Orange California is a vibrant city located in Orange County, California. It is known for its warm climate, beautiful landscapes, and thriving community. When it comes to purchasing a vehicle in Orange California, owner financing contracts offer an alternative payment option for buyers. An Orange California owner financing contract for a vehicle involves a transaction that allows the buyer to make installment payments directly to the vehicle's owner, rather than obtaining traditional financing from a bank or lending institution. This type of contract benefits buyers who may have a limited credit history, a less-than-desirable credit score, or those who prefer to bypass traditional lending channels. There are different types of Orange California owner financing contracts for vehicles, depending on the specific terms and conditions agreed upon between the buyer and the seller. Some common variations include: 1. Full Purchase Owner Financing Contract: In this type of contract, the buyer agrees to purchase the vehicle at an agreed-upon price, and the payment is spread out over a certain period. The buyer may negotiate the interest rate and the duration of the contract with the owner. 2. Lease Purchase Owner Financing Contract: This type of contract combines elements of both a lease and a purchase agreement. The buyer pays monthly installments to the owner but doesn't officially own the vehicle until the contract term expires or a final payment is made. 3. Balloon Payment Owner Financing Contract: This contract involves smaller monthly payments but includes a larger "balloon payment" due at the end of the contract term. This option may be suitable for buyers who anticipate having more financial flexibility in the future. 4. Subprime Owner Financing Contract: This type of contract caters to buyers who may have a lower credit score or a less-than-ideal financial profile. The owner may provide financing to buyers who may have difficulty securing traditional loans due to credit history or income restrictions. It is important to note that the terms and conditions of Orange California owner financing contracts for vehicles may vary. Buyers should thoroughly review the contract, including interest rates, payment schedules, potential penalties, and ownership transfer clauses, before entering into an agreement. Consulting with legal professionals or financial advisors is recommended to ensure a fair and transparent transaction for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Contrato de Financiamiento de Propietario para Vehículo - Owner Financing Contract for Vehicle

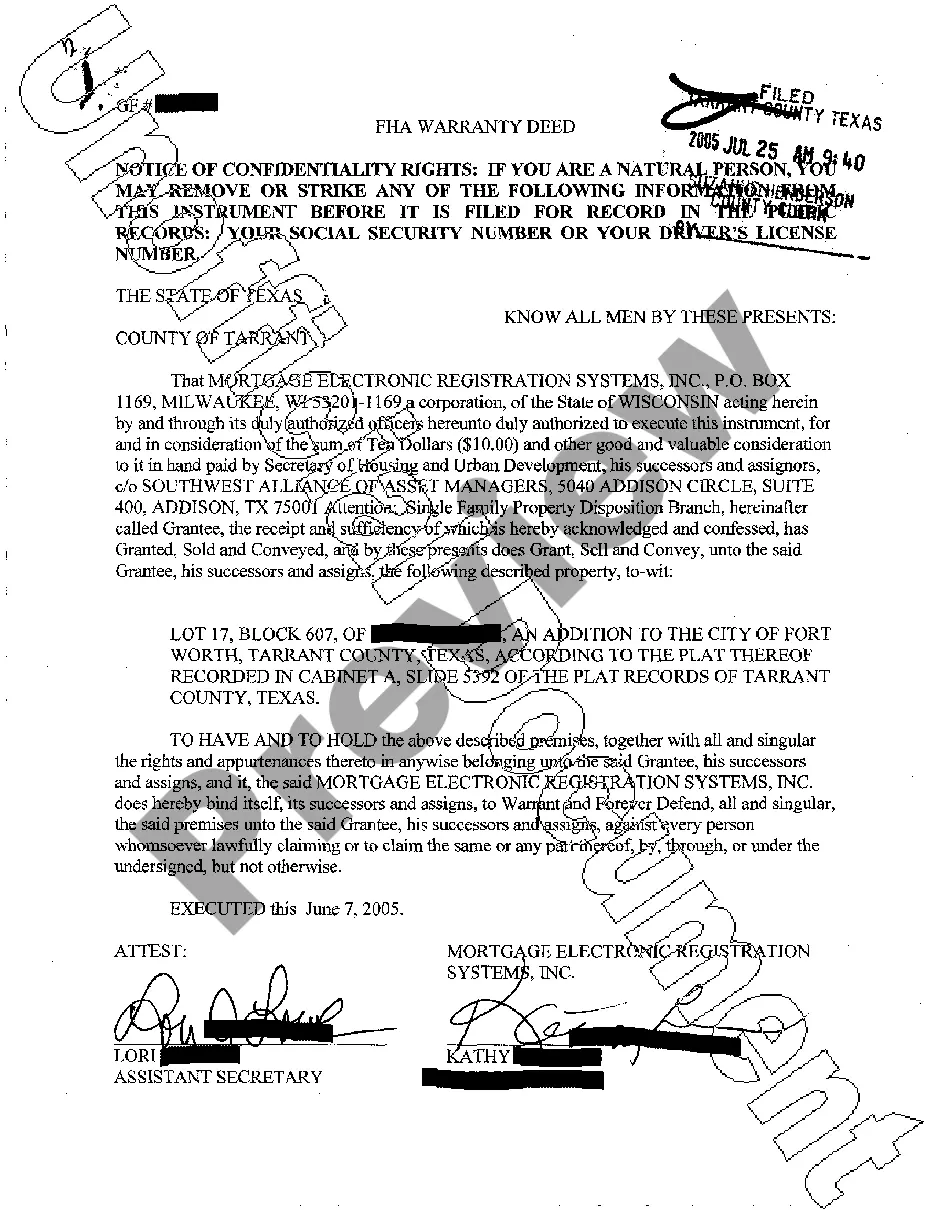

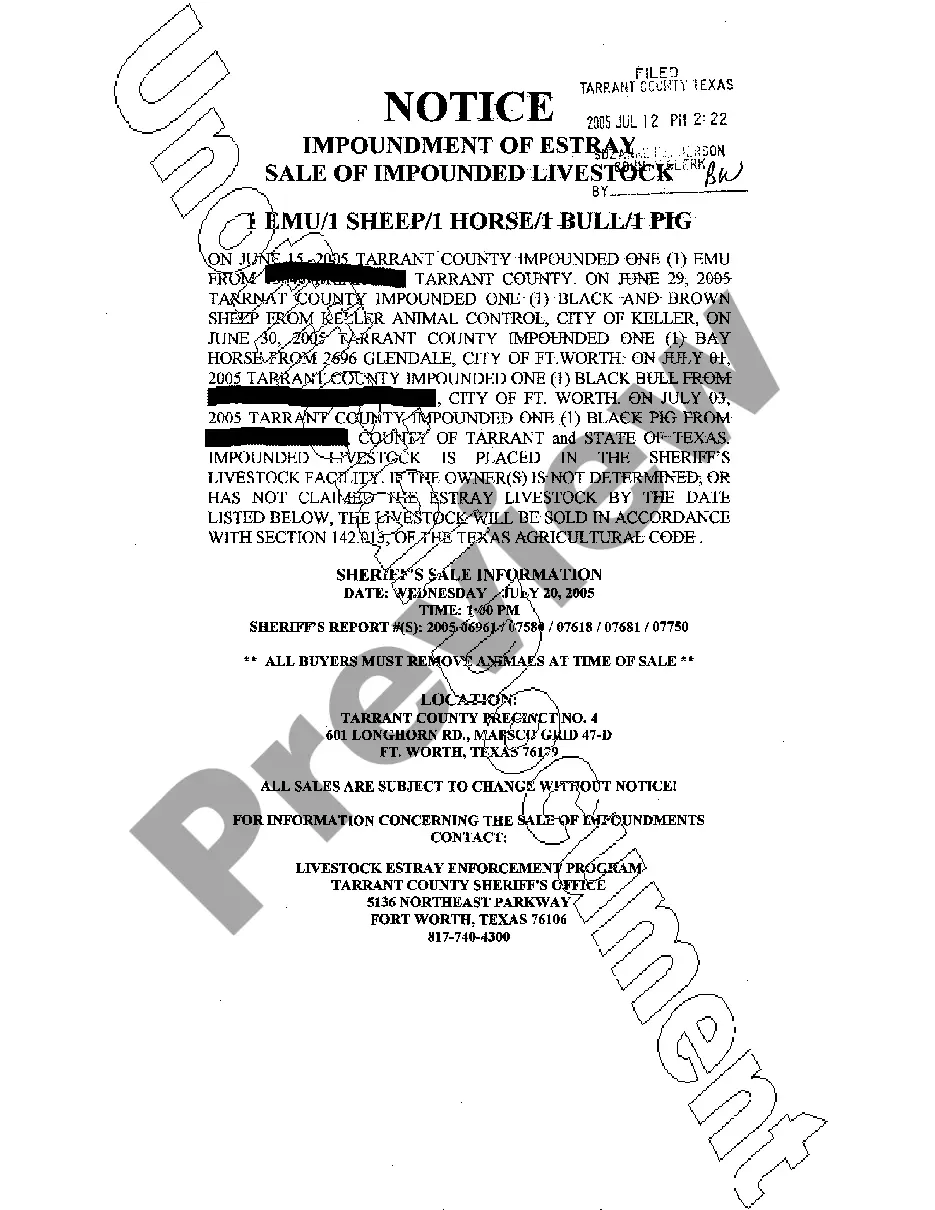

Description

How to fill out Orange California Contrato De Financiamiento De Propietario Para Vehículo?

Drafting paperwork for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Orange Owner Financing Contract for Vehicle without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Orange Owner Financing Contract for Vehicle by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Orange Owner Financing Contract for Vehicle:

- Examine the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!