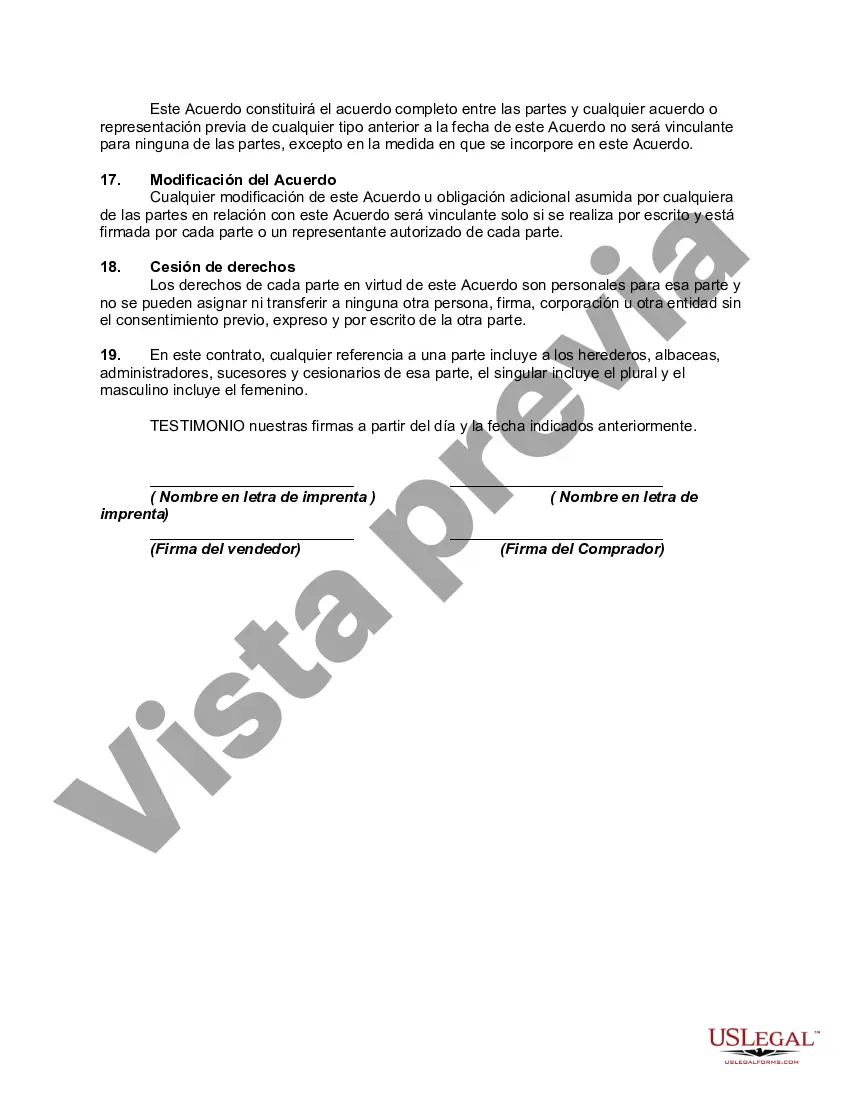

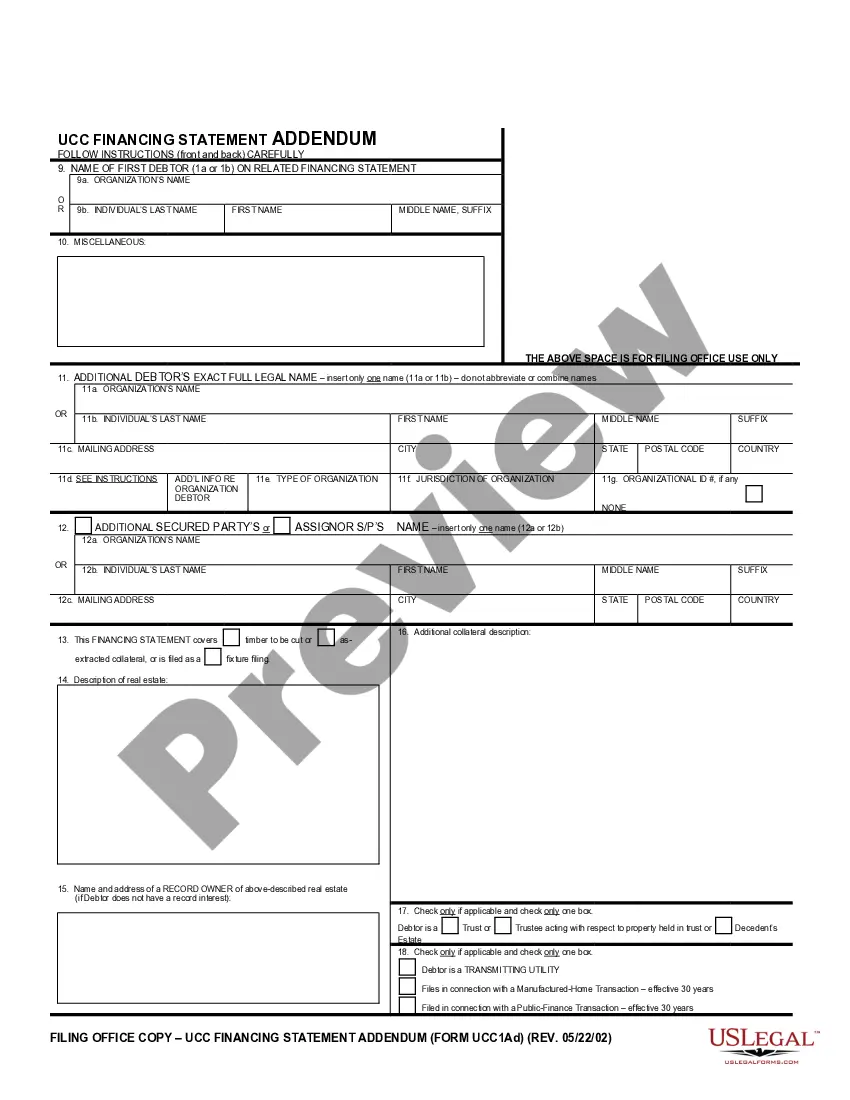

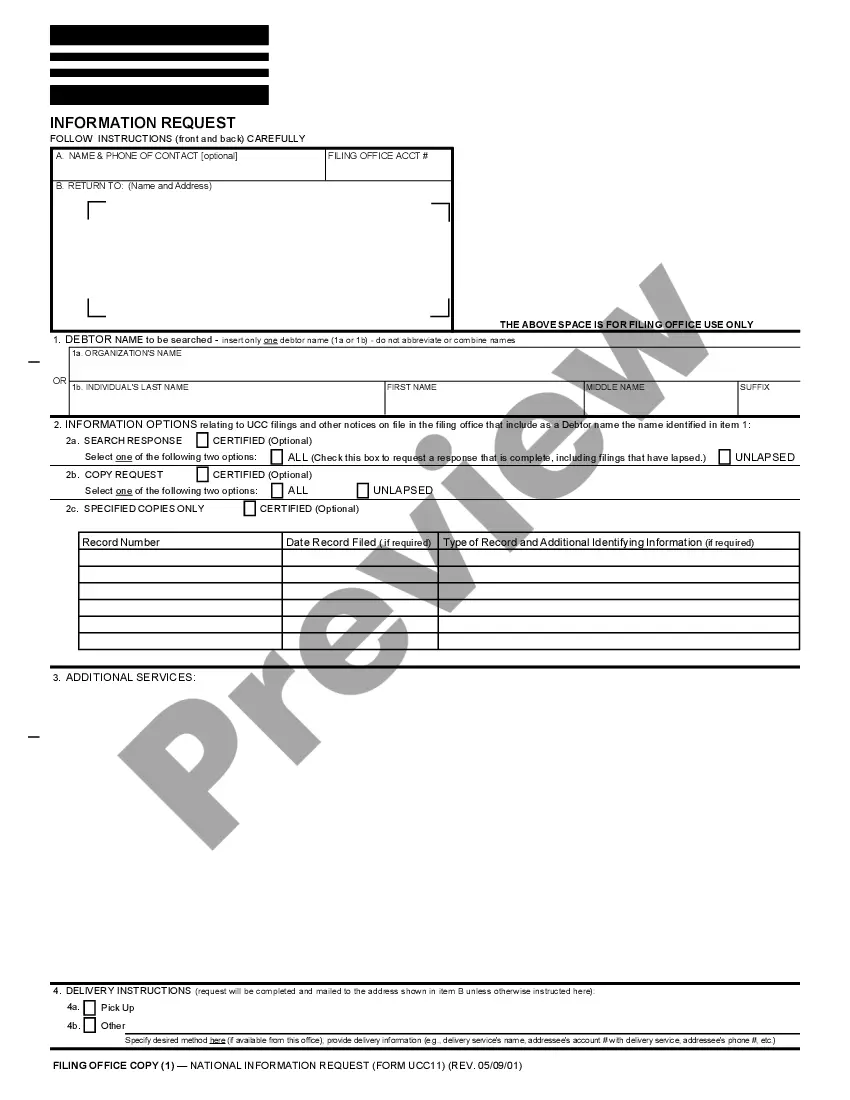

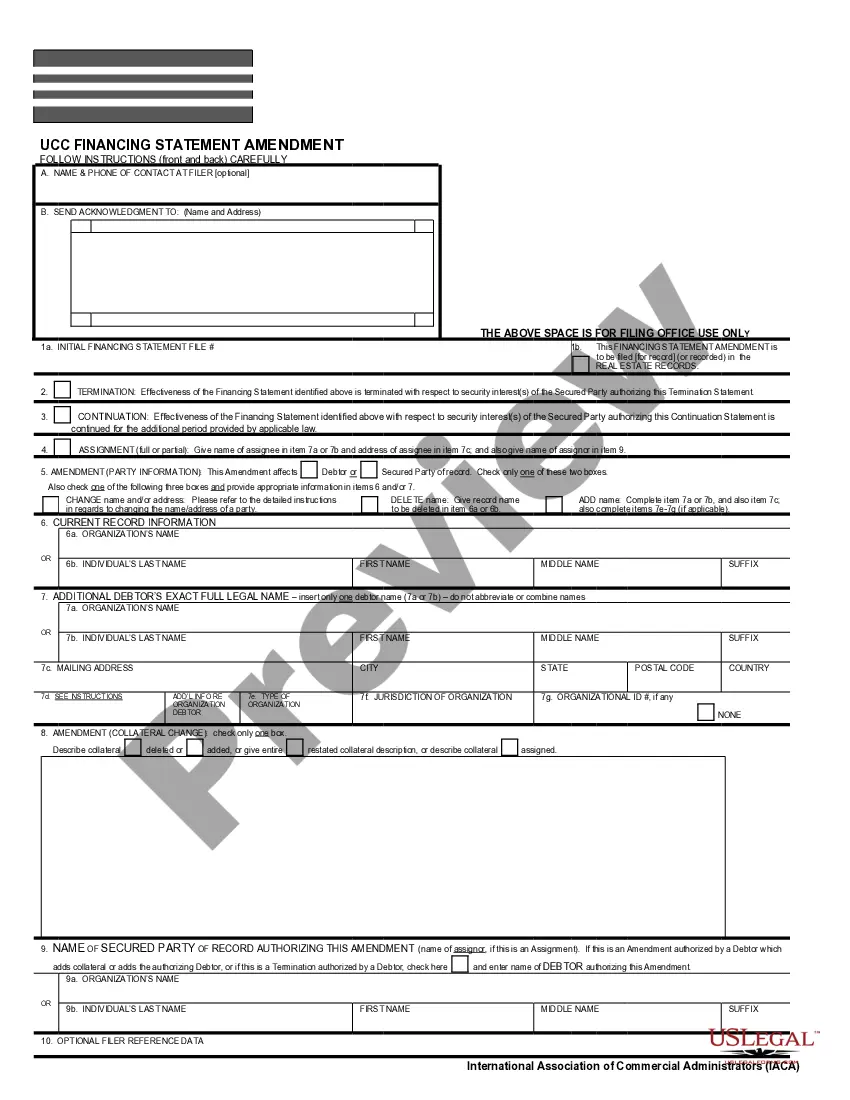

San Diego, California is a picturesque city located on the coast of Southern California. It is known for its beautiful beaches, vibrant lifestyle, and perfect year-round weather. With a population of over 1.4 million people, San Diego attracts visitors from all around the world. When it comes to purchasing a vehicle in San Diego, owner financing contracts offer an alternative financing option for potential buyers. These contracts allow individuals to buy a vehicle directly from the owner without involving traditional lenders such as banks or credit unions. Instead, the owner becomes the lender and provides financing directly to the buyer. The San Diego California Owner Financing Contract for Vehicles is a legally binding agreement that outlines the terms and conditions of the vehicle purchase. It includes important details such as the purchase price, interest rate, repayment schedule, and any additional fees or penalties. The contract typically requires the buyer to make monthly payments to the owner until the total purchase price is paid off. It also states the consequences of defaulting on payments, including the potential repossession of the vehicle. Different types of San Diego California Owner Financing Contracts for Vehicles may include: 1. Fixed-Rate Owner Financing: In this type of contract, the interest rate remains constant throughout the repayment period. This allows buyers to have fixed monthly payments, making budgeting easier. 2. Variable-Rate Owner Financing: Unlike fixed-rate contracts, variable-rate contracts have interest rates that can fluctuate over time. These rates are commonly tied to an index, such as the prime rate. Buyers should be cautious as this type of contract could lead to higher monthly payments if the interest rates increase. 3. Balloon Payment Owner Financing: Some contracts may have a balloon payment clause, which means a large lump-sum payment is due at the end of the contract term. This option can offer lower monthly payments during the contract period but requires a significant payment at the end. 4. Lease-to-Own Owner Financing: This type of financing contract allows individuals to lease a vehicle with an option to purchase it at the end of the lease term. A portion of the monthly payments goes towards the purchase price. It is essential for both buyers and sellers to thoroughly understand the terms and conditions of the San Diego California Owner Financing Contract for Vehicles before entering into an agreement. Consulting a legal professional is strongly recommended ensuring compliance with all applicable laws and regulations. In conclusion, San Diego, California offers various types of owner financing contracts for vehicles. These contracts provide flexibility and convenience for buyers who may not qualify for traditional financing options. However, it is crucial to conduct thorough research, seek legal advice, and carefully evaluate the terms of the contract to make an informed decision.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Contrato de Financiamiento de Propietario para Vehículo - Owner Financing Contract for Vehicle

Description

How to fill out San Diego California Contrato De Financiamiento De Propietario Para Vehículo?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Diego Owner Financing Contract for Vehicle, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the San Diego Owner Financing Contract for Vehicle from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the San Diego Owner Financing Contract for Vehicle:

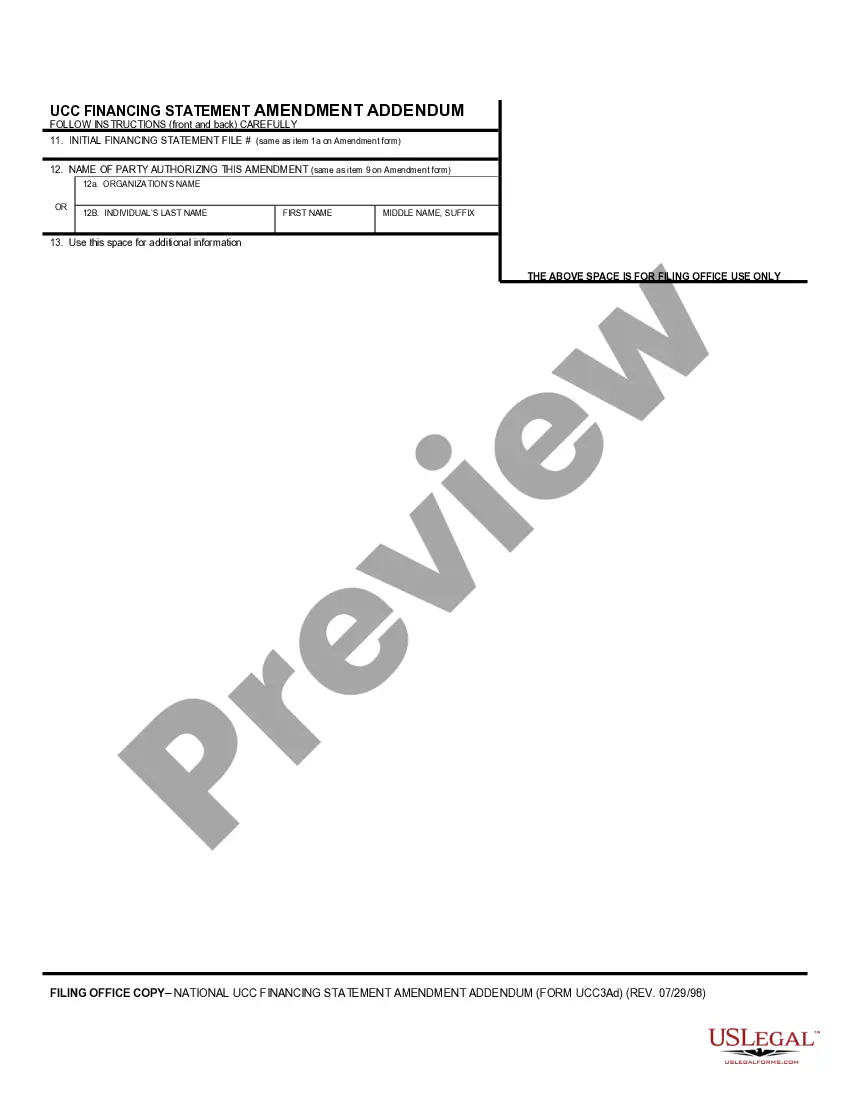

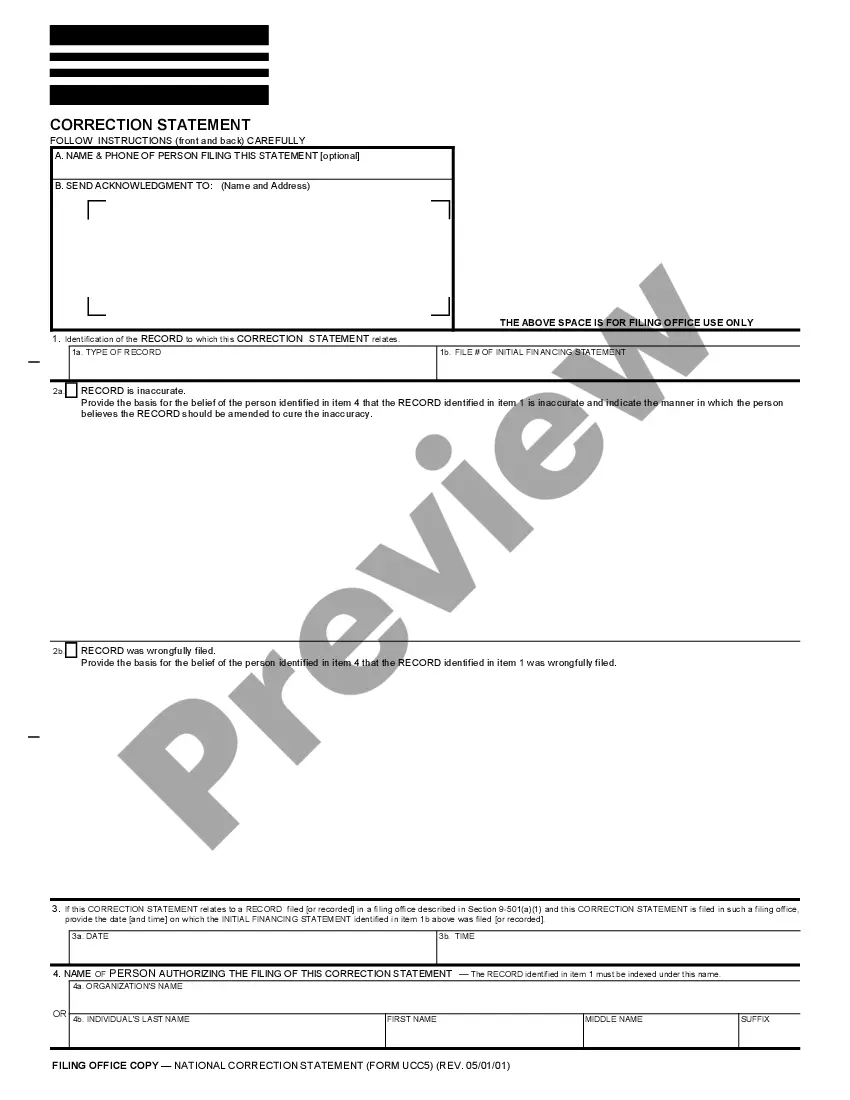

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!