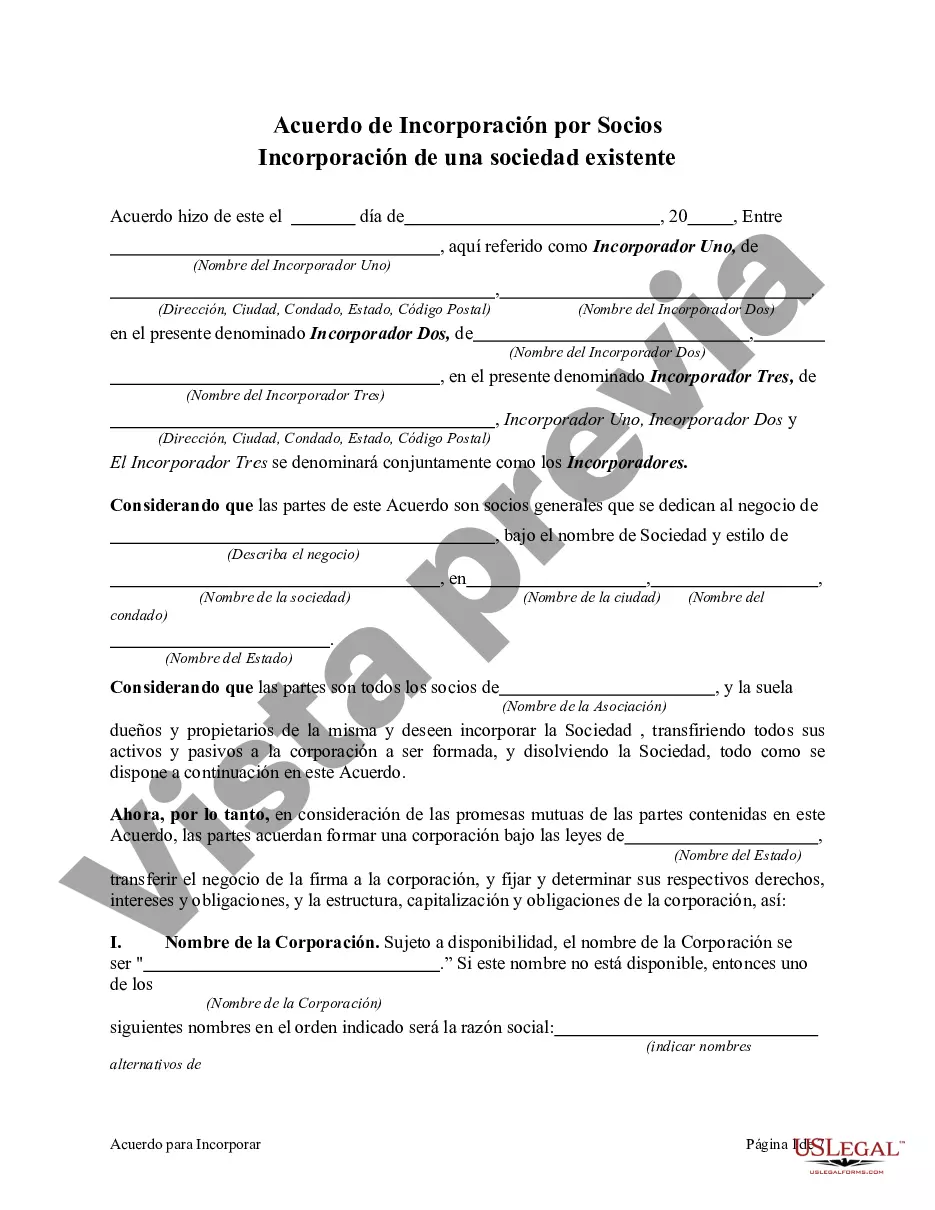

Title: Exploring the Cuyahoga Ohio Agreement to Incorporate by Partners Incorporating Existing Partnership Introduction: The Cuyahoga Ohio Agreement to Incorporate by Partners Incorporating Existing Partnership is an important legal provision within the state of Ohio that enables partners of an existing partnership to transition into a corporation. This article aims to provide a detailed description of this agreement, discuss its significance, and outline the various types of agreements available. 1. Understanding the Cuyahoga Ohio Agreement to Incorporate: The Cuyahoga Ohio Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that allows partners to convert their partnership into a corporation while maintaining their existing partnership structure. By incorporating, partners can gain numerous benefits, such as limited liability, enhanced credibility, and potential tax advantages. 2. Types of Cuyahoga Ohio Agreement to Incorporate by Partners Incorporating Existing Partnership: a) General Agreement to Incorporate: This type of agreement occurs when all partners of the existing partnership collectively agree to incorporate the business. It involves a unanimous decision and execution of the necessary legal obligations to form a corporation. b) Partial Agreement to Incorporate: In certain cases, not all partners may wish to convert the partnership into a corporation. The Partial Agreement to Incorporate allows those partners who are willing to incorporate to do so while the remaining partners continue the original partnership arrangement. c) Dissolution Agreement to Incorporate: In situations where some partners wish to incorporate, while others seek to dissolve the existing partnership, the Dissolution Agreement to Incorporate is utilized. This type of agreement ensures a smooth transition by outlining the dissolution terms as well as the incorporation process. 3. Key Elements of the Cuyahoga Ohio Agreement to Incorporate: a) Intent to Incorporate: The agreement should clearly state the partners' intention to convert the existing partnership into a corporation and outline the proposed name of the new corporation. b) Allocation of Shares: Partners must determine the allocation of shares within the new corporation, taking into consideration the partners' contributions, roles, and responsibilities. c) Transfer of Assets and Liabilities: The agreement should specify the transfer of existing partnership assets and liabilities to the newly formed corporation, ensuring a seamless transition. d) Governance and Decision-Making: The agreement should address the governance structure of the new corporation, including the appointment of directors, officers, and decision-making mechanisms. e) Dissolution Proceedings (if applicable): In cases of complete dissolution, the agreement should outline the procedures for winding up the original partnership, settling debts, and distributing the remaining assets among partners. Conclusion: The Cuyahoga Ohio Agreement to Incorporate by Partners Incorporating Existing Partnership offers a comprehensive framework for partners seeking to transition from a partnership to a corporation. Understanding the various types of agreements available and the essential elements they entail is crucial for a successful incorporation process. By utilizing this legal provision effectively, partners can unlock numerous benefits as they embrace the corporate structure while maintaining the essence of their existing partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuerdo para incorporar por socios que incorporan sociedad existente - Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Cuyahoga Ohio Acuerdo Para Incorporar Por Socios Que Incorporan Sociedad Existente?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Cuyahoga Agreement to Incorporate by Partners Incorporating Existing Partnership.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Cuyahoga Agreement to Incorporate by Partners Incorporating Existing Partnership will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Cuyahoga Agreement to Incorporate by Partners Incorporating Existing Partnership:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Cuyahoga Agreement to Incorporate by Partners Incorporating Existing Partnership on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!