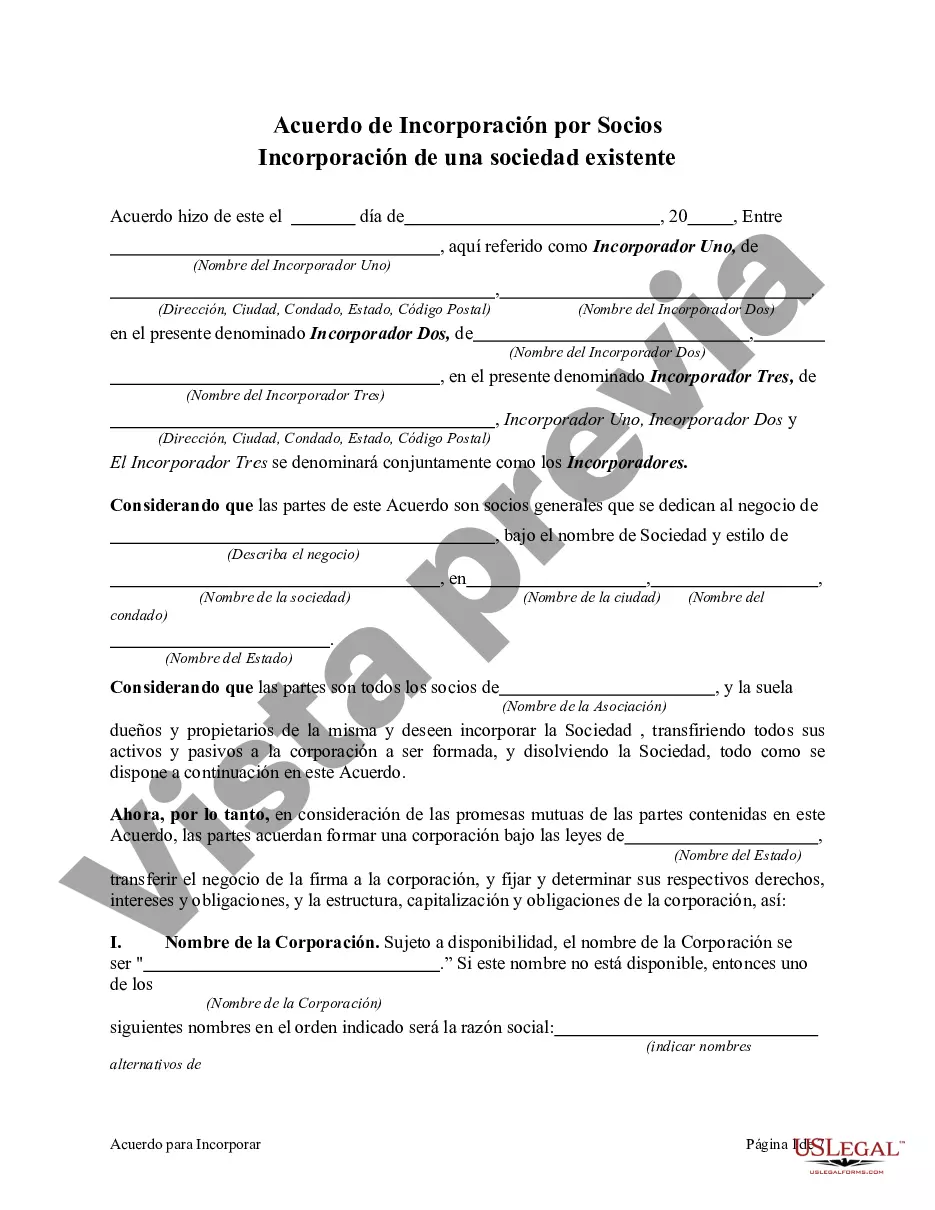

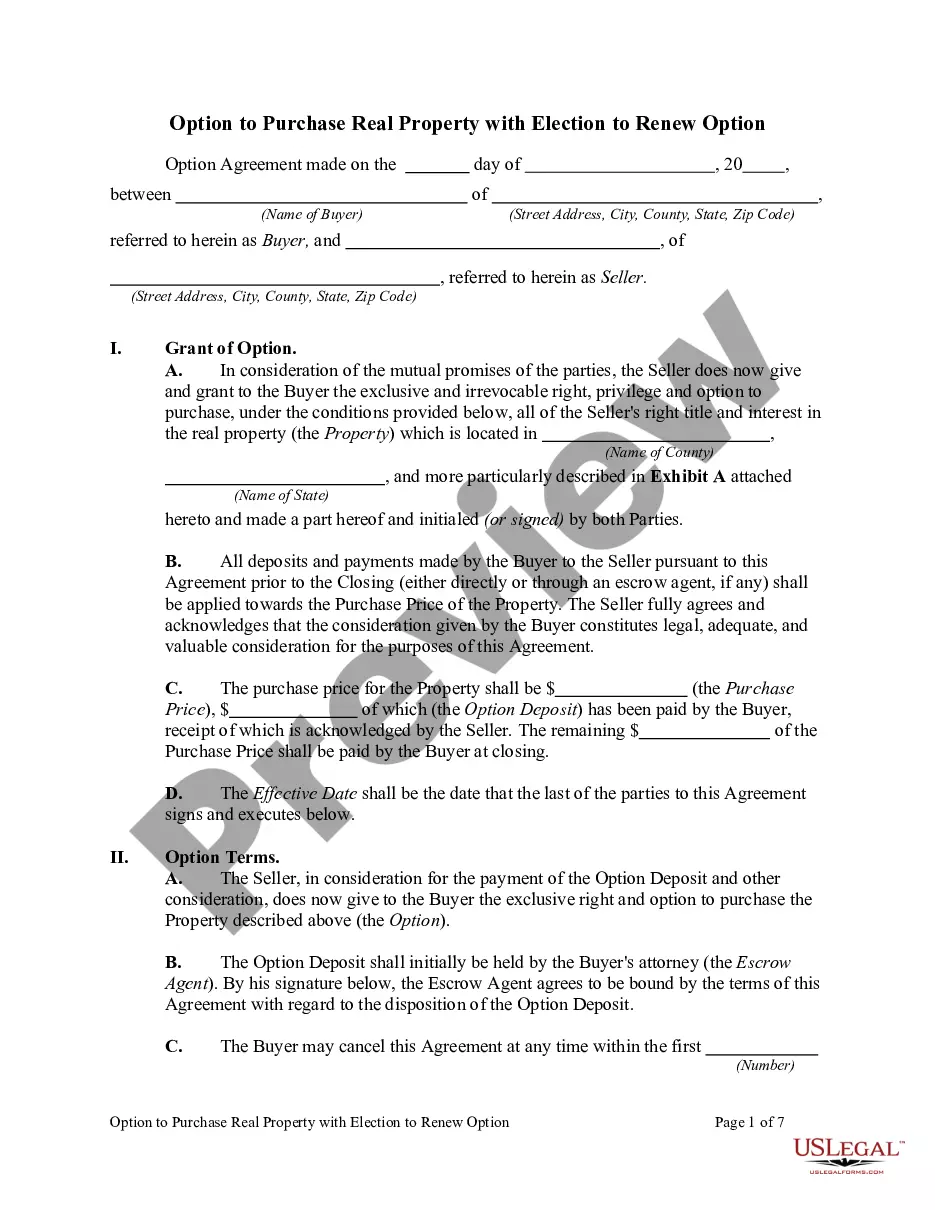

Hennepin Minnesota Agreement to Incorporate by Partners Incorporating Existing Partnership The Hennepin Minnesota Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that outlines the process of converting an existing partnership into a corporation in Hennepin County, Minnesota. This agreement serves as a roadmap for partners who wish to transform their partnership into a separate legal entity known as a corporation, with its own rights and responsibilities. Incorporating an existing partnership offers several benefits, including limited liability protection for the partners, potential tax advantages, and the ability to raise capital by selling shares of stock. By converting their partnership into a corporation, partners can ensure the longevity and continuity of their business, while also separating their personal assets from the company's liabilities. The Hennepin Minnesota Agreement to Incorporate by Partners Incorporating Existing Partnership typically covers the following key elements: 1. Purpose and Background: This section outlines the reasons for incorporation, including a brief history of the partnership and its current operations. It also highlights the partners' shared intent to establish a corporation to further develop their business. 2. Incorporation Process: Here, the agreement specifies the steps and timeline for the conversion process. It includes the necessary paperwork, such as filing articles of incorporation with the Minnesota Secretary of State, as well as any required permits or licenses. 3. Transfer of Assets and Liabilities: This section details how the partnership's assets and liabilities will be transferred to the new corporation. It may involve an assessment of the partnership's value, the issuance of stock to partners, and the allocation of profits and losses. 4. Corporate Structure: The agreement defines the corporate structure, including the number and type of shares, voting rights, and the roles and responsibilities of directors, officers, and shareholders. It outlines the rules for decision-making, appointments, and meetings within the newly formed corporation. 5. Intellectual Property and Contracts: If the partnership owned any intellectual property or had existing contracts, this section addresses the transfer of these assets to the corporation. It ensures that the new entity possesses all necessary rights and permissions for continued business operations. 6. Dissolution of Partnership: This clause outlines the termination of the partnership following the incorporation process. It may address the distribution of any remaining partnership assets, settlement of debts, and the release of any contractual obligations. Different types of Hennepin Minnesota Agreement to Incorporate by Partners Incorporating Existing Partnership may include variations based on the specific needs of the partners and their business. For instance, some agreements may emphasize the protection of minority shareholders or include specific provisions for disputes resolution. In conclusion, the Hennepin Minnesota Agreement to Incorporate by Partners Incorporating Existing Partnership provides a comprehensive framework for partners seeking to convert their partnership into a corporation. This agreement ensures a smooth transition while protecting the interests of the partners and promoting the long-term success of the business.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Acuerdo para incorporar por socios que incorporan sociedad existente - Agreement to Incorporate by Partners Incorporating Existing Partnership

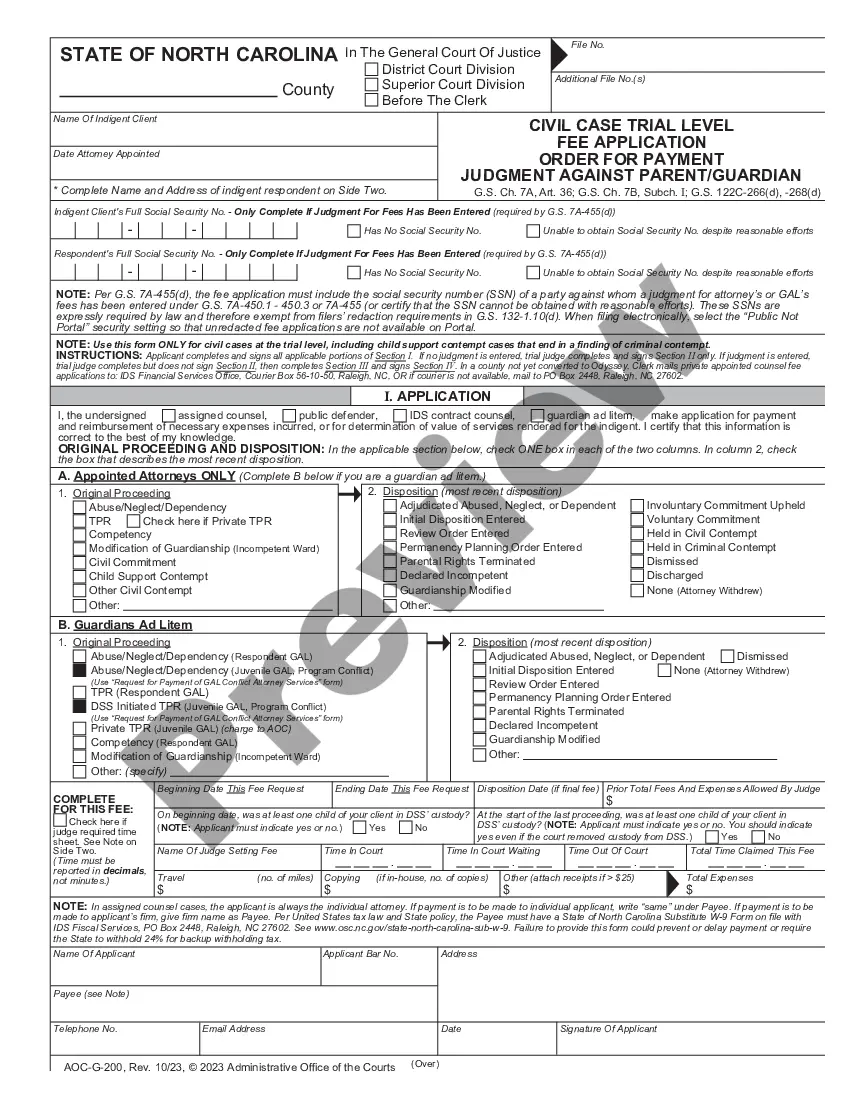

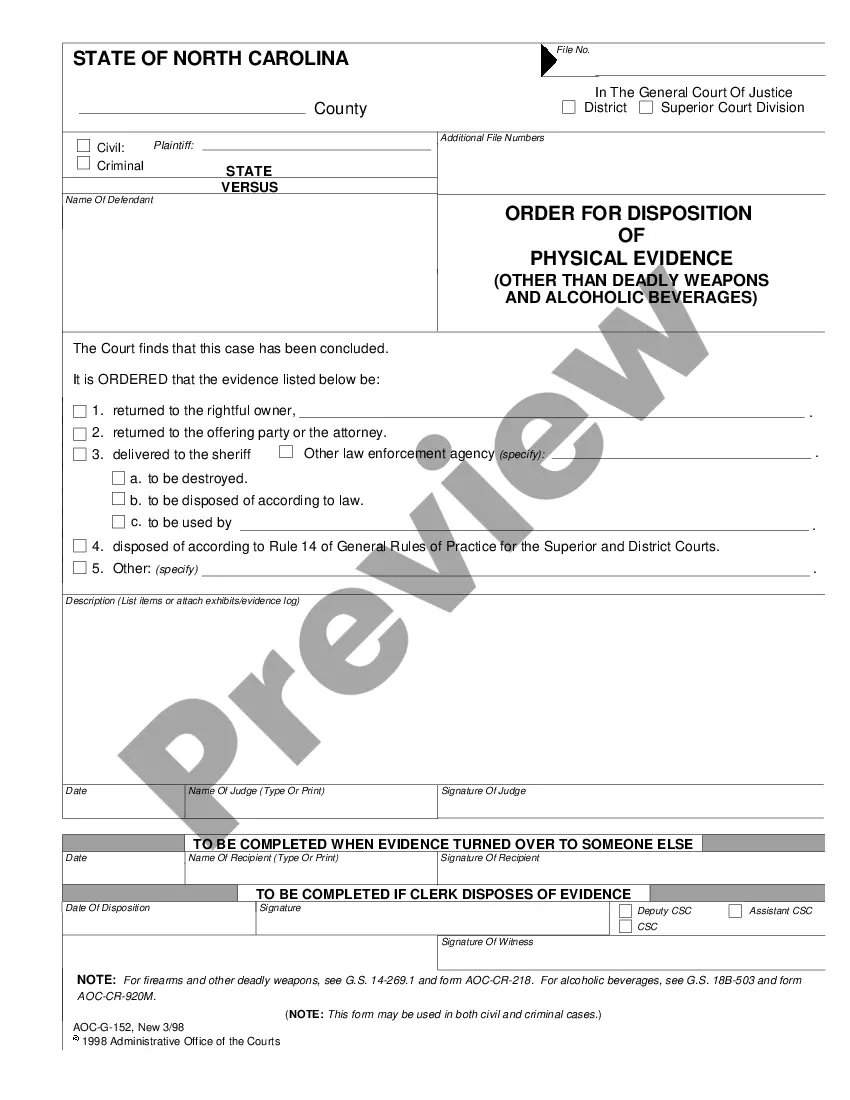

Description

How to fill out Hennepin Minnesota Acuerdo Para Incorporar Por Socios Que Incorporan Sociedad Existente?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Hennepin Agreement to Incorporate by Partners Incorporating Existing Partnership without expert assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Hennepin Agreement to Incorporate by Partners Incorporating Existing Partnership by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Hennepin Agreement to Incorporate by Partners Incorporating Existing Partnership:

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!