This agreement contains a security agreement creating a security interest in the property being sold. A security interest refers to the property rights of a lender or creditor whose right to collect a debt is secured by property. A secured transaction is created by means of a security agreement in which a lender (the secured party) may take specified collateral owned by the borrower if he or she should default on the loan. Collateral is the property, that secures the debt and may be forfeited to the creditor if the debtor fails to pay the debt. Property of numerous types may serve as collateral, such as houses, cars, and jewelry. By creating a security interest, the secured party is also assured that if the debtor should go bankrupt he or she may be able to recover the value of the loan by taking possession of the specified collateral instead of receiving only a portion of the borrowers property after it is divided among all creditors.

The Uniform Commercial Code is a model statute covering transactions in such matters as the sale of goods, credit, bank transactions, conduct of business, warranties, negotiable instruments, loans secured by personal property and other commercial matters. Article 9 of the Uniform Commercial Code covers most types of security agreements for personal property that are both consensual and commercial. All states have adopted and adapted the entire UCC, with the exception of Louisiana, which only adopted parts of it.

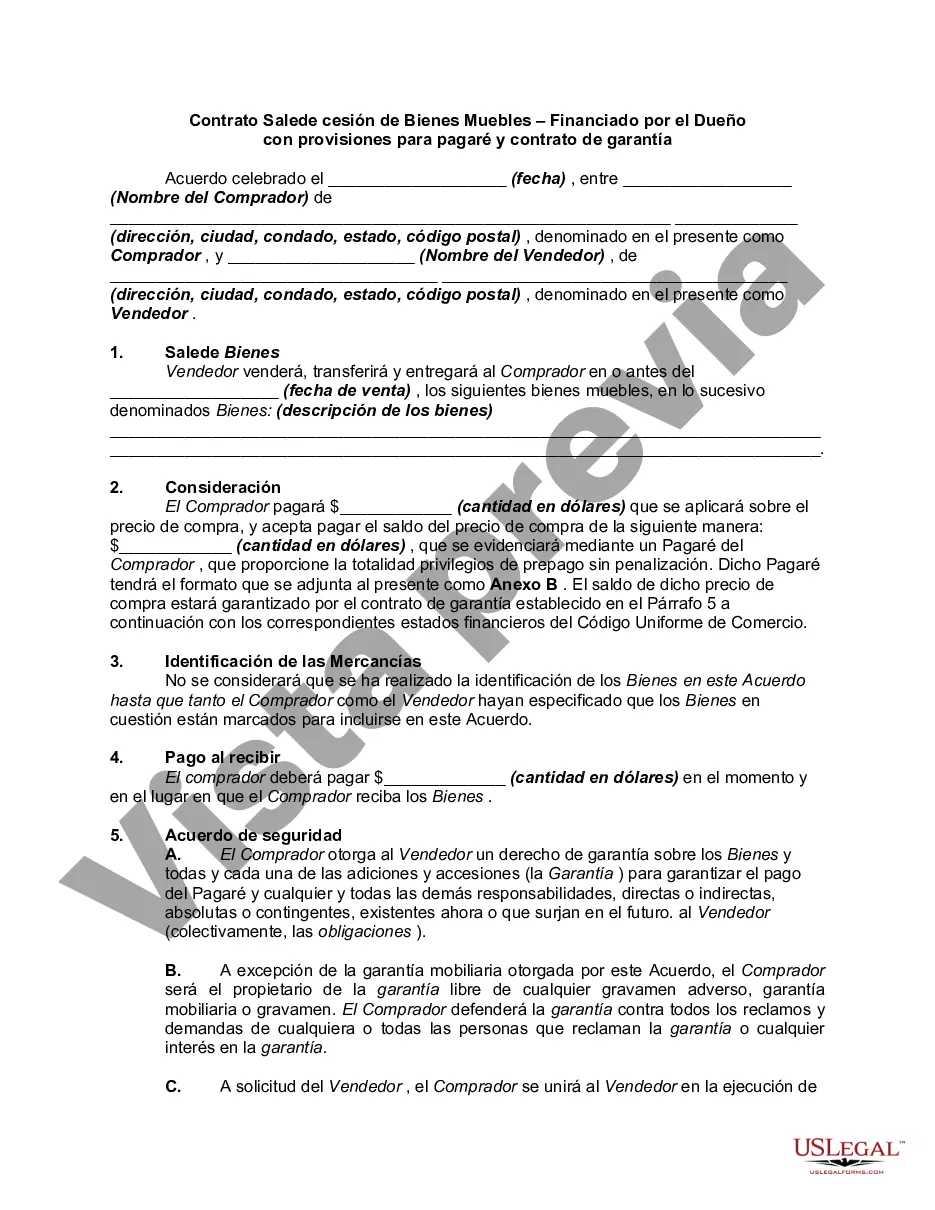

San Antonio Texas Contract for the Sale of Personal Property — Owner Financed with Provisions for Note and Security Agreement is a legally binding document that outlines the terms and conditions for the sale of personal property between a seller and buyer in San Antonio, Texas. This type of contract specifically addresses the owner financing aspect, allowing the buyer to make installment payments over time rather than obtaining traditional financing from a lender. The contract includes details about the personal property being sold, such as its description, condition, and any warranties or guarantees provided by the seller. It also contains provisions for the purchase price, down payment, and installment amounts, including the frequency and duration of payments. The contract will explicitly state the interest rate applied to the outstanding balance, if any. Additionally, the contract will outline the security agreement in which the buyer grants a security interest in the property being sold as collateral to secure the payment of the agreed-upon purchase price. This ensures that if the buyer defaults on the payments, the seller has legal recourse to reclaim the property and offset any outstanding balance. There may be different types or variations of the San Antonio Texas Contract for the Sale of Personal Property — Owner Financed with Provisions for Note and Security Agreement, depending on the specific requirements of the parties involved, such as: 1. Residential Property Contract: This contract type is tailored for the sale of personal property that includes residential homes, houses, or other dwellings. It may include additional provisions and contingencies related to property inspections, repairs, and occupancy. 2. Commercial Property Contract: This contract is designed for the sale of personal property that comprises commercial real estate or business properties. It may include unique clauses relating to zoning, lease agreements, and other commercial considerations. 3. Vehicle or Equipment Contract: This variation applies to the sale of personal property such as vehicles, machinery, or equipment. It may include specific details regarding vehicle identification numbers (VIN's), condition reports, or warranties applicable to the personal property being sold. 4. Partial Payments Contract: This type of San Antonio Texas Contract for the Sale of Personal Property focuses on accommodating partial payments rather than installment payments. It outlines the terms for the buyer to make irregular or non-fixed payments towards the purchase price. Regardless of the type, a San Antonio Texas Contract for the Sale of Personal Property — Owner Financed with Provisions for Note and Security Agreement ensures that the rights and obligations of both the buyer and seller are protected throughout the transaction. It offers a comprehensive framework for a smooth and secure owner-financed sale of personal property in San Antonio, Texas.San Antonio Texas Contract for the Sale of Personal Property — Owner Financed with Provisions for Note and Security Agreement is a legally binding document that outlines the terms and conditions for the sale of personal property between a seller and buyer in San Antonio, Texas. This type of contract specifically addresses the owner financing aspect, allowing the buyer to make installment payments over time rather than obtaining traditional financing from a lender. The contract includes details about the personal property being sold, such as its description, condition, and any warranties or guarantees provided by the seller. It also contains provisions for the purchase price, down payment, and installment amounts, including the frequency and duration of payments. The contract will explicitly state the interest rate applied to the outstanding balance, if any. Additionally, the contract will outline the security agreement in which the buyer grants a security interest in the property being sold as collateral to secure the payment of the agreed-upon purchase price. This ensures that if the buyer defaults on the payments, the seller has legal recourse to reclaim the property and offset any outstanding balance. There may be different types or variations of the San Antonio Texas Contract for the Sale of Personal Property — Owner Financed with Provisions for Note and Security Agreement, depending on the specific requirements of the parties involved, such as: 1. Residential Property Contract: This contract type is tailored for the sale of personal property that includes residential homes, houses, or other dwellings. It may include additional provisions and contingencies related to property inspections, repairs, and occupancy. 2. Commercial Property Contract: This contract is designed for the sale of personal property that comprises commercial real estate or business properties. It may include unique clauses relating to zoning, lease agreements, and other commercial considerations. 3. Vehicle or Equipment Contract: This variation applies to the sale of personal property such as vehicles, machinery, or equipment. It may include specific details regarding vehicle identification numbers (VIN's), condition reports, or warranties applicable to the personal property being sold. 4. Partial Payments Contract: This type of San Antonio Texas Contract for the Sale of Personal Property focuses on accommodating partial payments rather than installment payments. It outlines the terms for the buyer to make irregular or non-fixed payments towards the purchase price. Regardless of the type, a San Antonio Texas Contract for the Sale of Personal Property — Owner Financed with Provisions for Note and Security Agreement ensures that the rights and obligations of both the buyer and seller are protected throughout the transaction. It offers a comprehensive framework for a smooth and secure owner-financed sale of personal property in San Antonio, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.