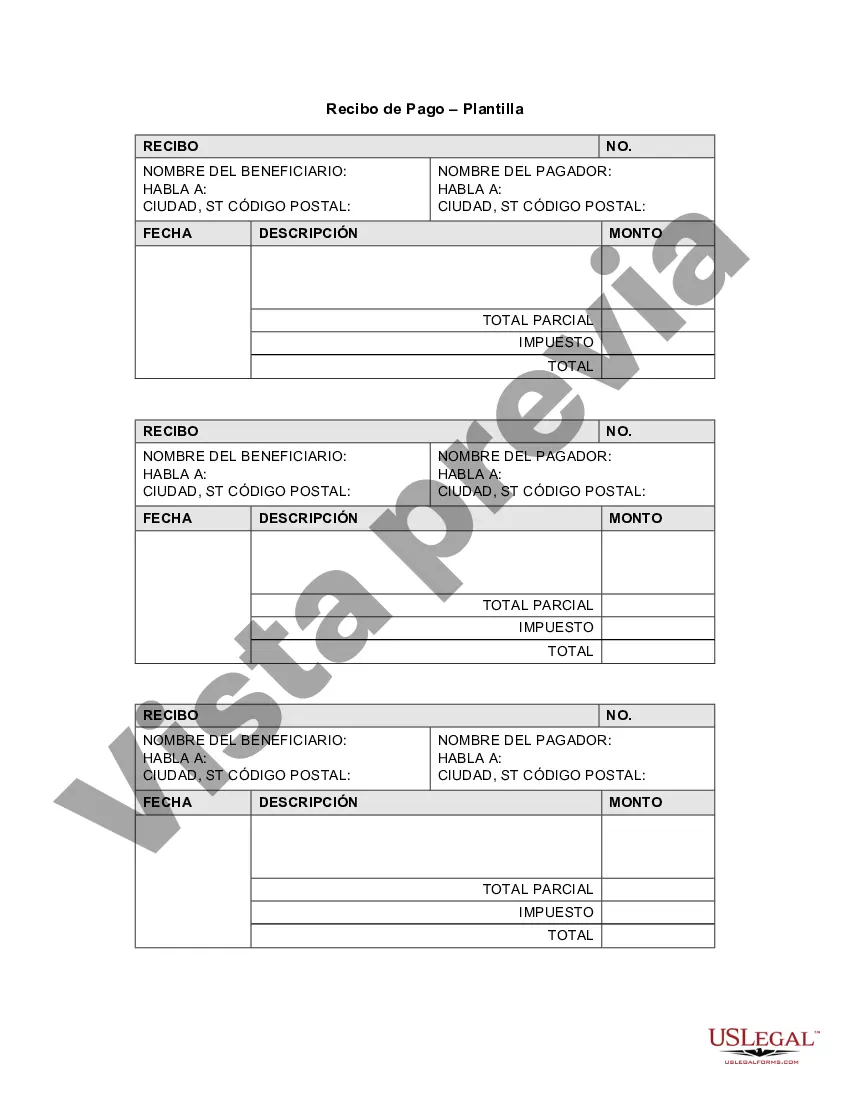

Harris Texas Receipt Template for Small Business: A Comprehensive Guide Introduction: A Harris Texas receipt template for small businesses is an essential tool for accurately documenting financial transactions between a business and its customers. It serves as proof of purchase and enables both parties to keep track of sales, payments, and other pertinent information. This guide aims to provide a detailed description of Harris Texas receipt templates for small businesses, explaining their importance, key elements, and different types available. Importance of Harris Texas Receipt Templates for Small Businesses: 1. Legal Compliance: Using a receipt template ensures that your small business meets the legal requirements set by the state of Texas and the Harris County authorities for record-keeping purposes. 2. Financial Accuracy: These templates help maintain accurate financial records, facilitating the reconciliation of sales revenue with payment collections and minimizing any potential errors or discrepancies. 3. Customer Satisfaction: Providing well-designed receipts gives your customers a professional impression of your business, enhances their trust, and can serve as a reference for potential returns or warranty claims. 4. Tax Documentation: Receipt templates assist in easily tracking and reporting taxable income, simplifying your tax filing process and promoting compliance with tax regulations. Key Elements of a Harris Texas Receipt Template for Small Businesses: 1. Business Information: Include your business name, address, phone number, and other contact details. 2. Customer Information: Include the customer's name, address, and contact details for identification purposes and ease of communication. 3. Receipt Number: Assign a unique number to each receipt for easy organization and reference. 4. Date and Time: Clearly mention the date and time of the transaction to establish a timeline and reference point. 5. Description of Goods or Services: Provide a detailed description of each product or service purchased, including quantities, unit prices, and any applicable taxes or discounts. 6. Total Amount: Calculate and display the total amount paid, including the sum of all items, taxes, and deductions. 7. Payment Method: Specify the payment method used (cash, credit card, check, etc.) and record relevant details such as card numbers or check references. 8. Business Logo: Incorporate your business logo to add a professional touch and reinforce brand identity. Different Types of Harris Texas Receipt Templates for Small Businesses: 1. Standard Receipt Template: This is a basic template suitable for most small businesses. It includes key elements such as business information, customer details, description of goods or services, and payment information. 2. Itemized Receipt Template: Ideal for businesses that deal with multiple products or services, this template provides a detailed breakdown of each item purchased, ensuring transparency and easy reference. 3. Digital Receipt Template: With the rise of online businesses, a digital receipt template allows businesses to provide electronic receipts via email or electronic payment platforms, saving paper and providing convenience for both customers and businesses. 4. Rental Receipt Template: Designed specifically for businesses involved in the rental industry, this template includes fields to document rental periods, security deposits, and any additional fees associated with the transaction. In conclusion, a Harris Texas receipt template for small businesses is an essential tool for legal compliance, financial accuracy, customer satisfaction, and tax documentation. By incorporating all relevant and necessary information, these templates help small businesses streamline their financial operations and maintain organized records. Choose the type of template that aligns with your business requirements and enjoy the benefits of efficient receipt management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Plantilla de recibo para pequeñas empresas - Receipt Template for Small Business

Description

How to fill out Harris Texas Plantilla De Recibo Para Pequeñas Empresas?

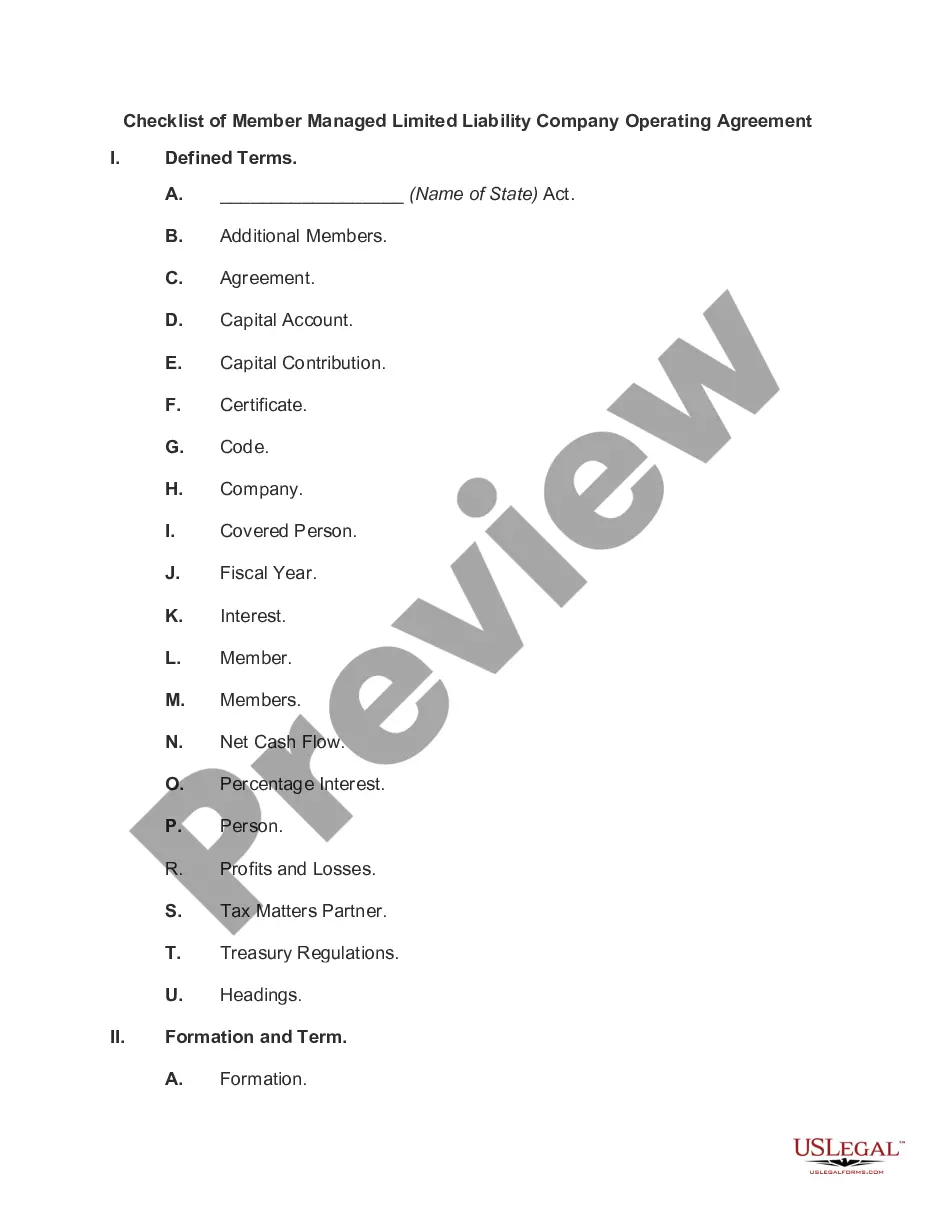

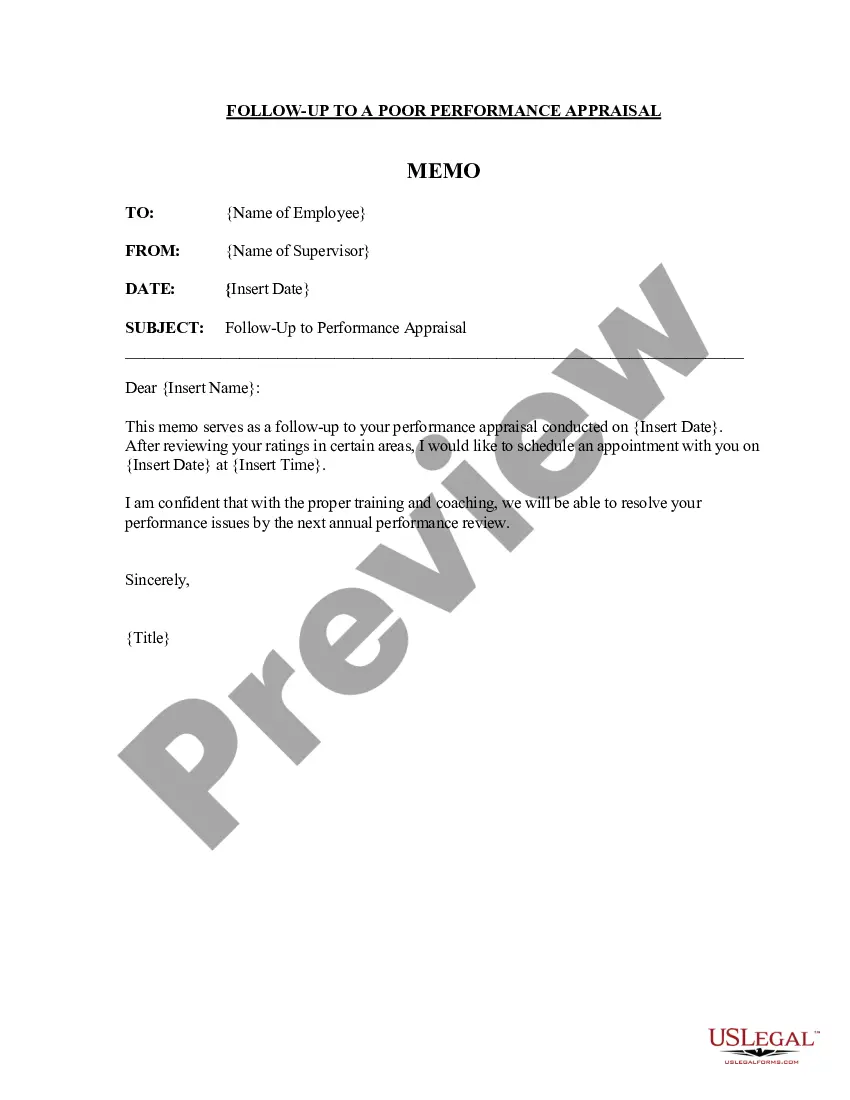

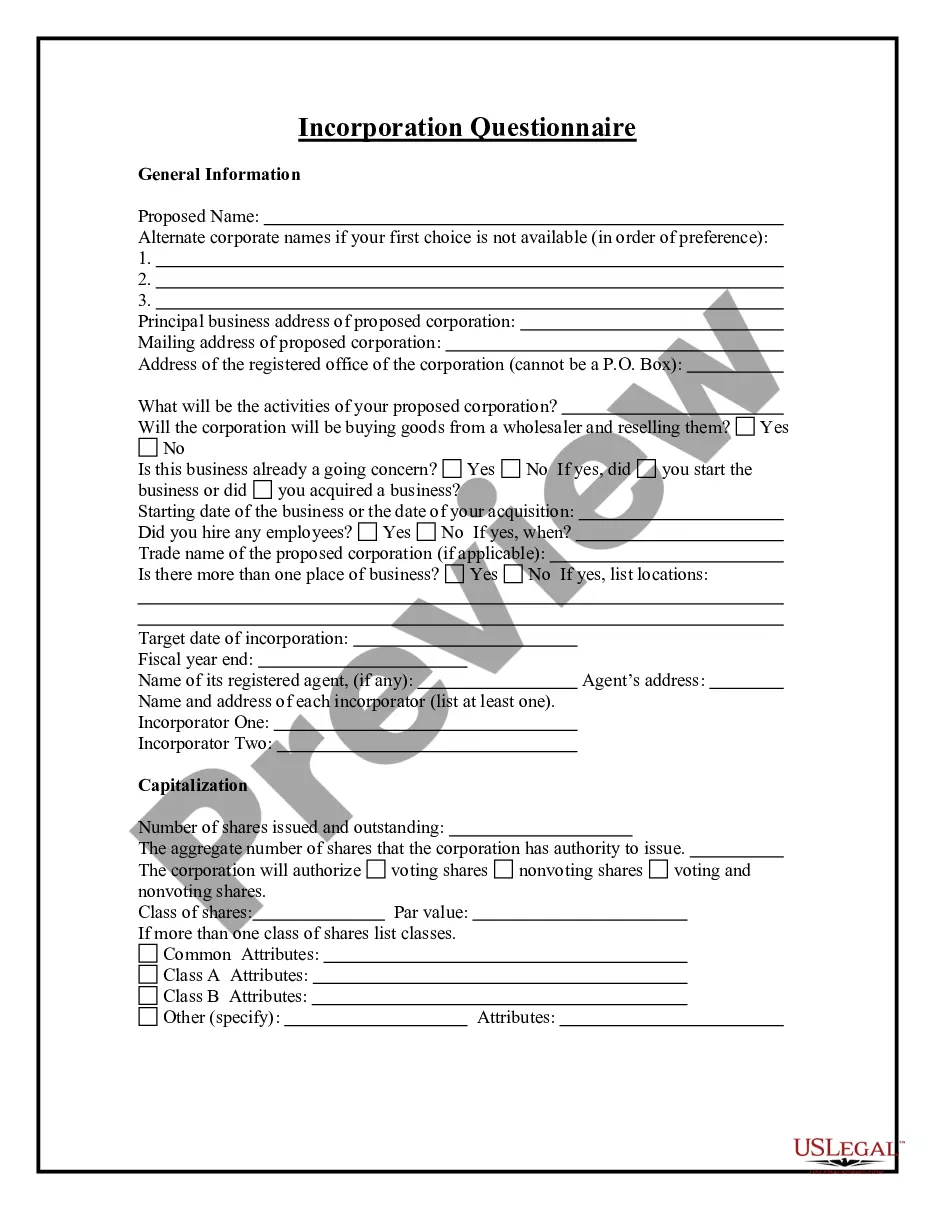

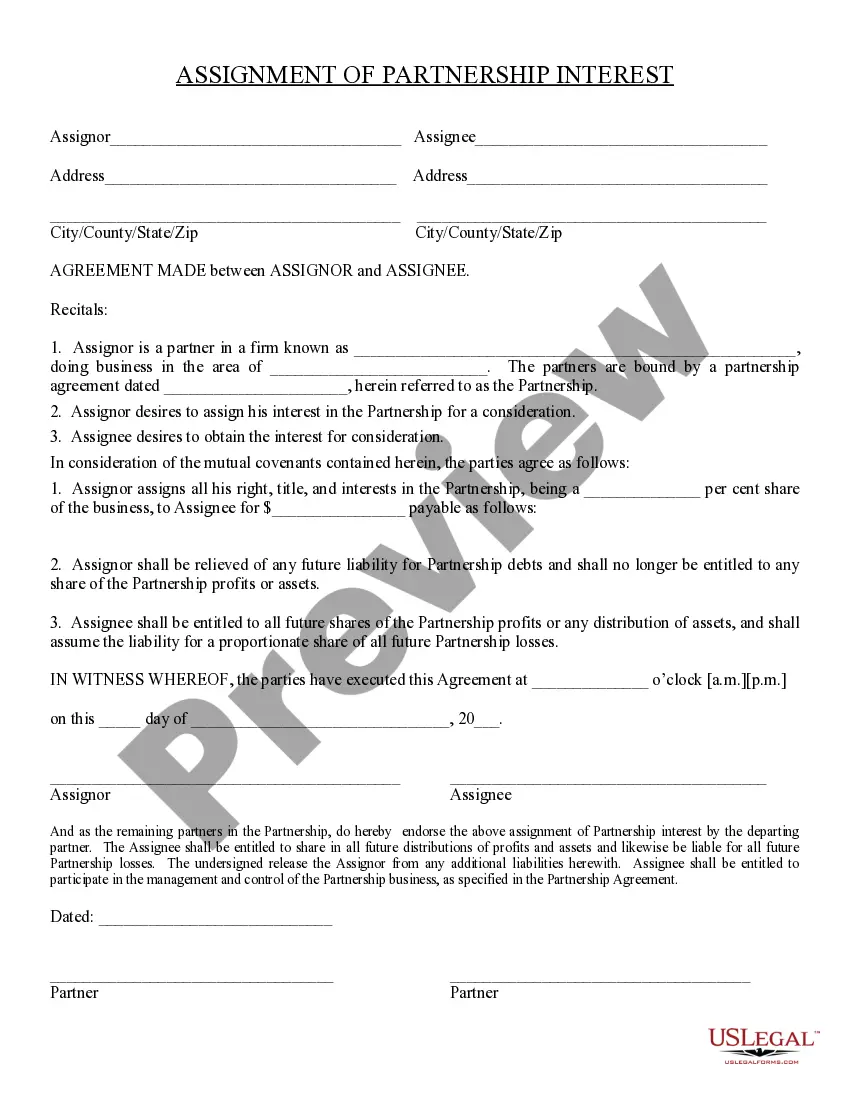

Creating forms, like Harris Receipt Template for Small Business, to manage your legal affairs is a challenging and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms intended for various scenarios and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Harris Receipt Template for Small Business form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before downloading Harris Receipt Template for Small Business:

- Ensure that your document is specific to your state/county since the rules for creating legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Harris Receipt Template for Small Business isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start utilizing our website and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!