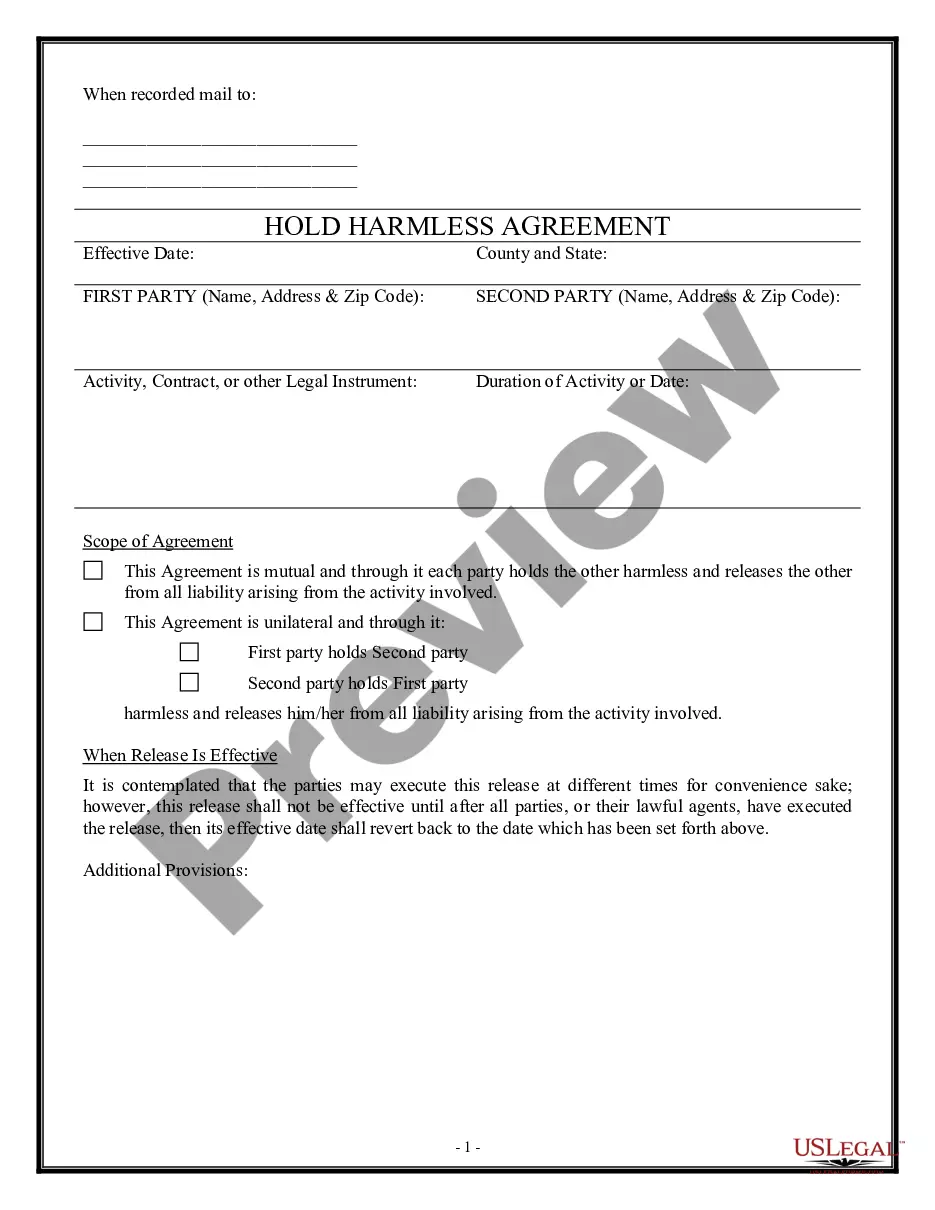

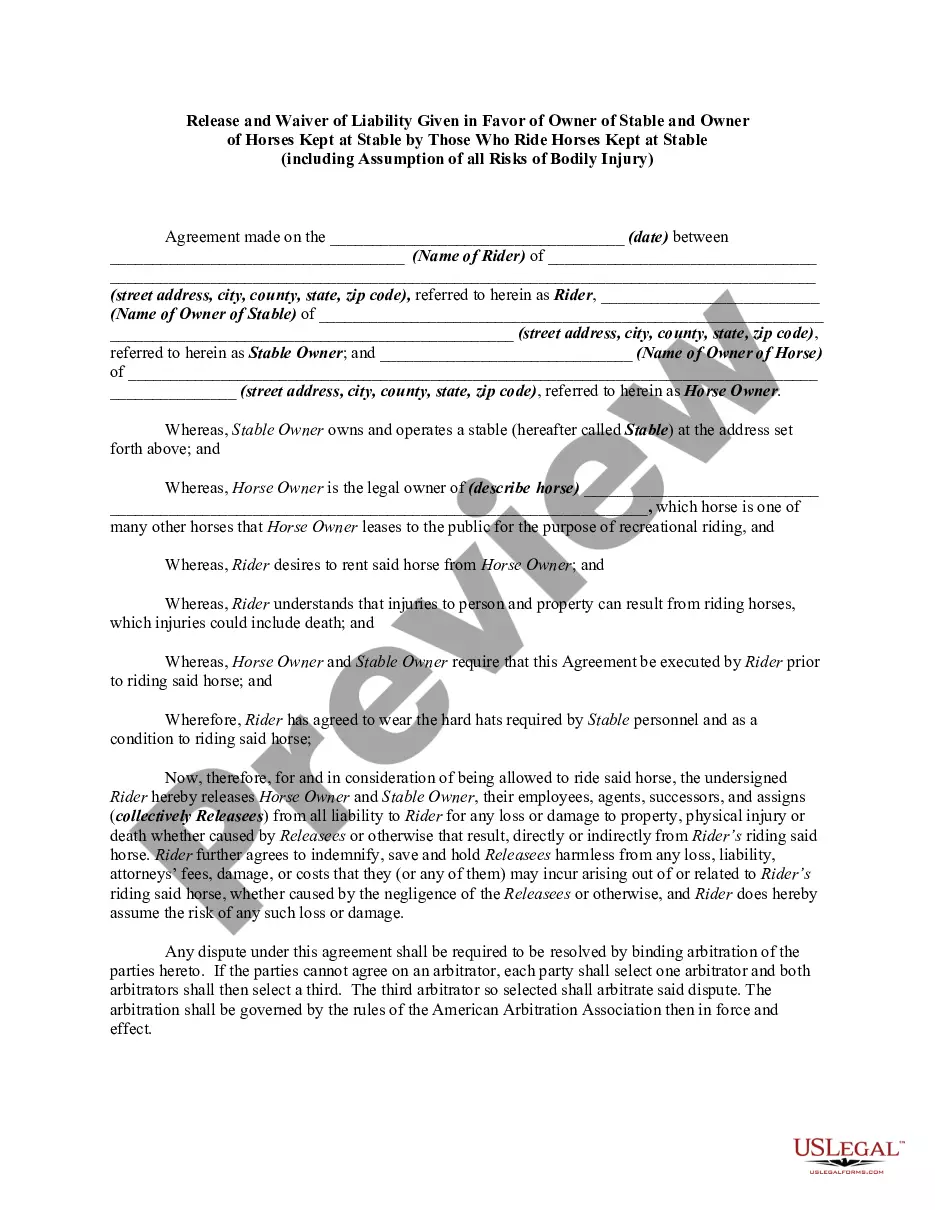

Wake North Carolina Owner Financing Contract for Land is a legally binding agreement between the seller and the buyer, where the seller agrees to finance the purchase of a piece of land in Wake County, North Carolina. This contract allows the buyer to pay the purchase price of the land in installments, instead of securing a traditional mortgage loan or paying the entire amount upfront. The Wake North Carolina Owner Financing Contract for Land sets out the terms and conditions of the agreement, including the purchase price, interest rate, repayment schedule, and any additional terms agreed upon by both parties. This contract offers flexibility to buyers who may not qualify for a conventional loan or prefer an alternative financing option. As for the different types of Wake North Carolina Owner Financing Contracts for Land, there can be variations based on the specific terms negotiated by the parties involved. Some common types of owner financing contracts include: 1. Fixed-Interest Owner Financing Contract: This type of contract specifies a fixed interest rate, which remains unchanged throughout the repayment period. It provides stability for the buyer, as their monthly payments will not fluctuate. 2. Variable-Interest Owner Financing Contract: In this type of contract, the interest rate is not fixed and may be subject to adjustments based on an agreed-upon index, such as the prime rate. The monthly payments may vary over time, depending on the market conditions. 3. Balloon Payment Owner Financing Contract: A balloon payment contract involves making smaller monthly payments for a specific period, followed by a lump sum payment (balloon payment) at the end. This allows buyers to defer a significant portion of the purchase price until a later date. 4. Lease-Option to Purchase: This contract combines a lease agreement with an option for the buyer to purchase the land at a predetermined price within a specified period. A portion of the monthly lease payment may be credited towards the purchase price if the buyer exercises their option to buy. In summary, the Wake North Carolina Owner Financing Contract for Land is a flexible alternative to traditional mortgage financing, enabling buyers to purchase land in Wake County with customizable terms. Different types of owner financing contracts offer varying interest rate structures, payment schedules, and options for deferred payments, providing options to suit the needs and preferences of both buyers and sellers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Contrato de Financiamiento del Propietario para la Tierra - Owner Financing Contract for Land

Description

How to fill out Wake North Carolina Contrato De Financiamiento Del Propietario Para La Tierra?

Draftwing forms, like Wake Owner Financing Contract for Land, to take care of your legal matters is a difficult and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for various cases and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Wake Owner Financing Contract for Land template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Wake Owner Financing Contract for Land:

- Ensure that your form is specific to your state/county since the regulations for writing legal papers may differ from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Wake Owner Financing Contract for Land isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start using our service and get the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can go ahead and download it.

It’s easy to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!