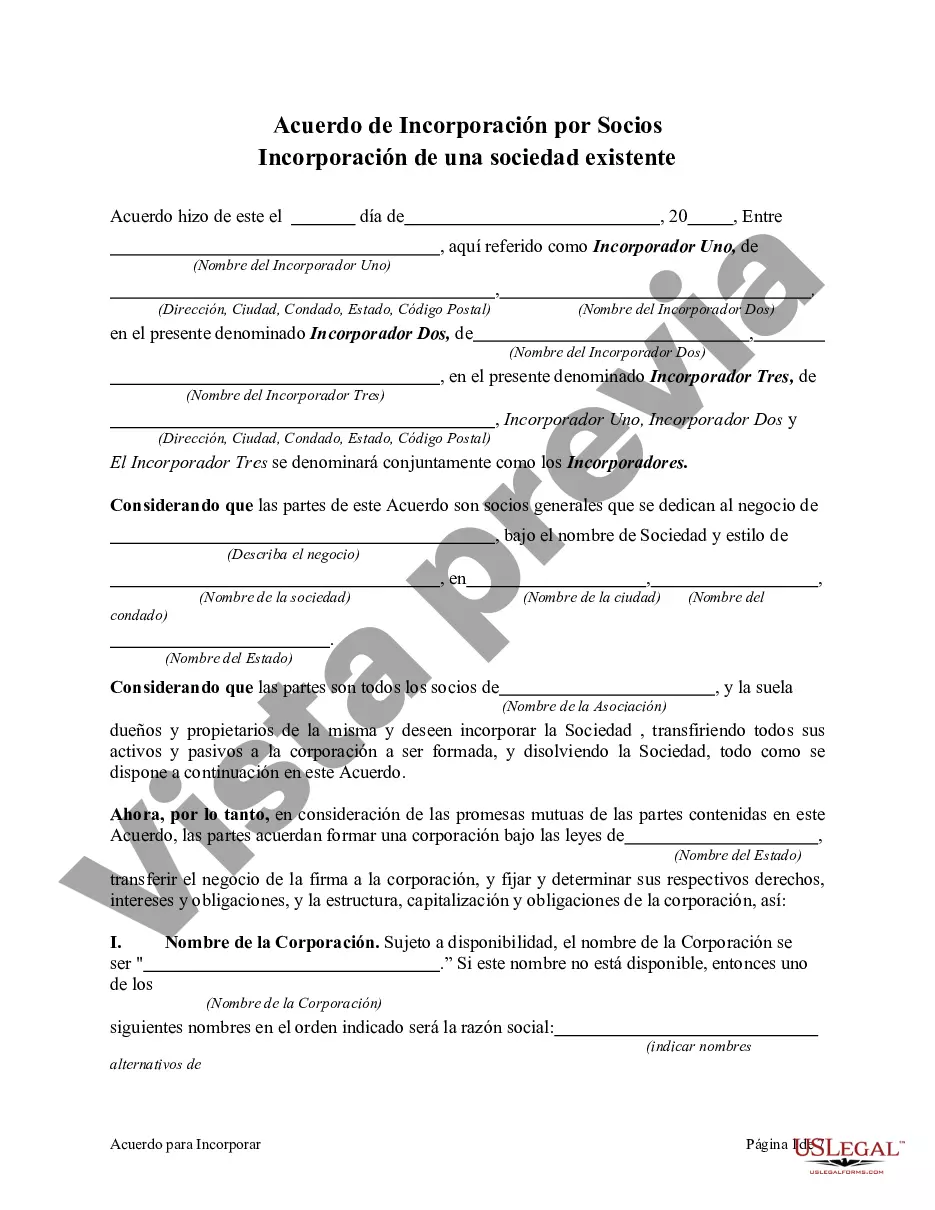

Collin Texas Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that outlines the process and terms for converting an existing partnership into a corporation in Collin County, Texas. This agreement serves as the foundation for the new business structure and establishes the rights, responsibilities, and obligations of each partner involved. The Collin Texas Agreement to Incorporate by Partners Incorporating Existing Partnership includes various essential elements such as: 1. Name and Address: The agreement starts by legally identifying the existing partnership by its name, principal place of business, and address. 2. Purpose: This section outlines the purpose and objectives of incorporating the existing partnership, indicating the intent to transition into a corporation and the benefits associated with this change. 3. Effective Date: The date from which the agreement comes into effect is specified to ensure clarity regarding the transition timeline. 4. Conversion Process: The agreement provides a detailed explanation of the process by which the partnership will be converted into a corporation. It may involve filing necessary documents with the Texas Secretary of State, obtaining appropriate permits, licenses, and any other legal requirements. 5. Capitalization: This section focuses on addressing the capitalization and financing of the newly formed corporation, emphasizing the initial capital contribution obligations of each partner and any additional financing needs. 6. Ownership and Equity: The agreement defines the ownership structure of the corporation and outlines the distribution of shares among the partners. It may specify the percentage of ownership for each partner based on their respective contributions. 7. Roles and Responsibilities: The document clearly defines the roles and responsibilities of each partner within the corporation, including their duties, decision-making authority, and participation in the daily operations of the business. 8. Governance and Decision-Making: The agreement establishes the governing rules and procedures for decision-making, board meetings, voting rights, and the appointment of officers, directors, or managers. 9. Dissolution and Exit Strategies: In case of any future dissolution, this section covers the procedures and guidelines to be followed, including the allocation of assets and settlement of liabilities. 10. Miscellaneous Provisions: This section includes other important provisions such as dispute resolution methods, non-compete or non-disclosure agreements, and any applicable laws governing the agreement. It's worth noting that there may not be different types of Collin Texas Agreement to Incorporate by Partners Incorporating Existing Partnership, as the specific details and requirements would be customized based on the circumstances of each partnership and their goals for incorporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Acuerdo para incorporar por socios que incorporan sociedad existente - Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Collin Texas Acuerdo Para Incorporar Por Socios Que Incorporan Sociedad Existente?

Preparing papers for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Collin Agreement to Incorporate by Partners Incorporating Existing Partnership without professional help.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Collin Agreement to Incorporate by Partners Incorporating Existing Partnership on your own, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Collin Agreement to Incorporate by Partners Incorporating Existing Partnership:

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!