Bartering are agreements for the exchange of personal and real property are subject to the general rules of law applicable to contracts, and particularly to the rules applicable to sales of personal and real property. A binding exchange agreement is formed if an offer to make an exchange is unconditionally accepted before the offer has been revoked. Federal tax aspects of exchanges of personal property should be considered carefully in the preparation of an exchange agreement.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Santa Clara, California, is a city located in the heart of Silicon Valley and known for its vibrant community, diverse culture, and thriving economy. It attracts people from all over the world, both residents and businesses, due to its strategic location and excellent opportunities for growth. When it comes to the real estate market in Santa Clara, there are various contract or agreement types available for those looking to engage in an exchange or barter of real property for personal property. These agreements are legally binding documents that safeguard the interests of both parties involved in the transaction. Below, we will explore some key types of contracts or agreements commonly used in Santa Clara, California. 1. Purchase and Sale Agreement: This is the most typical type of contract used when buying or selling real property. It outlines the terms and conditions of the transaction, including the purchase price, financing arrangements, contingencies, and timelines for completion. 2. 1031 Exchange Agreement: A 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting the proceeds from the sale of one property into the purchase of another property. In Santa Clara, California, investors utilize this agreement to exchange real property for personal property while deferring taxes. 3. Land Swap Agreement: In some instances, individuals or entities may desire to exchange parcels of land with one another. A land swap agreement outlines the terms and conditions of the exchange, including the value comparison of the properties, any additional considerations, and legal requirements. 4. Lease Purchase Agreement: This agreement combines elements of a lease and purchase agreement, allowing a tenant to lease a property with an option to buy it at a later date. The terms of the lease purchase agreement cover rental details, purchase price, the option period, and any contingencies. 5. Trade Agreement: A trade agreement involves the direct exchange of real property for personal property without monetary transactions. This type of agreement outlines the properties being traded and any other specific terms or conditions agreed upon by both parties involved. When entering into any contract or agreement in Santa Clara, California, it's crucial to consult with a licensed attorney specializing in real estate law to ensure all legal requirements are met and to protect your rights and interests effectively. The specific nature of the transaction, be it a purchase, exchange, or barter, will determine which agreement is most appropriate.Santa Clara, California, is a city located in the heart of Silicon Valley and known for its vibrant community, diverse culture, and thriving economy. It attracts people from all over the world, both residents and businesses, due to its strategic location and excellent opportunities for growth. When it comes to the real estate market in Santa Clara, there are various contract or agreement types available for those looking to engage in an exchange or barter of real property for personal property. These agreements are legally binding documents that safeguard the interests of both parties involved in the transaction. Below, we will explore some key types of contracts or agreements commonly used in Santa Clara, California. 1. Purchase and Sale Agreement: This is the most typical type of contract used when buying or selling real property. It outlines the terms and conditions of the transaction, including the purchase price, financing arrangements, contingencies, and timelines for completion. 2. 1031 Exchange Agreement: A 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting the proceeds from the sale of one property into the purchase of another property. In Santa Clara, California, investors utilize this agreement to exchange real property for personal property while deferring taxes. 3. Land Swap Agreement: In some instances, individuals or entities may desire to exchange parcels of land with one another. A land swap agreement outlines the terms and conditions of the exchange, including the value comparison of the properties, any additional considerations, and legal requirements. 4. Lease Purchase Agreement: This agreement combines elements of a lease and purchase agreement, allowing a tenant to lease a property with an option to buy it at a later date. The terms of the lease purchase agreement cover rental details, purchase price, the option period, and any contingencies. 5. Trade Agreement: A trade agreement involves the direct exchange of real property for personal property without monetary transactions. This type of agreement outlines the properties being traded and any other specific terms or conditions agreed upon by both parties involved. When entering into any contract or agreement in Santa Clara, California, it's crucial to consult with a licensed attorney specializing in real estate law to ensure all legal requirements are met and to protect your rights and interests effectively. The specific nature of the transaction, be it a purchase, exchange, or barter, will determine which agreement is most appropriate.

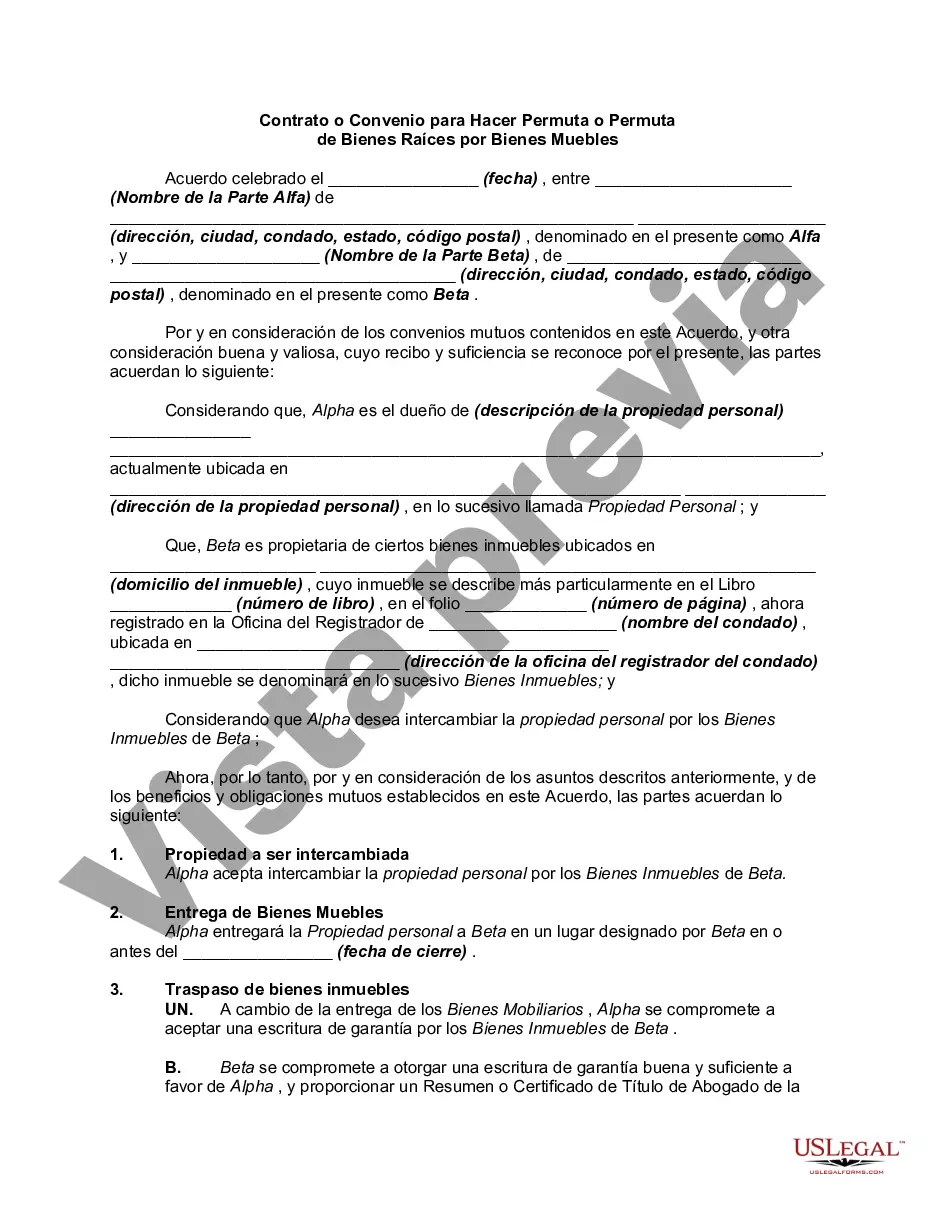

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.