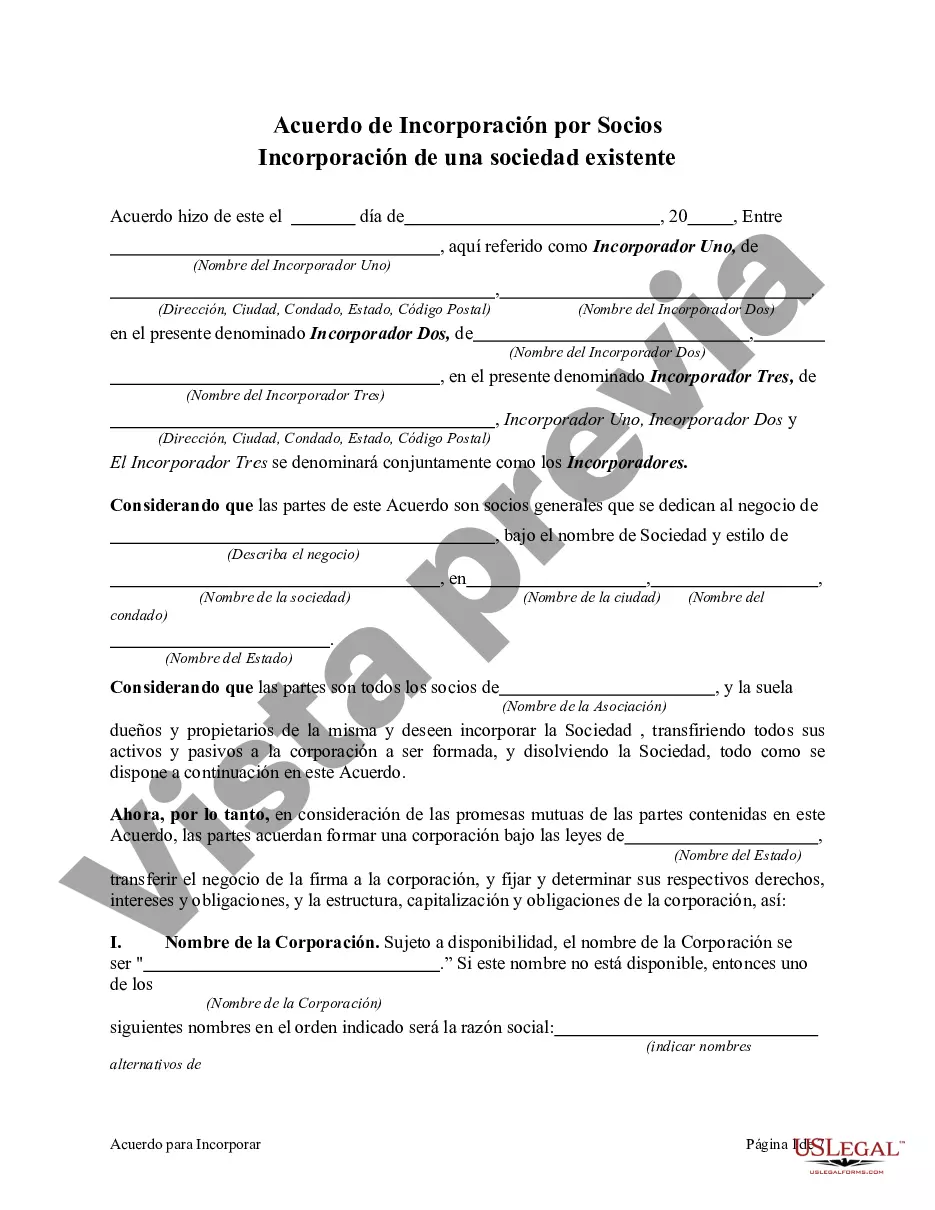

Wayne Michigan Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that outlines the process of incorporating an existing partnership into a corporation in Wayne, Michigan. This agreement serves as a blueprint for partners who wish to transition their partnership into a formal corporate entity. Incorporating an existing partnership provides several benefits, including increased liability protection, potential tax advantages, and a structured framework for business operations. The Wayne Michigan Agreement to Incorporate by Partners Incorporating Existing Partnership ensures that partners are aligned with the requirements and regulations of incorporating in the state of Michigan. Key elements covered in this agreement may include: 1. Identification of the existing partnership: Partners must clearly state the name and address of their existing partnership, along with the nature of their business activities. This information helps to identify the parties involved and the scope of their operations. 2. Incorporation process: The agreement includes a detailed step-by-step guide on how the existing partnership will be incorporated into a corporation. This may involve appointing directors, issuing shares, drafting bylaws, and registering with the appropriate authorities. 3. Capital structure: Partners must specify the equity ownership structure of the new corporation. This includes the allocation of shares among partners and any changes to their ownership interests. 4. Management and decision-making: The agreement outlines how the management and decision-making responsibilities of the existing partnership will be transferred to the corporation. This involves appointing officers and directors, determining their roles and responsibilities, and establishing voting rights. 5. Assets and liabilities: Partners need to address how the assets and liabilities of the existing partnership will be transferred to the new corporation. This may involve assigning contracts, licenses, leases, and other business agreements. 6. Dissolution of the partnership: The agreement should include provisions for dissolving the existing partnership and transferring its assets to the newly incorporated entity. This ensures a smooth transition and avoids any legal complications. 7. Indemnification and liability: Partners may include clauses related to indemnification, limiting personal liability, and protecting individual partners from legal claims arising from the incorporation process. Different types of "Wayne Michigan Agreement to Incorporate by Partners Incorporating Existing Partnership" may vary based on the specific industry or sector involved in the partnership. For example, there could be specialized agreements tailored for partnerships in real estate, healthcare, technology, or professional services. These specialized agreements may include additional clauses or considerations relevant to the particular industry or sector in which the partnership operates. In conclusion, the Wayne Michigan Agreement to Incorporate by Partners Incorporating Existing Partnership is a crucial legal document that guides partners through the process of transitioning their partnership into a formal corporation. It provides a clear framework for incorporating in Wayne, Michigan, and ensures compliance with state regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Acuerdo para incorporar por socios que incorporan sociedad existente - Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out Wayne Michigan Acuerdo Para Incorporar Por Socios Que Incorporan Sociedad Existente?

Creating documents, like Wayne Agreement to Incorporate by Partners Incorporating Existing Partnership, to take care of your legal matters is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for various scenarios and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Wayne Agreement to Incorporate by Partners Incorporating Existing Partnership form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before downloading Wayne Agreement to Incorporate by Partners Incorporating Existing Partnership:

- Make sure that your form is specific to your state/county since the regulations for writing legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Wayne Agreement to Incorporate by Partners Incorporating Existing Partnership isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our website and get the form.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!