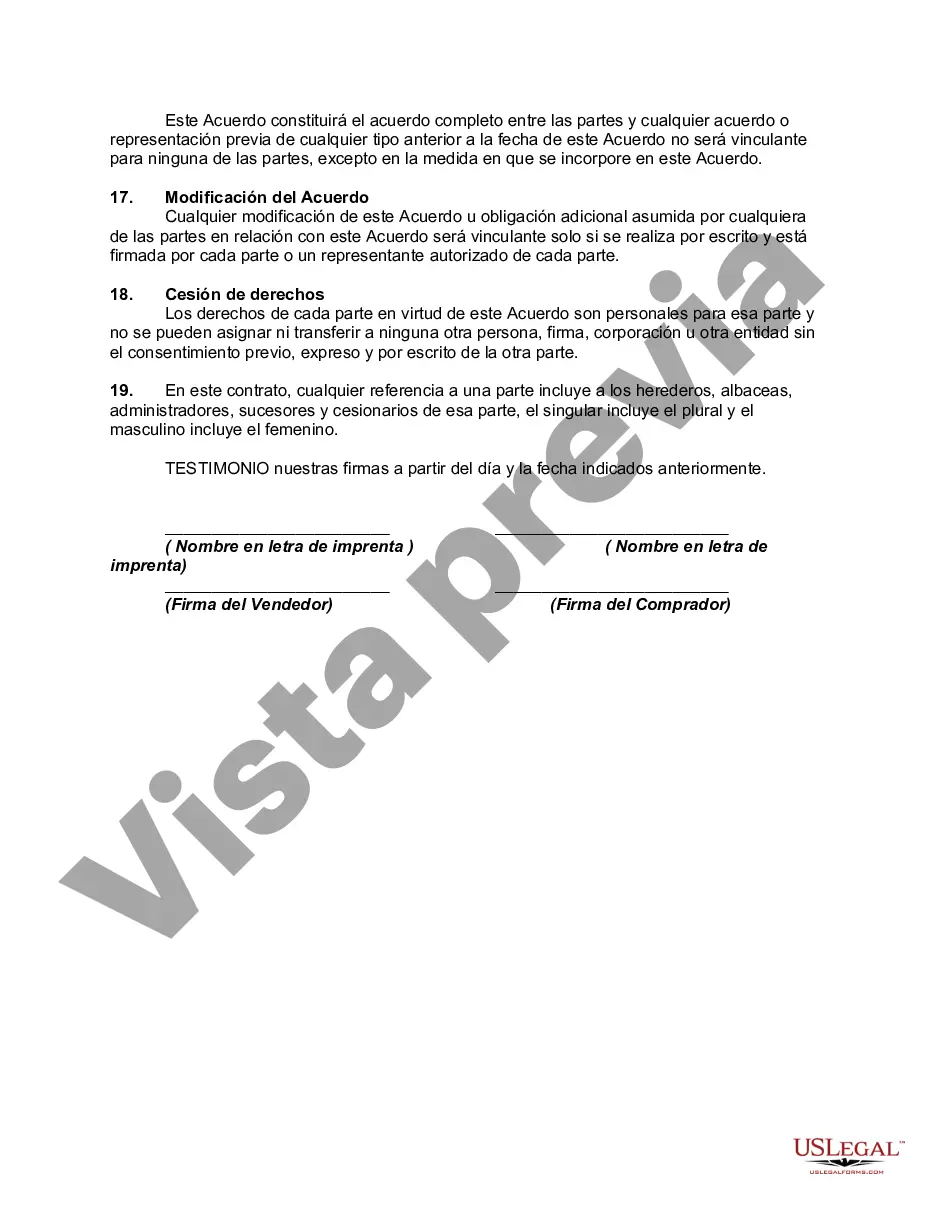

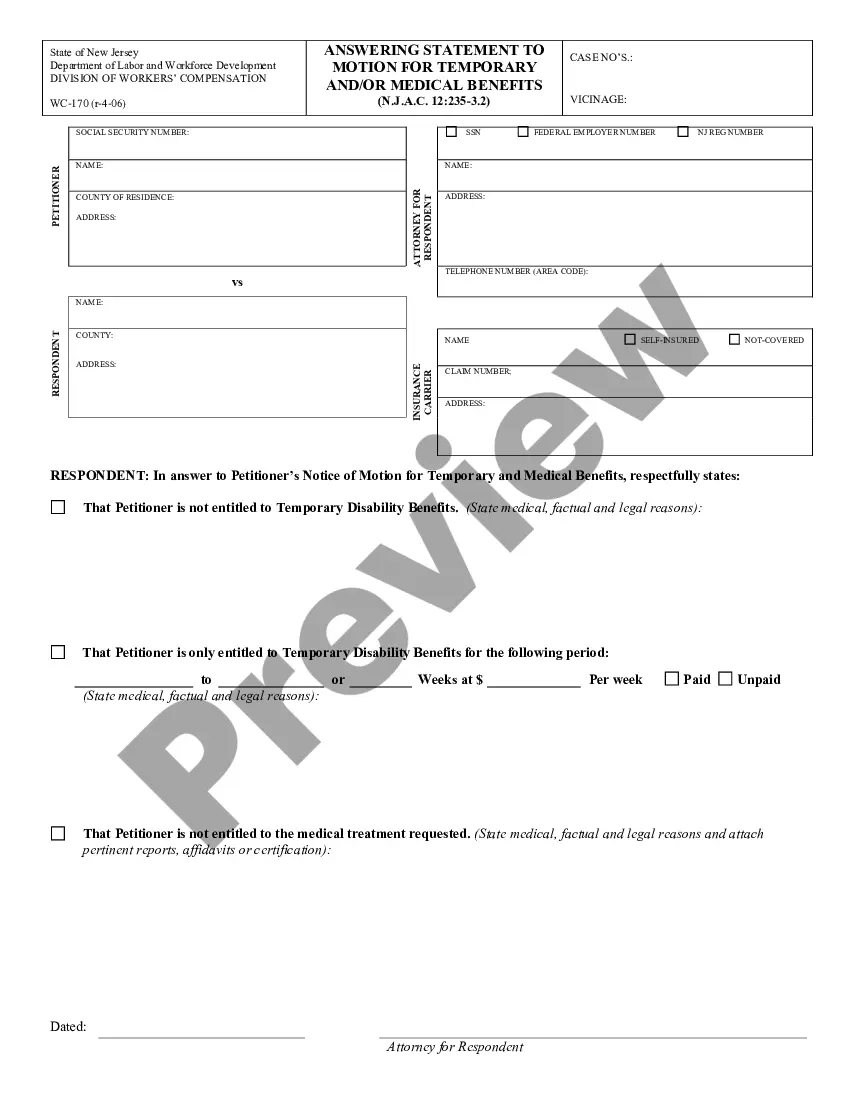

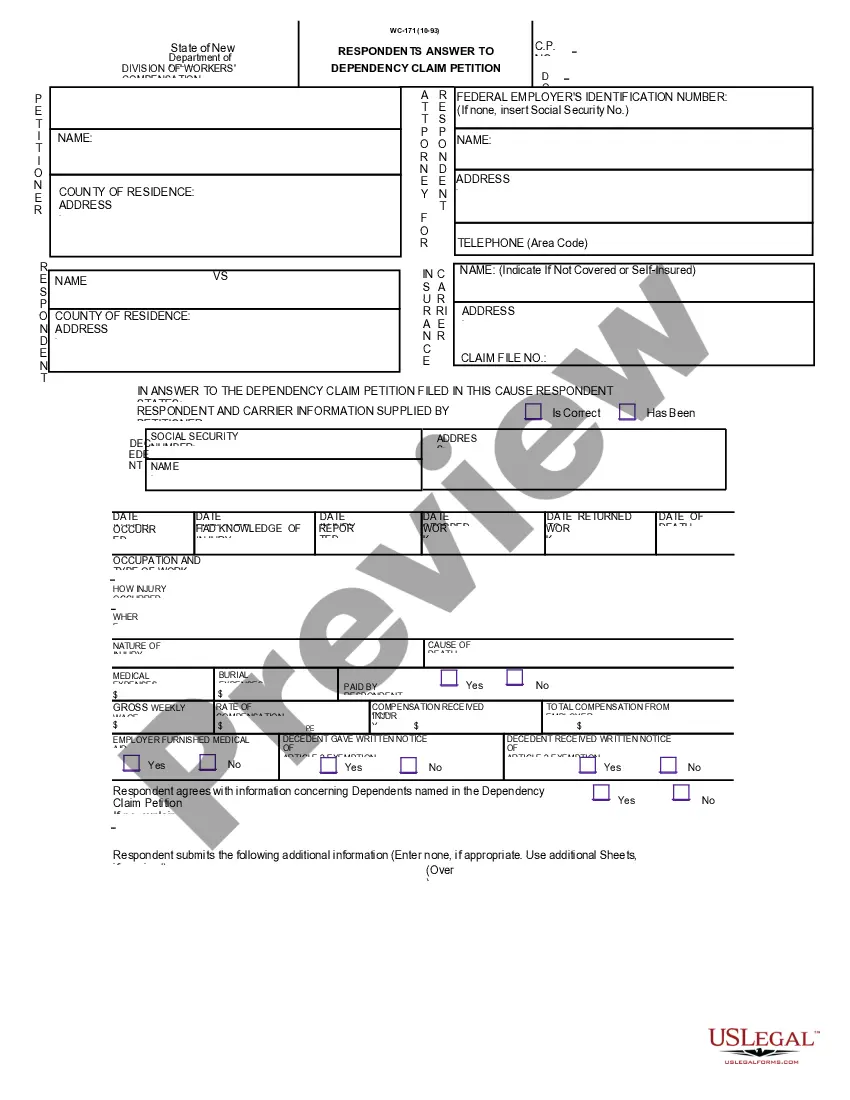

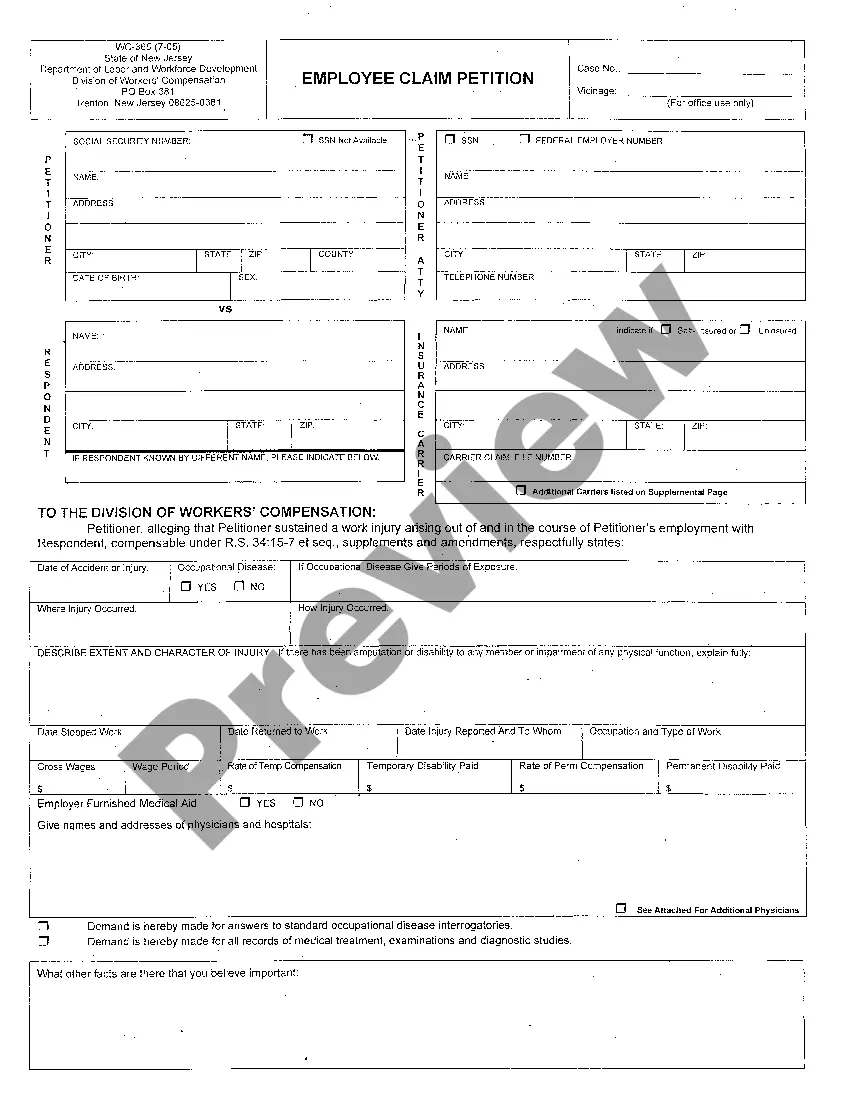

San Diego California Owner Financing Contract for Home is a legally binding agreement between a buyer and a seller in the real estate market. It provides an alternative method of purchasing a property without involving a traditional mortgage lender or bank. This arrangement allows the seller to act as the lender and finance the purchase directly with the buyer. The San Diego California Owner Financing Contract for Home typically includes the following key elements: 1. Purchase Price: The contract clearly states the agreed-upon purchase price of the property. Both parties need to agree on this amount, which is often negotiable. 2. Down Payment: The contract outlines the amount of down payment required by the buyer to secure the property. It is usually a percentage of the purchase price and is paid upfront. The down payment amount can vary depending on the agreement between the buyer and seller. 3. Interest Rate: The contract specifies the interest rate charged by the seller for financing the purchase. This rate can be fixed or adjustable, and it is important for both parties to agree on the terms. The interest rate is a key factor in determining the total cost of the financing. 4. Payment Schedule: The contract outlines the payment schedule and terms of the loan. It includes the frequency of payments (monthly, quarterly, etc.), the due dates, and the duration of the loan term. The duration can range from a few years to several decades, depending on the agreement. 5. Default and Remedies: The contract addresses the consequences of default by either party. It outlines the actions that can be taken by the seller, such as foreclosure or repossession, in case of non-payment or breach of the contract. It may also include provisions for late fees or penalties. 6. Closing and Title Transfer: The contract specifies the process and timeline for the closing of the transaction and the transfer of the property's title. It may stipulate whether the title remains with the seller until the full payment is received or if it is transferred to the buyer at the time of purchase. Different types of San Diego California Owner Financing Contracts for Home may include: 1. Land Contract: This type of contract is used when the buyer purchases both the land and the property together. The buyer pays installments to the seller until the full purchase price is paid, and the title is transferred. 2. Contract for Deed: Also known as a "bond for title" or "installment land contract," this type of contract allows the buyer to occupy the property while making payments to the seller. The seller retains the legal title until the buyer fulfills the payment obligations. 3. Lease Option: This arrangement combines a lease agreement with an option to purchase the property at a later date. The buyer typically pays a higher rental amount, with a portion going toward the eventual purchase price. 4. Wraparound Mortgage: In this type of owner financing, the seller remains responsible for their existing mortgage while financing the additional amount for the buyer. The buyer makes one monthly payment to the seller, who then distributes the appropriate portions to the original mortgage lender. San Diego California Owner Financing Contracts for Home offer flexibility to buyers who may face challenges obtaining a traditional mortgage. It is crucial for both parties to thoroughly understand the contract's terms and consult legal professionals to ensure a fair and valid agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Contrato de Financiamiento del Propietario para el Hogar - Owner Financing Contract for Home

Description

How to fill out San Diego California Contrato De Financiamiento Del Propietario Para El Hogar?

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life situation, finding a San Diego Owner Financing Contract for Home meeting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. In addition to the San Diego Owner Financing Contract for Home, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your San Diego Owner Financing Contract for Home:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Diego Owner Financing Contract for Home.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!