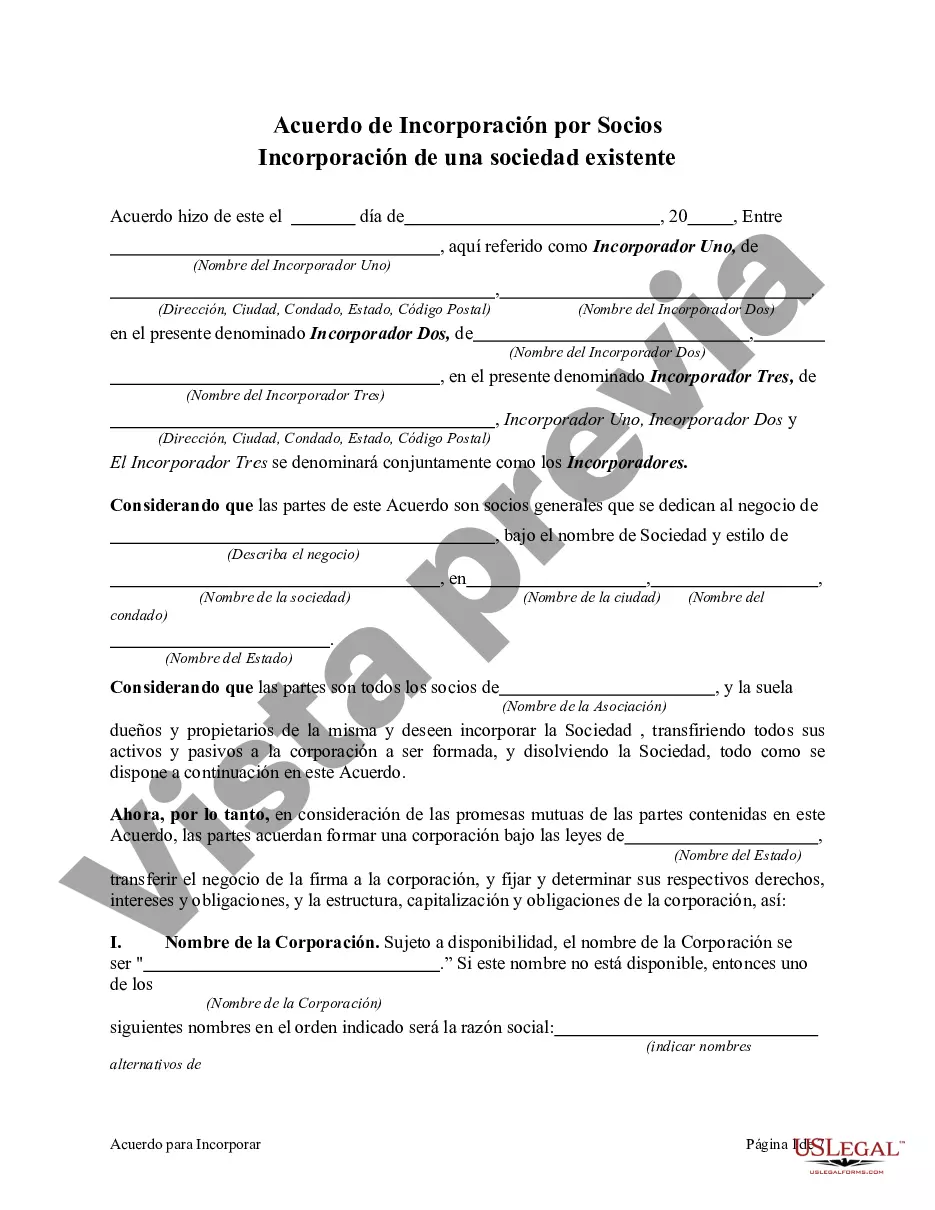

San Diego, California Agreement to Incorporate by Partners Incorporating Existing Partnership is a legally binding document that outlines the process of transforming a partnership into a corporation in the city of San Diego, California. This agreement is designed to guide partners in incorporating their existing partnership, offering greater flexibility, limited liability, and additional benefits for their business. Incorporating a partnership helps protect partners' personal assets and establishes a separate legal entity for the business. There are a few types of San Diego, California Agreement to Incorporate by Partners Incorporating Existing Partnership, each tailored to specific circumstances: 1. General Agreement to Incorporate: This agreement serves as a comprehensive document for partners who wish to incorporate their partnership in San Diego, California. It covers essential aspects such as the purpose of the corporation, the allocation of shares, the appointment of directors, and the distribution of assets. 2. Simple Agreement to Incorporate: This type of agreement is suitable for partners with straightforward businesses seeking a simplified incorporation process. It typically covers the minimum requirements for incorporating a partnership in San Diego, California, while still ensuring compliance with legal regulations. 3. Agreement to Incorporate with Custom Provisions: Some partnerships may have unique requirements or provisions that need to be addressed during the incorporation process. This type of agreement allows partners to include specific clauses or provisions that are relevant to their business needs in San Diego, California. 4. Agreement to Incorporate with Special Tax Considerations: When incorporating a partnership, partners may want to consider the tax implications of the new corporate structure. This type of agreement focuses on addressing specific tax-related concerns in San Diego, California, ensuring partners are aware of potential advantages and obligations. 5. Agreement to Incorporate with Exit Strategy: In certain cases, partners may want to incorporate their existing partnership in San Diego, California with a clear exit strategy in mind. This agreement outlines the procedures and conditions for partners to sell their shares or dissolve the corporation if specific events occur, providing a framework for contingency planning. Regardless of the type of San Diego, California Agreement to Incorporate by Partners Incorporating Existing Partnership chosen, it is crucial for partners to seek professional legal advice to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Acuerdo para incorporar por socios que incorporan sociedad existente - Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out San Diego California Acuerdo Para Incorporar Por Socios Que Incorporan Sociedad Existente?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, locating a San Diego Agreement to Incorporate by Partners Incorporating Existing Partnership suiting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the San Diego Agreement to Incorporate by Partners Incorporating Existing Partnership, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your San Diego Agreement to Incorporate by Partners Incorporating Existing Partnership:

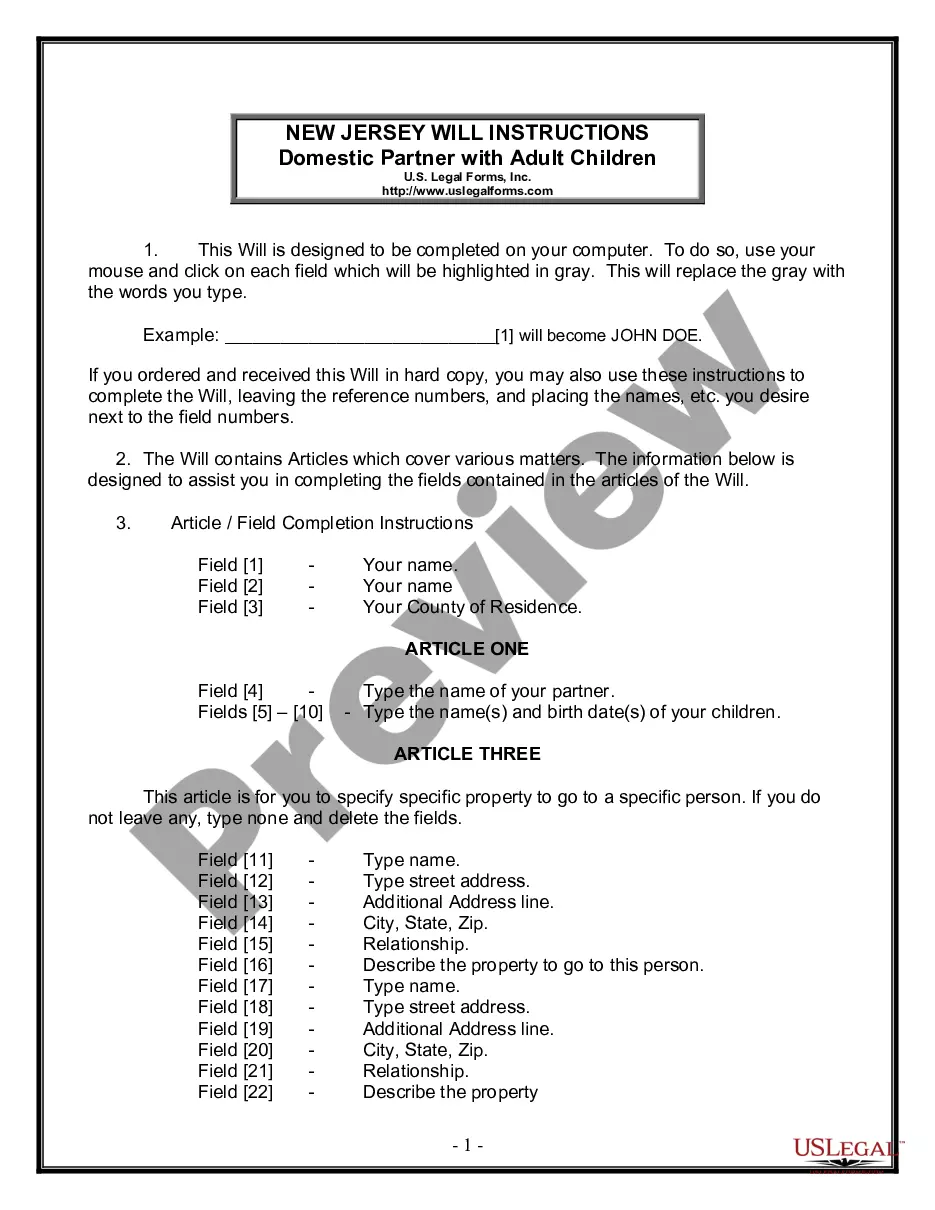

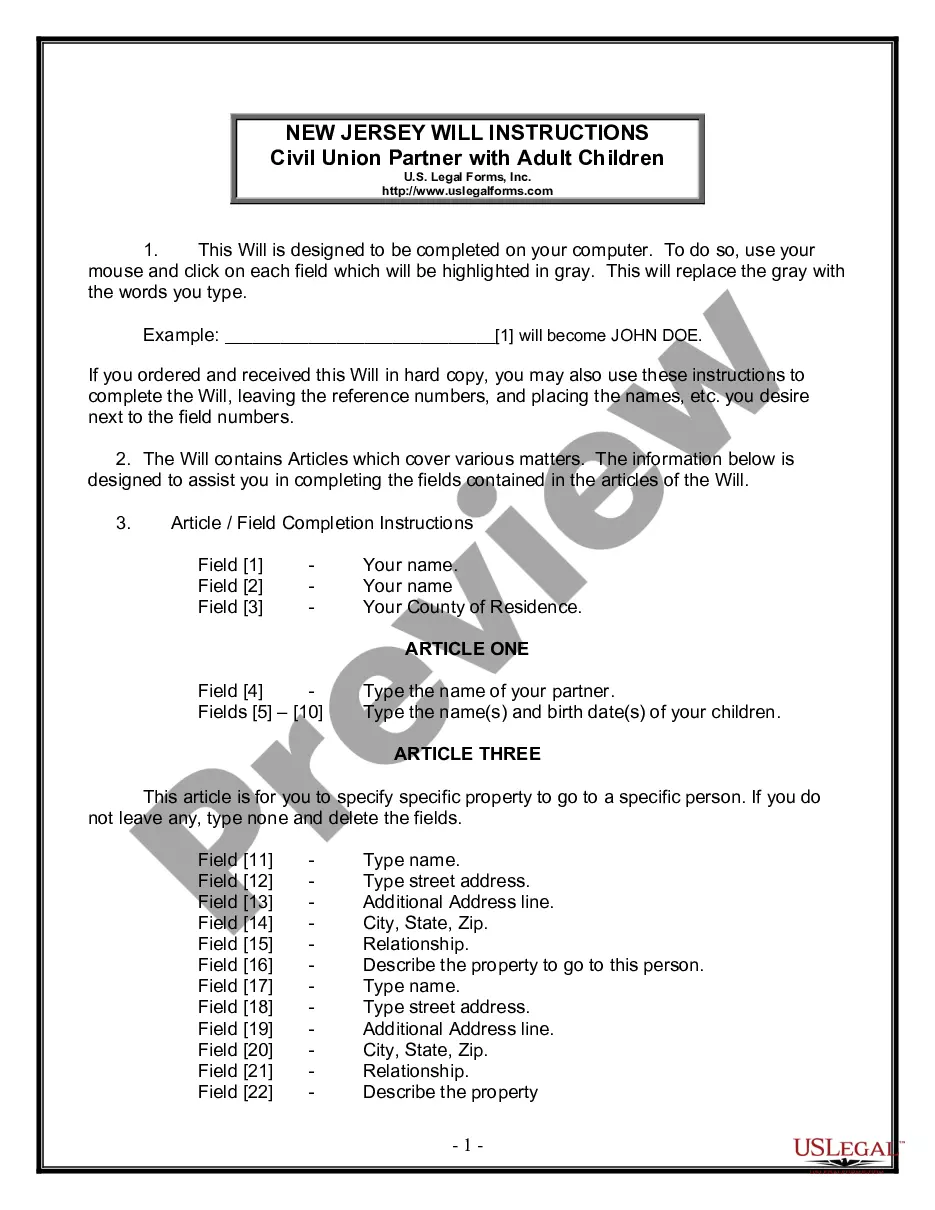

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Diego Agreement to Incorporate by Partners Incorporating Existing Partnership.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!