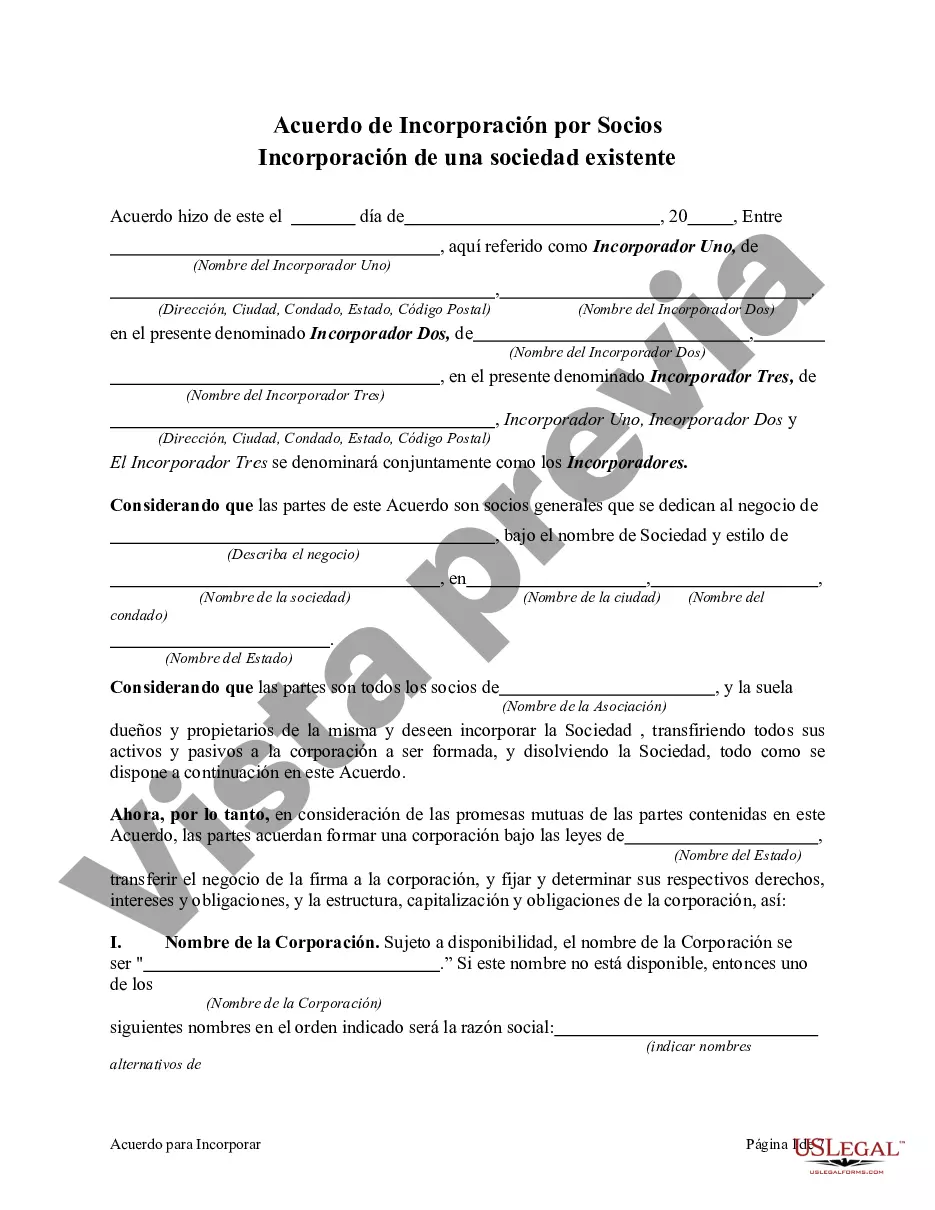

Keywords: Phoenix Arizona, agreement to incorporate, partners, incorporating, existing partnership, types Description: Phoenix Arizona Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that outlines the process and terms by which a partnership in Phoenix, Arizona, can convert itself into a corporation. This agreement serves as a roadmap for the partners involved, safeguarding their rights and ensuring a smooth transition from a partnership to a corporate entity. One type of Phoenix Arizona Agreement to Incorporate by Partners Incorporating Existing Partnership is the Standard Agreement. This type of agreement encompasses the basic provisions required for the conversion, such as the purpose of incorporation, the rights, and responsibilities of each partner, share distribution, and the name of the new corporation. Another type of agreement is the Customized Agreement. This agreement is tailored to meet specific needs and requirements of the partners involved. It may include additional terms and conditions agreed upon by the partners, such as special voting rights, profit-sharing arrangements, or management structures within the newly formed corporation. The customized agreement can be beneficial when partners wish to have unique provisions that suit their individual circumstances. Incorporating an existing partnership through this agreement involves several significant steps. First, the partners must decide on the type of corporation they want to establish, such as a C Corporation or an S Corporation, considering their specific goals, taxation implications, and liability limitations. Next, they need to draft and file the Articles of Incorporation with the appropriate state authorities, specifying essential details about the corporation, including its name, registered office address, purpose, and duration. During the incorporation process, partners must also determine the allocation of shares in the new corporation. This is a crucial step as it outlines each partner's ownership stake and governs the distribution of profits and voting rights. Additionally, partners should properly address the transfer of assets, contracts, and liabilities from the existing partnership to the newly formed corporation, ensuring a seamless transition without any legal complications. Once the Phoenix Arizona Agreement to Incorporate by Partners Incorporating Existing Partnership is fully executed and the incorporation process complete, the partnership officially becomes a separate legal entity, providing the partners with limited liability protection and various tax advantages associated with corporate structure. The agreement further delineates the ongoing obligations and responsibilities of each partner within the corporation, ensuring the smooth functioning and governance of the newly formed entity. Overall, the Phoenix Arizona Agreement to Incorporate by Partners Incorporating Existing Partnership is a crucial legal document that allows partners to convert their partnership into a corporation. It provides a clear framework for the transition, protects the rights of all partners, and ensures compliance with the relevant laws and regulations. Whether choosing a standard or customized agreement, this process enables partners to embrace the benefits of a corporate structure to achieve their business goals effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Acuerdo para incorporar por socios que incorporan sociedad existente - Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Phoenix Arizona Acuerdo Para Incorporar Por Socios Que Incorporan Sociedad Existente?

Preparing papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to create Phoenix Agreement to Incorporate by Partners Incorporating Existing Partnership without expert assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Phoenix Agreement to Incorporate by Partners Incorporating Existing Partnership by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step guide below to get the Phoenix Agreement to Incorporate by Partners Incorporating Existing Partnership:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!