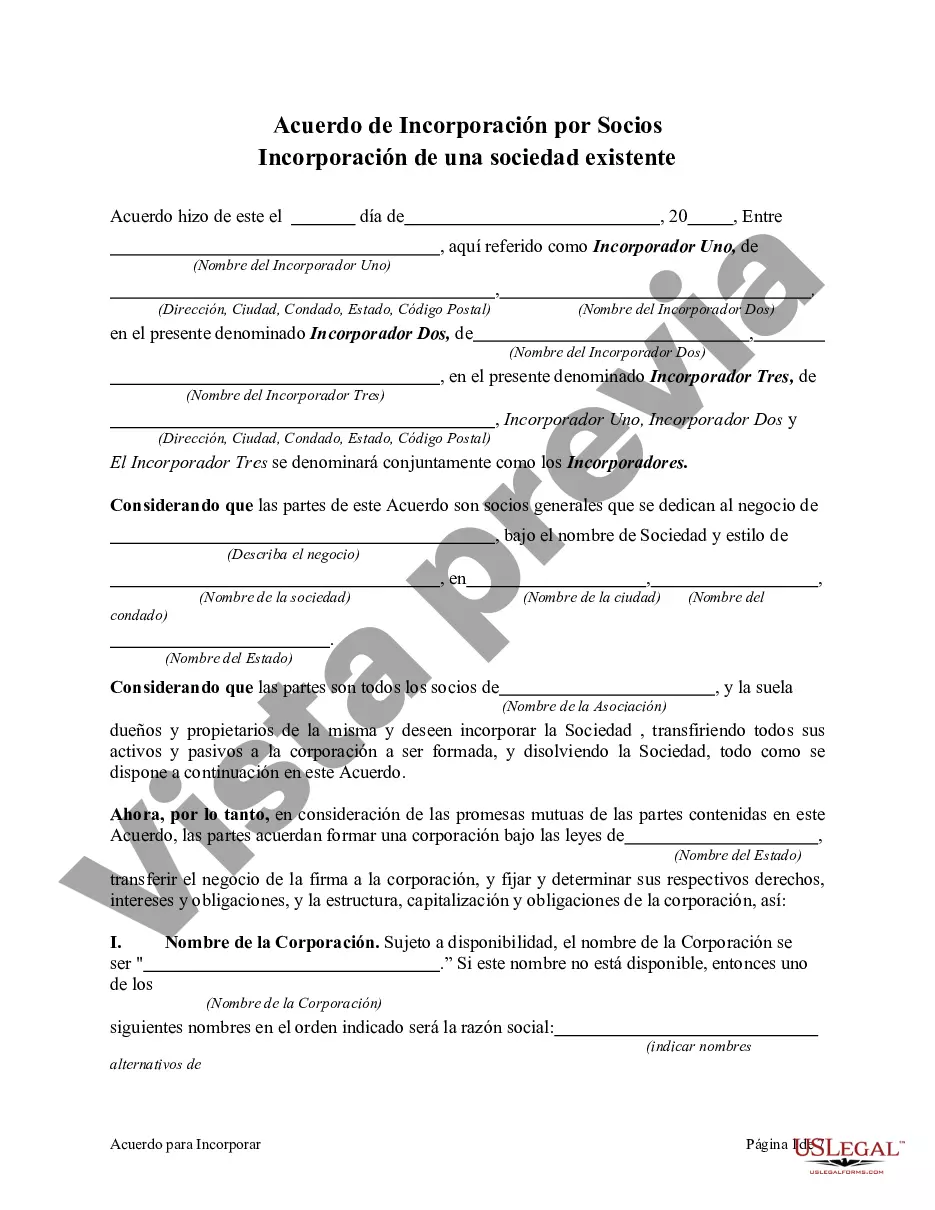

Chicago Illinois Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that outlines the process and terms for converting an existing partnership into a corporation in the city of Chicago, Illinois. This agreement is designed to protect the rights and interests of the partners involved in the existing partnership while establishing a new corporate entity. Incorporating an existing partnership into a corporation provides several benefits, including limited liability protection for the partners, potential tax advantages, and enhanced business credibility. This agreement serves as a blueprint for the conversion process and ensures that all partners are on the same page regarding the terms of incorporation. Key elements included in the Chicago Illinois Agreement to Incorporate by Partners Incorporating Existing Partnership may include: 1. Purpose: Clearly states the intention of the partners to convert their partnership into a corporation and outlines the goals and objectives of the new corporate entity. 2. Conversion Process: Describes the steps involved in the conversion, such as obtaining required permits and licenses, transferring assets and liabilities from the partnership to the corporation, and complying with local and state laws. 3. Shares and Ownership: Specifies the allocation of shares and ownership percentages in the new corporation among the partners based on their contributions and interests in the existing partnership. 4. Board of Directors: Outlines the structure and composition of the board of directors in the new corporation, including the appointment and removal processes, as well as the powers and responsibilities of directors. 5. Capital Contributions: Details the financial contributions that each partner will make to the corporation and the process for accepting additional capital investments in the future. 6. Distribution of Profits and Losses: Defines how profits and losses will be allocated among the partners-turned-shareholders in the new corporation, considering factors such as initial capital contributions and ongoing involvement in the business. 7. Dissolution and Termination: Sets forth the circumstances under which the corporation may be dissolved, including agreement among the partners, bankruptcy, or other legal or financial events. Variations of the Chicago Illinois Agreement to Incorporate by Partners Incorporating Existing Partnership may exist based on specific industry or partnership requirements. However, the core components mentioned above remain crucial in all variations to ensure a smooth transition and protect the interests of all parties involved. It is advisable to consult with a qualified attorney or legal professional to draft or review the Chicago Illinois Agreement to Incorporate by Partners Incorporating Existing Partnership, as it involves complex legal considerations and compliance with local regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo para incorporar por socios que incorporan sociedad existente - Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Chicago Illinois Acuerdo Para Incorporar Por Socios Que Incorporan Sociedad Existente?

If you need to get a reliable legal paperwork provider to get the Chicago Agreement to Incorporate by Partners Incorporating Existing Partnership, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can browse from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of supporting resources, and dedicated support make it easy to find and complete different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply type to search or browse Chicago Agreement to Incorporate by Partners Incorporating Existing Partnership, either by a keyword or by the state/county the document is created for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Chicago Agreement to Incorporate by Partners Incorporating Existing Partnership template and check the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less costly and more affordable. Create your first company, arrange your advance care planning, create a real estate contract, or complete the Chicago Agreement to Incorporate by Partners Incorporating Existing Partnership - all from the comfort of your sofa.

Join US Legal Forms now!