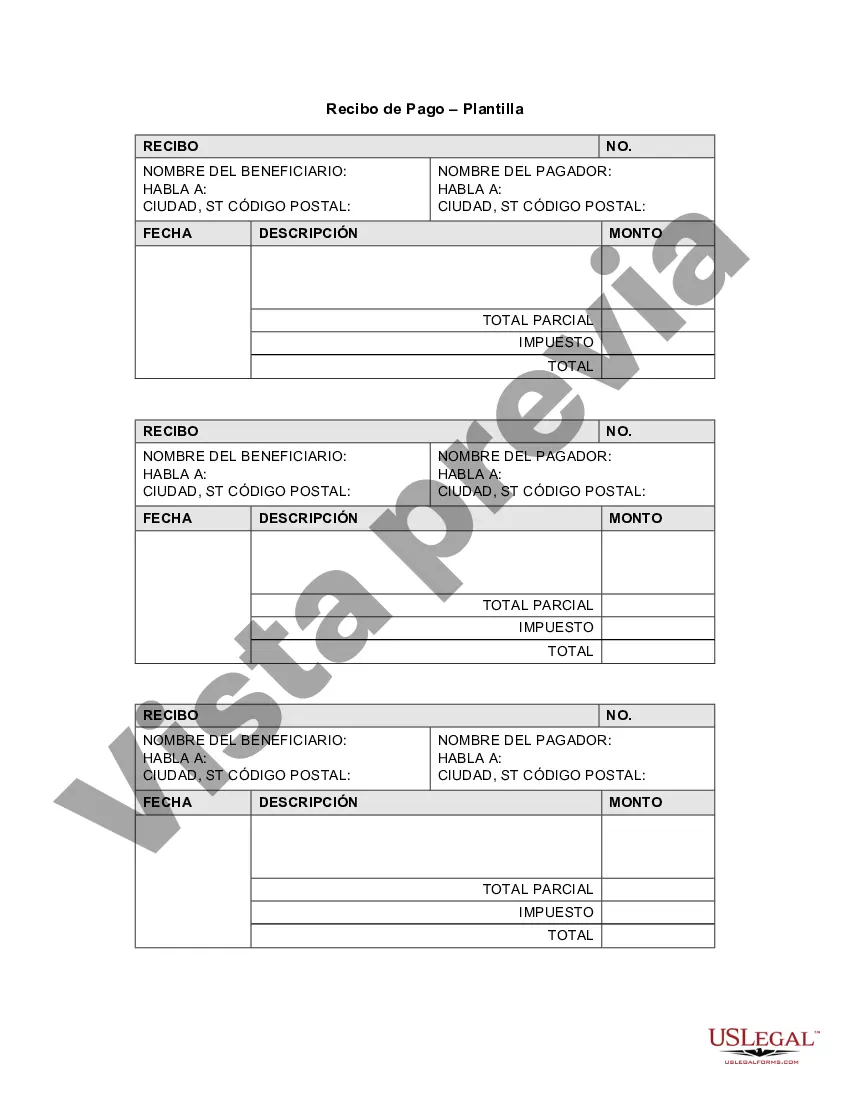

Fulton Georgia Receipt Template for Small Business is a customizable and user-friendly document that serves as evidence of a financial transaction between a buyer and a seller. This template is specifically tailored for small businesses operating in Fulton County, Georgia, and is designed to meet the specific legal and accounting requirements of the region. The Fulton Georgia Receipt Template for Small Business is an essential tool for recording sales, providing customers with proof of purchase, and maintaining accurate financial records. This template typically includes key information such as the date and time of the transaction, the names and contact details of both the buyer and the seller, the items or services purchased, the quantity, unit price, and the total amount paid. By utilizing this receipt template, small businesses in Fulton County can better track their sales, calculate taxes, and streamline their accounting processes. It enables businesses to maintain proper documentation for auditing purposes and helps in ensuring compliance with state and local regulations. Different types of Fulton Georgia Receipt Templates for Small Business may include: 1. Basic Receipt Template: Includes essential fields such as transaction date, buyer and seller information, itemized list of products/services, and total amount paid. It is suitable for businesses with straightforward transactions. 2. Invoice Receipt Template: Combines the features of an invoice and a receipt. It includes additional fields such as payment terms, due dates, and billing information. This template is useful for businesses that provide services and require detailed documentation for billing purposes. 3. Sales Receipt Template: Particularly beneficial for businesses engaged in retail or e-commerce, this template includes fields like product descriptions, SKU numbers, quantities, and prices. It allows businesses to efficiently monitor inventory and analyze sales patterns. 4. Credit Receipt Template: This template is used when refunding or crediting a customer for returned goods or canceled services. It includes fields for the reason for the credit, original transaction details, and the amount credited back to the customer. It helps businesses maintain transparency and customer satisfaction. 5. Tax Receipt Template: Designed to calculate and display taxes separately, this template aids businesses in complying with tax regulations. It includes fields for tax rates, tax amount, and exemptions, ensuring accurate tax reporting and reducing the chances of errors. Overall, the Fulton Georgia Receipt Template for Small Business provides small businesses in Fulton County with a methodical and professional way of documenting transactions, enhancing financial management, and facilitating efficient business operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Plantilla de recibo para pequeñas empresas - Receipt Template for Small Business

Description

How to fill out Fulton Georgia Plantilla De Recibo Para Pequeñas Empresas?

If you need to find a trustworthy legal document supplier to obtain the Fulton Receipt Template for Small Business, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support make it easy to get and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to look for or browse Fulton Receipt Template for Small Business, either by a keyword or by the state/county the document is created for. After locating needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Fulton Receipt Template for Small Business template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less costly and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or execute the Fulton Receipt Template for Small Business - all from the convenience of your sofa.

Sign up for US Legal Forms now!